PH Maybank Personal Loan Application free printable template

Show details

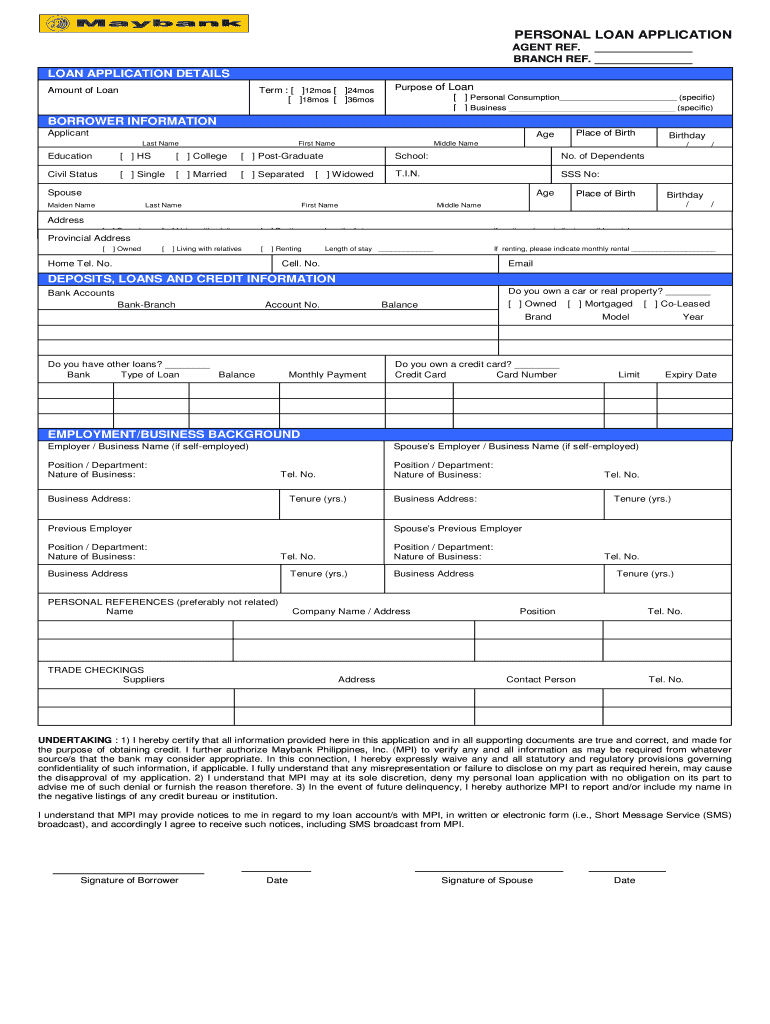

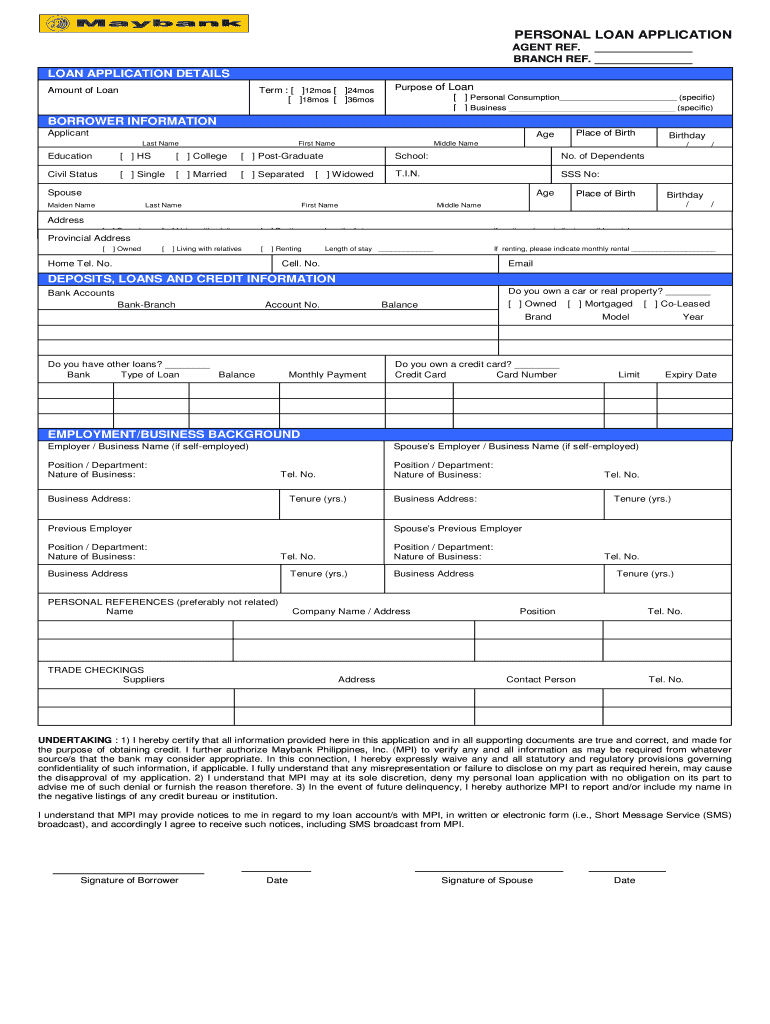

PERSONAL LOAN APPLICATION AGENT REF. BRANCH REF. LOAN APPLICATION DETAILS Amount of Loan Term : 12mos 24mos 18mos 36mos Purpose of Loan Personal Consumption (specific) Business (specific) BORROWER

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign maybank loan application form

Edit your philippines maybank application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan application form maybank form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit citizenship zip residence online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit citizenship residence required form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out verification residence type form

How to fill out PH Maybank Personal Loan Application

01

Obtain the PH Maybank Personal Loan Application form from the Maybank website or a local branch.

02

Fill in personal details including your full name, address, date of birth, and contact information.

03

Provide employment information such as your employer’s name, your job title, and length of employment.

04

Input your financial information, including your monthly income, existing loans, and other financial commitments.

05

Attach required documents such as identification, proof of income (payslip or bank statement), and employment verification.

06

Review the completed application for accuracy and completeness.

07

Submit the application form along with the attached documents either online or at a Maybank branch.

08

Await a response from Maybank regarding the approval status of your loan application.

Who needs PH Maybank Personal Loan Application?

01

Individuals seeking financial assistance for personal expenses.

02

People looking to consolidate existing debts.

03

Borrowers needing funds for significant purchases like home renovations or medical expenses.

04

Those who want to finance lifestyle improvements or emergencies.

Fill

information citizenship

: Try Risk Free

People Also Ask about philippines maybank form

How do you borrow money from a bank?

Check whether you qualify for a bank loan. Before applying for a bank loan, you'll want to know whether you qualify. Compare rates on bank loans. Submit your application for a bank loan. Review the loan agreement. Receive your funds.

What does a loan application do?

When applying for a mortgage, the borrower starts the process by submitting a loan application to the lender, all the supporting documents required, and the fee for processing the application. Your loan application includes everything that will help determine whether or not you qualify for a mortgage.

How to apply in Maybank?

Download the Maybank2U PH App from Apple App Store, Google Play Store, or Huawei App Gallery. Fill out and submit the application form in-app.

How to borrow personal loan?

From documents required to how to apply for a Personal Loan, we have all the angles covered: Step 1: Determine your requirement. Figure out why you need a Personal Loan and how much you need. Step 2: Check loan eligibility. Step 3: Calculate monthly instalments. Step 4: Approach the bank. Step 5: Submit documents.

What does loan application requirements mean?

This initial application will often ask for your personal information, such as your name, contact information, date of birth, and Social Security number. You may also be required to state your desired loan amount and purpose as well as additional financial details like your gross monthly income or mortgage payment.

What is loan application forms?

A loan application form is a document used by banks to collect the relevant information from a potential borrower when applying for a loan.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the maybank loan application form pdf in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit verification residence required on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign citizenship zip required on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit verification residence telephone on an Android device?

You can make any changes to PDF files, like verification province required, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is PH Maybank Personal Loan Application?

The PH Maybank Personal Loan Application is a formal request submitted by individuals to Maybank Philippines to apply for a personal loan. It includes the details of the applicant and the amount of loan they wish to obtain.

Who is required to file PH Maybank Personal Loan Application?

Individuals who wish to obtain a personal loan from Maybank Philippines need to file the PH Maybank Personal Loan Application. This typically includes employed individuals, self-employed persons, or those with a stable source of income.

How to fill out PH Maybank Personal Loan Application?

To fill out the PH Maybank Personal Loan Application, applicants must provide personal information such as name, address, contact details, employment status, income details, and the loan amount requested. It may also require additional documents for verification.

What is the purpose of PH Maybank Personal Loan Application?

The purpose of the PH Maybank Personal Loan Application is to enable individuals to access funds for personal use, such as for emergencies, education, home improvements, or debt consolidation, through a formal lending process.

What information must be reported on PH Maybank Personal Loan Application?

Essential information that must be reported on the PH Maybank Personal Loan Application includes the applicant's full name, contact information, employment details, monthly income, loan amount requested, purpose of the loan, and identification documents.

Fill out your maybank personal loan form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Province Origin Citizenship is not the form you're looking for?Search for another form here.

Keywords relevant to province origin required

Related to state number residence

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.