Get the free Aon KiwiSaver Scheme

Show details

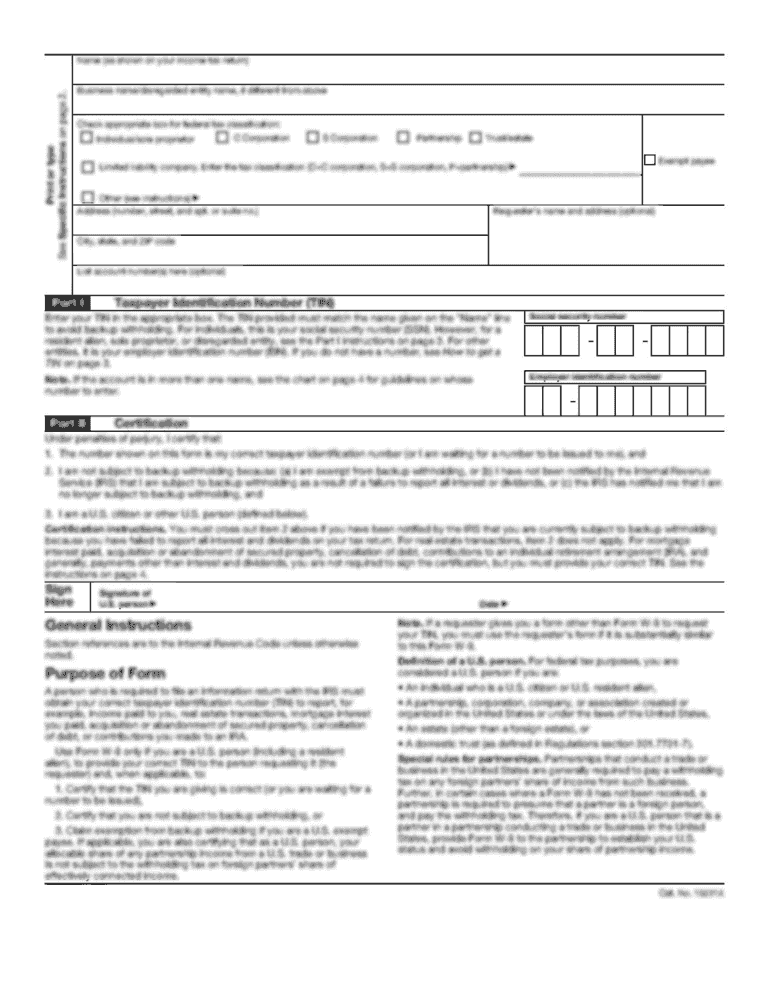

This form is used by members of the Aon KiwiSaver Scheme to elect to switch their investment options within their member account.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aon kiwisaver scheme

Edit your aon kiwisaver scheme form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aon kiwisaver scheme form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing aon kiwisaver scheme online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit aon kiwisaver scheme. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aon kiwisaver scheme

How to fill out Aon KiwiSaver Scheme

01

Visit the Aon website and navigate to the KiwiSaver Scheme section.

02

Gather necessary documents such as identification and proof of address.

03

Fill out the online application form with your personal details.

04

Choose your preferred investment options and risk profile.

05

Review the terms and conditions before submitting your application.

06

Submit the application and await confirmation of your enrollment.

Who needs Aon KiwiSaver Scheme?

01

Individuals looking to save for retirement in New Zealand.

02

Young professionals starting their careers who want to build savings early.

03

Employees seeking employer contributions to boost retirement savings.

04

Individuals who want a structured savings plan with potential for investment growth.

05

Those seeking additional retirement savings beyond the government pension.

Fill

form

: Try Risk Free

People Also Ask about

What is the most ethical KiwiSaver?

The Most Ethical KiwiSaver Funds Pathfinder KiwiSaver Growth Fund. Management Fee: 1.30% p.a. Booster SRI High Growth Fund. Management Fee: 1.24% p.a. MAS Aggressive Growth Fund. Management Fee: 0.99% p.a. Simplicity Growth Fund. Management Fee: 0.25% p.a. SuperLife Ethica (Balanced) Fund. Management Fee: 0.60% p.a.

What's the best rate for KiwiSaver?

Your KiwiSaver contributions count We estimate that the difference between contributing 3% versus 10% over a lifetime of working can be $229,000 for those on an average salary, so a huge difference. Take a moment to plug your details into our KiwiSaver calculator to get an idea if you're on track to achieve your goals.

How do I access my KiwiSaver account online?

Online Portals: To access your account, you can go to your provider's website KiwiSaver login section. Once you're logged in, you'll find your account dashboard or summary page. Here, you can see your current balance, contributions made, investment options, returns, and any associated fees.

Is KiwiSaver a good investment?

Yes, everyone should be using KiwiSaver. The government gives you just over $500 per year and your employer has to put in a minimum of 3% of what you make. All the money you, the government and your employer put in gets put into a fund which compounds over time.

What is the KiwiSaver scheme?

KiwiSaver is a voluntary savings scheme to help set you up for your retirement. You can make regular contributions from your pay or directly to your scheme provider.

Which is the best KiwiSaver provider in NZ?

Top 10 KiwiSaver Funds By No. Members 1 ANZ KIWISAVER GROWTH FUND. 2 ASB KIWISAVER GROWTH FUND. 3 WESTPAC KIWISAVER CONSERVATIVE FUND. 4 ASB KIWISAVER CONSERVATIVE FUND. 5 WESTPAC KIWISAVER GROWTH FUND. 6 FISHER FUNDS KIWISAVER GROWTH FUND. 7 GENERATE FOCUSED GROWTH FUND. 8 ASB BALANCED FUND.

What is the best KiwiSaver scheme in NZ?

Top 10 KiwiSaver Funds By No. Members 1 ANZ KIWISAVER GROWTH FUND. 2 ASB KIWISAVER GROWTH FUND. 3 WESTPAC KIWISAVER CONSERVATIVE FUND. 4 ASB KIWISAVER CONSERVATIVE FUND. 5 WESTPAC KIWISAVER GROWTH FUND. 6 FISHER FUNDS KIWISAVER GROWTH FUND. 7 GENERATE FOCUSED GROWTH FUND. 8 ASB BALANCED FUND.

Which is better, Milford or Generate?

Milford has maintained consistently high performance in the balanced and growth categories over the long term. Generate is delivering strong numbers across multiple periods. In summary, quality non-bank providers continue to outperform all bank KiwiSaver providers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Aon KiwiSaver Scheme?

The Aon KiwiSaver Scheme is a retirement savings initiative in New Zealand that allows individuals to save for their retirement in a regulated investment fund.

Who is required to file Aon KiwiSaver Scheme?

Individuals who are members of the Aon KiwiSaver Scheme and employers who make contributions on behalf of their employees are required to file for the scheme.

How to fill out Aon KiwiSaver Scheme?

To fill out the Aon KiwiSaver Scheme, individuals need to complete an application form, which includes personal details, employment information, and tax residency status.

What is the purpose of Aon KiwiSaver Scheme?

The purpose of the Aon KiwiSaver Scheme is to help New Zealanders save for retirement, providing them with a structured and regulated way to grow their savings over time.

What information must be reported on Aon KiwiSaver Scheme?

The information that must be reported includes member contributions, employer contributions, fund performance, and any changes in member details.

Fill out your aon kiwisaver scheme online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aon Kiwisaver Scheme is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.