Canada T2201 E 2010 free printable template

Get, Create, Make and Sign canadian disability tax credit

Editing canadian disability tax credit online

Uncompromising security for your PDF editing and eSignature needs

Canada T2201 E Form Versions

How to fill out canadian disability tax credit

How to fill out Canada T2201 E

Who needs Canada T2201 E?

Instructions and Help about canadian disability tax credit

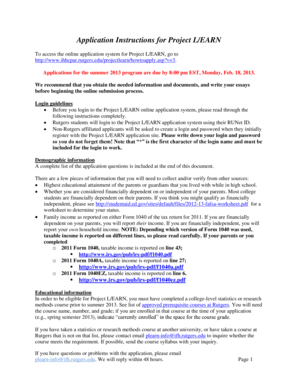

OK. One way we can make a form fairly easily is to start with a template that we make in Word or Excel or some other editor. So in this case I just used Excel municipal two-column format with the entry fields on the right so using this I'll be able to create an Adobe PDF form. So the first thing I'm going to do is going to Acrobat 10, and I'm going to choose to create PDF. It's going to ask what I want to open. In this case, I'm going to go navigate to the location of my file. As soon as I do that, it has to launch in my case Excel in order to read content from it. That's going to pull over and a copy of that of how it looks. So now I have this a flat file essentially an image. If I want to deepen it a little and create some content. I'm going to go over here to the tools button in Acrobat 10, and I'm going to say “Create” under Forms. It's going to say quot;Use an existing file” and then also it said quot;Use the current document'. Asks if I want to save. Certainly. Why not? I'll just give it a somewhat descriptive name. OK. So now you'll see that it took a crack at trying to name the fields after the information near, but it doesn't do a terribly good job at this. You'll see then that now at least it was shrewd enough to know that each of my lines on the right was going to be a data entry field. And over on the right side you'll notice in my fields section that each of these has its own definition. So I'm going to go in click on these things and rename them. So I have clicked once on the name, and you can either slow click twice or hit, click once and hit F2 to make it editable. So “sum×siblings”. Sounds like a terrible complaint. And then just going to give each one a more meaningful name. That instinctively I've given each one of these fields, I've the syntax without the use for the field names has been to separate them with underscores instead of spaces. This just goes back to all database protocol. It used to be at least that you couldn't have field names with spaces, so I got in the habit of using underscores. This is probably not a form that's going to dump into a database but just in case I guess. I'm sticking with that syntax. OK. So now I have done that. If I choose close formatting, noticed now that I can go in If you just bump up the Zoom In a little, so I can go in here and start typing things. Say I have got 9 siblings and I prefer sea. And I eat breakfast every day. And I'm just hitting tab between each of these two favorite restaurants. OK. So what do I want to say about is these are editable until or unless I save this form with particular attributes. I won't be able to save it. I have to prove myself wrong. Furthermore, I am going to throw this onto the desktop. And see what happens if I close it and reopen it. Did it keep my data? It did. OK. I was about going to launch feel about how you had to go to “Save As” and choose 'Reader Extended Pequot;. “Enable AdditionaFeatures

People Also Ask about

Is there a disability tax credit in Canada?

How does Canada disability tax credit work?

Why am I getting disability tax?

What is the IRS disability form?

How do I get disability tax credit in Canada?

What is a disability tax form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify canadian disability tax credit without leaving Google Drive?

Where do I find canadian disability tax credit?

Can I sign the canadian disability tax credit electronically in Chrome?

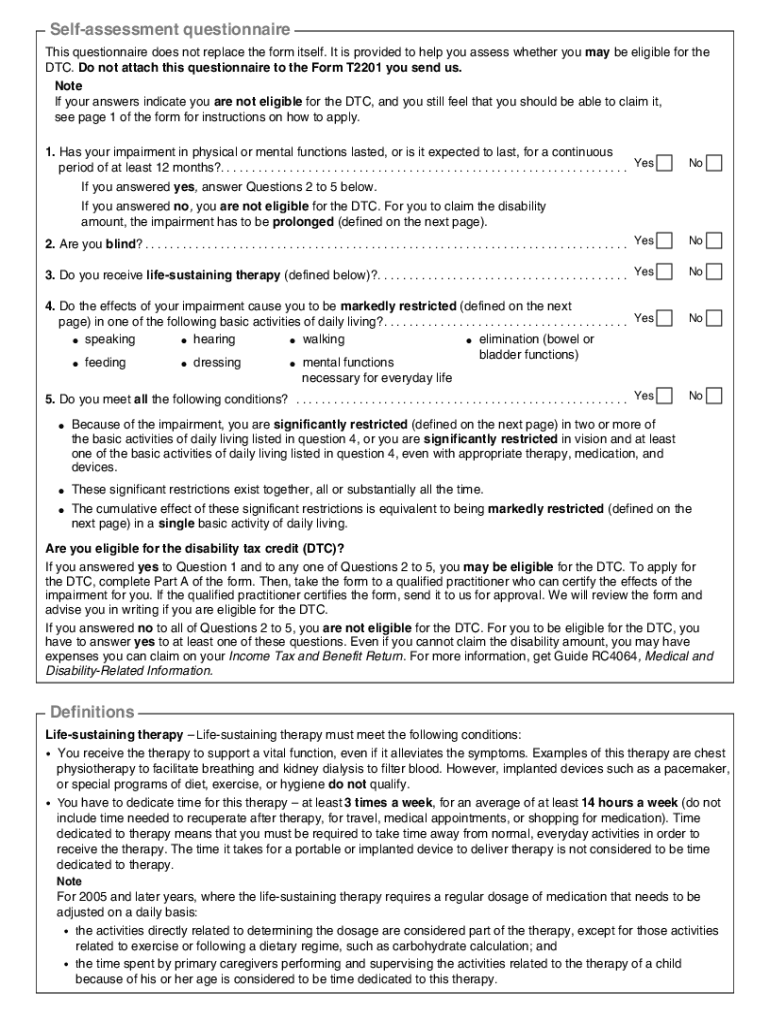

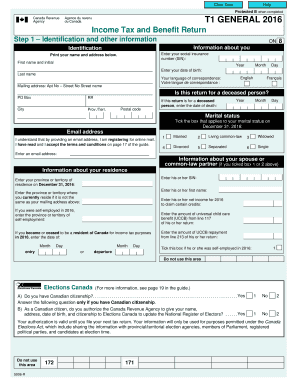

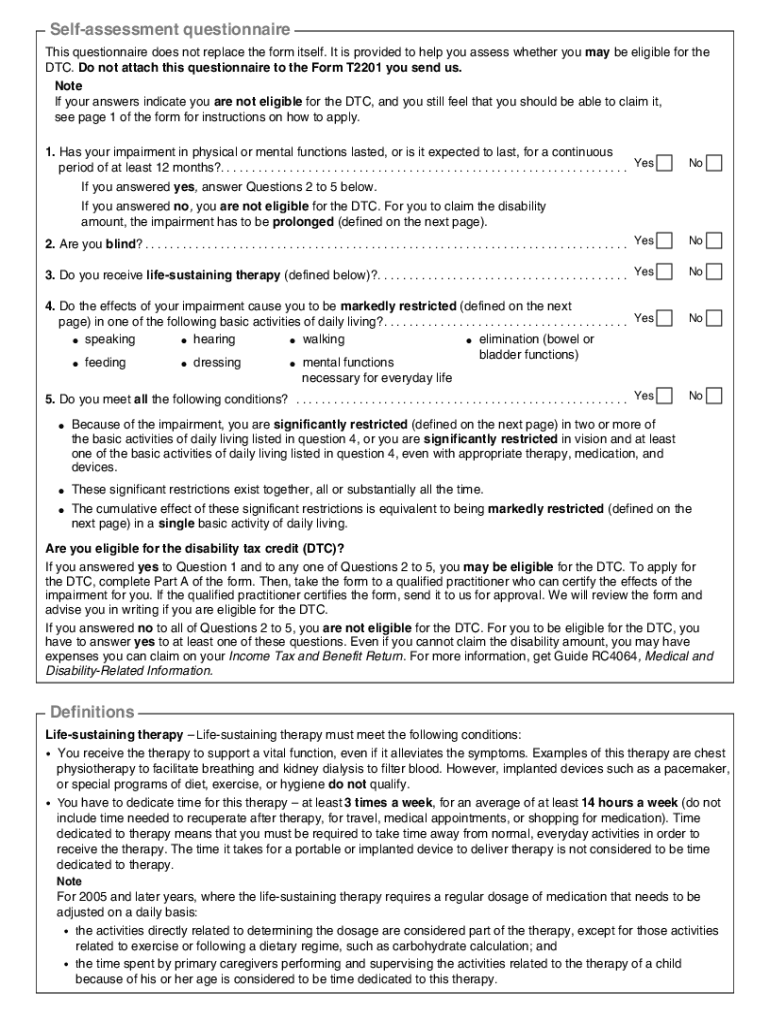

What is Canada T2201 E?

Who is required to file Canada T2201 E?

How to fill out Canada T2201 E?

What is the purpose of Canada T2201 E?

What information must be reported on Canada T2201 E?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.