VA IRP 1 2011-2026 free printable template

Show details

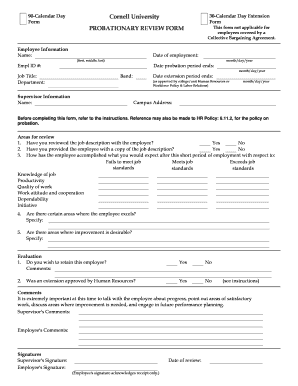

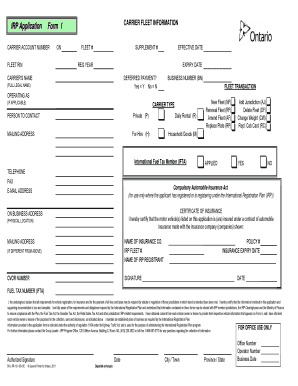

IRP 1 (08/25/2011) VIRGINIA INTERNATIONAL REGISTRATION PLAN (IRP) APPLICATION Purpose: Instructions: Use this form to establish a new Virginia IRP account, to renew or make changes to an existing

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign va irp1 form

Edit your virginia irp1 pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your virginia international registration plan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irp1 application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit VA IRP 1. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out VA IRP 1

How to fill out VA IRP 1

01

Gather all necessary personal information such as your Social Security number and contact details.

02

Review the instructions provided with the VA IRP 1 form carefully.

03

Fill in your name, including any middle initials.

04

Provide your current address, and ensure it is accurate.

05

Indicate your service history, including dates of service and branch.

06

Complete any medical history sections as required.

07

Review your answers for accuracy and completeness.

08

Sign and date the form before submission.

Who needs VA IRP 1?

01

Veterans seeking benefits or compensation from the VA.

02

Individuals who have a disability or health condition related to their military service.

Fill

form

: Try Risk Free

People Also Ask about

What is a SUT 3 form Virginia?

Purchaser's Statement of Tax Exemption (SUT 3) – Department of Motor Vehicles Government Form in Virginia – Formalu.

What is a Form E filing in Virginia?

FORM E – INSTRUCTIONS FOR. PRE-ACQUISITION NOTIFICATION FORM. REGARDING THE POTENTIAL COMPETITIVE IMPACT. OF A PROPOSED MERGER OR ACQUISITION BY A. NON-DOMICILIARY INSURER DOING BUSINESS IN THIS COMMONWEALTH OR BY A DOMESTIC INSURER PURSUANT TO § 38.2-1323 OF THE CODE OF VIRGINIA.

How do I avoid paying tax on a gifted car in Virginia?

Do I have to pay sales tax on a gifted car in VA? If the gifted car was not from a parent or spouse, then yes—the purchase will be subject to Sales and Use Tax. However, the gifter can list the price of the vehicle as $0. How much does it cost to transfer a car title in Virginia as a gift?

How do I get an IRP in Virginia?

How To Apply for IRP Title each vehicle in the fleet in Virginia. Determine the type of operation. Submit a Virginia Apportioned Registration Application (Form IRP-1). Provide proof of Heavy Vehicle Use Tax (HVUT) filing with IRS (Form 2290, Schedule 1), if applicable.

What is the SUT tax in Virginia?

Virginia is required to collect a 4.15% Sales and Use Tax (SUT) at the time of titling whenever a vehicle is sold, and/or the ownership of the vehicle changes. The amount due is based on the vehicle's gross sales price, or $75, whichever is greater.

How much does it cost to get IRP plates in Virginia?

Virginia 10-Day International Registration Plan (IRP) $52.50 for Virginia trip permit (plus service fees if you apply through a permit service).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my VA IRP 1 directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your VA IRP 1 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit VA IRP 1 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing VA IRP 1, you need to install and log in to the app.

How do I edit VA IRP 1 on an iOS device?

Create, edit, and share VA IRP 1 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is VA IRP 1?

VA IRP 1 is a form used by the Virginia Department of Taxation for reporting and remitting individual income tax withheld from employee wages.

Who is required to file VA IRP 1?

Employers who withhold Virginia individual income tax from their employees' wages are required to file VA IRP 1.

How to fill out VA IRP 1?

To fill out VA IRP 1, employers need to provide their business information, the period of withholding, total wages paid, the amount of tax withheld, and any other relevant details as specified in the form instructions.

What is the purpose of VA IRP 1?

The purpose of VA IRP 1 is to report and remit the total individual income tax withheld from employees' wages to the state of Virginia.

What information must be reported on VA IRP 1?

The information that must be reported on VA IRP 1 includes the employer's name and ID, the reporting period, total wages paid, total Virginia income tax withheld, and any adjustments or special circumstances.

Fill out your VA IRP 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA IRP 1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.