Get the free canadian disability tax credit form

Show details

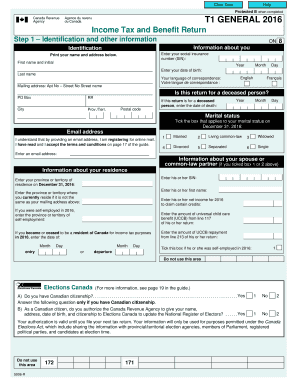

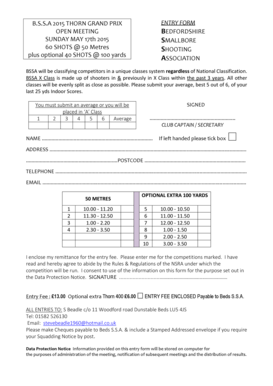

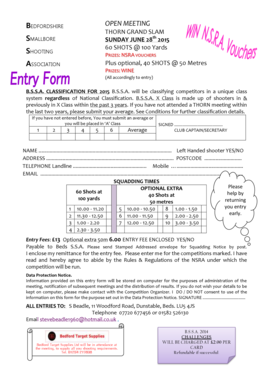

6729 DISABILITY TAX CREDIT Certificates This form is separated into two sections: the introduction and the form itself. The introduction includes the following: general information about the disability

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign canadian disability tax credit

Edit your canadian disability tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your canadian disability tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing canadian disability tax credit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit canadian disability tax credit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out canadian disability tax credit

How to fill out Canada T2201 E

01

Obtain the Canada T2201 E form from the Canada Revenue Agency (CRA) website or your local CRA office.

02

Fill out the identification section with your personal information, including your name, address, and social insurance number (SIN).

03

Answer questions about your disability status in the relevant sections, providing information about your impairment.

04

If applicable, indicate the nature and duration of your disability.

05

Have a qualified practitioner complete and sign the certification part of the form to validate your disability claim.

06

Review the completed form for accuracy and completeness.

07

Submit the form to the CRA, either by mail or electronically, depending on the method allowed.

Who needs Canada T2201 E?

01

Individuals who have a disability as defined by the CRA.

02

Those seeking to claim the Disability Tax Credit (DTC) in Canada.

03

Persons who require assistance in completing their tax returns due to a physical or mental impairment.

Fill

form

: Try Risk Free

People Also Ask about

Is there a disability tax credit in Canada?

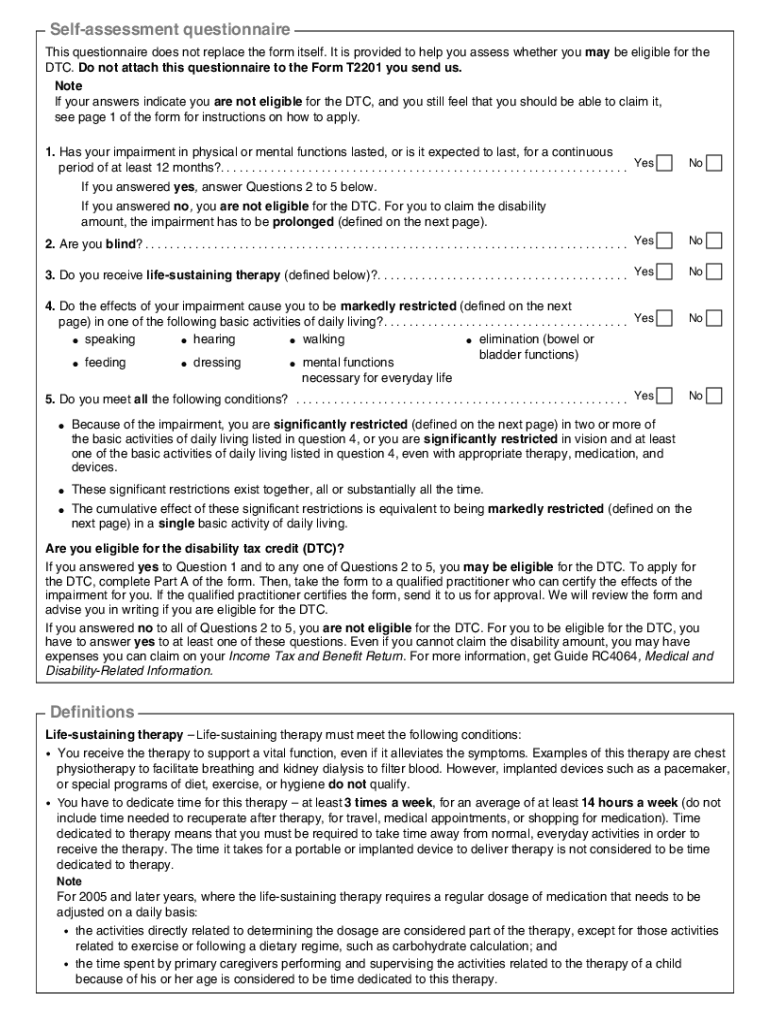

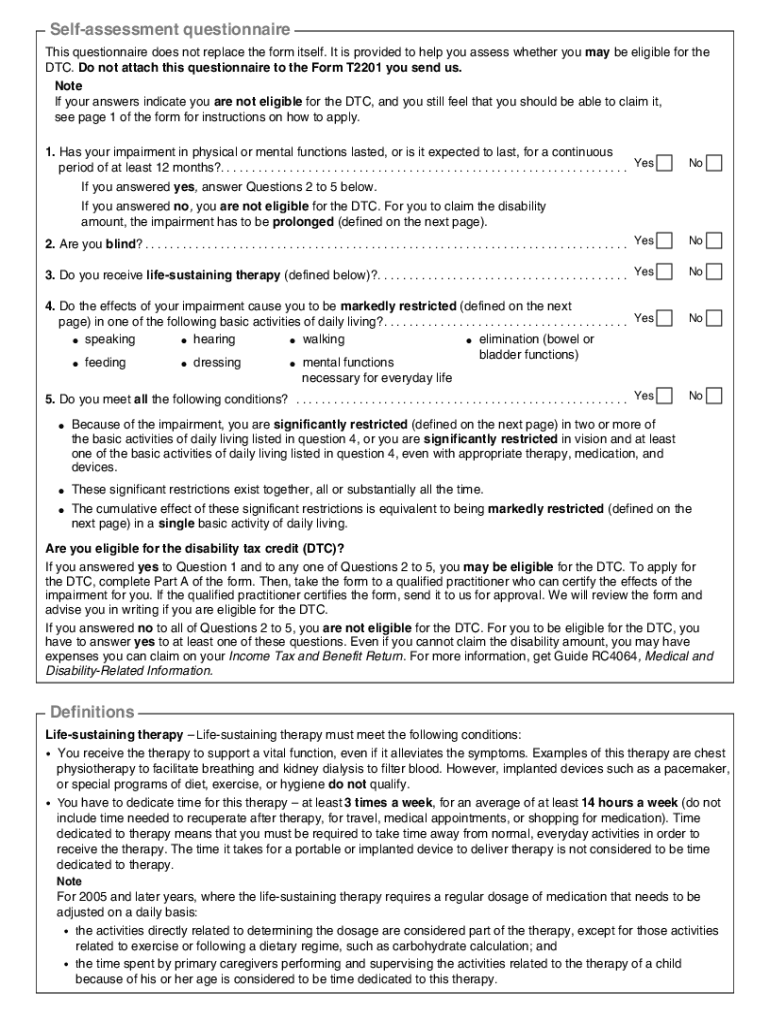

You may be eligible for the DTC if a medical practitioner certifies that you have a severe and prolonged impairment in 1 of the categories, significant limitations in 2 or more categories, or receive therapy to support a vital function.

How does Canada disability tax credit work?

The Disability Tax Credit (DTC) is a non-refundable credit used to reduce your taxable income to zero; it's designed to offset the extra living costs related to a disability. The DTC tax credit is non-refundable, which means it'll benefit you in reducing your taxes owing.

Why am I getting disability tax?

Your benefits may be taxable if the total of (1) one-half of your benefits, plus (2) all of your other income, including tax-exempt interest, is greater than the base amount for your filing status.

What is the IRS disability form?

More In Forms and Instructions Eligible small businesses use Form 8826 to claim the disabled access credit. This credit is part of the general business credit.

How do I get disability tax credit in Canada?

Apply with the new digital form Applicants can now complete Part A of the DTC application using the new digital form. Medical practitioners may use the DTC digital application to fill out Part B of Form T2201, Disability tax credit certificate. Once completed it will be automatically submitted to the CRA.

What is a disability tax form?

An SSA-1099 is a tax form we mail each year in January to people who receive Social Security benefits. It shows the total amount of benefits you received from us in the previous year so you know how much Social Security income to report to the Internal Revenue Service on your tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify canadian disability tax credit without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like canadian disability tax credit, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Where do I find canadian disability tax credit?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific canadian disability tax credit and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I sign the canadian disability tax credit electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your canadian disability tax credit and you'll be done in minutes.

What is Canada T2201 E?

The Canada T2201 E is the Disability Tax Credit Certificate form used in Canada to help individuals with disabilities qualify for tax credits and benefits.

Who is required to file Canada T2201 E?

Individuals who believe they have a disability that substantially impairs their ability to carry out basic daily activities and wish to claim the Disability Tax Credit must file Canada T2201 E.

How to fill out Canada T2201 E?

To fill out Canada T2201 E, individuals should complete the form with their personal information, details about their disability, and have a qualified medical professional complete the certification section.

What is the purpose of Canada T2201 E?

The purpose of Canada T2201 E is to determine eligibility for the Disability Tax Credit, which can provide tax relief to individuals with significant disabilities.

What information must be reported on Canada T2201 E?

Information that must be reported includes personal details of the individual making the claim, a description of the disability, the severity and duration of the disability, and confirmation from a qualified medical practitioner.

Fill out your canadian disability tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canadian Disability Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.