WI F-13161 2008-2026 free printable template

Show details

DEPARTMENT OF HEALTH SERVICES Division of Health Care Access and Accountability F-13161 (07/08) STATE OF WISCONSIN P.L. 104-191 WISCONSIN SENIOR CARE HIPAA PRIVACY AUTHORIZATION FOR USE OR DISCLOSURE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign hipaa authorization form wisconsin

Edit your WI F-13161 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI F-13161 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI F-13161 online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit WI F-13161. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out WI F-13161

How to fill out WI F-13161

01

Obtain the WI F-13161 form from the Wisconsin Department of Revenue website.

02

Fill out your personal information including your name, address, and Social Security number.

03

Provide the details of your income and any deductions you wish to claim.

04

Review the instructions provided with the form for any specific requirements.

05

Calculate your total tax liability or refund amount based on the information you provided.

06

Sign and date the form to certify that the information is accurate.

07

Submit the completed form by the required deadline, either by mail or electronically if applicable.

Who needs WI F-13161?

01

Individuals who are residents of Wisconsin and need to file their state income taxes.

02

Taxpayers who are claiming specific credits or adjustments as outlined in the WI F-13161 form.

03

Anyone who has received a notification from the Wisconsin Department of Revenue requesting additional information pertaining to their income tax return.

Fill

form

: Try Risk Free

People Also Ask about

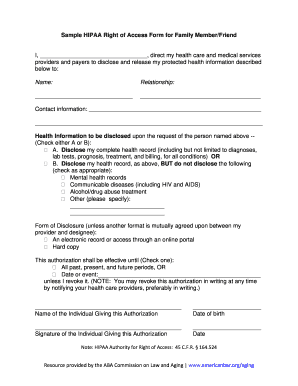

What is an example of HIPAA authorization?

I hereby authorize use or disclosure of protected health information about me as described below. I understand that the information used or disclosed may be subject to re-disclosure by the person or class of persons or facility receiving it, and would then no longer be protected by federal privacy regulations.

How do I create a HIPAA compliant form?

How to create effective HIPAA compliant forms Using a HIPAA compliant form builder. Collect HIPAA compliant electronic signatures. Collecting all patient information in one intake form. Restricting form field entry. Making form fields required. Using conditional logic in forms. Autocomplete forms.

What must be included in a HIPAA release?

The core elements of a valid authorization include: A meaningful description of the information to be disclosed. The name of the individual or the name of the person authorized to make the requested disclosure. The name or other identification of the recipient of the information.

What is HIPAA patient consent form?

A HIPAA consent form is a legal document that authorizes covered entities to disclose protected health information that is not permitted by the HIPAA Privacy Rule. The form must be retained as proof that the authorization was obtained in writing to waive certain Privacy Rule restrictions.

What is a HIPAA privacy form?

What is the HIPAA notice I receive from my doctor and health plan? Your health care provider and health plan must give you a notice that tells you how they may use and share your health information. It must also include your health privacy rights.

What is HIPAA in Florida?

In 1996, Congress passed the Health Insurance Portability and Accountability Act (HIPAA). One component of HIPAA was to streamline the process to exchange information and to make health information more readily accessible to patients.

What is a HIPAA form used for?

A HIPAA authorization form gives covered entities permission to use protected health information for purposes other than treatment, payment, or health care operations.

How do you write a HIPAA release form?

I hereby authorize the release of my complete health record (including records relating to mental health care, communicable diseases, HIV or AIDS, and treatment of alcohol/drug abuse). medical treatment or consultation, billing or claims payment, or other purposes as I may direct. at which time it expires.

Can you sue for HIPAA violation in Florida?

There is no private cause of action in HIPAA, so it is not possible for a patient to sue for a HIPAA violation.

What does signing a HIPAA privacy form mean?

The HIPAA privacy form is a document that outlines the manner in which a patient's PHI (protected health information) may be disclosed to third parties (e.g. health clearinghouses). Patients who sign one of these forms legally acknowledge that they have understood the provider's privacy practices.

What is the Florida version of HIPAA?

The Florida Information Protection Act of 2014 (FIPA) governs privacy rules for entities handling personal information. As such, the law can be thought of as “HIPAA Florida.” While it is important to comply with both laws, there are instances in which meeting the requirements of one law will satisfy the other.

How do I file a HIPAA violation in Florida?

Your complaint must: Be filed in writing by mail, fax, e-mail, or via the OCR Complaint Portal. Name the covered entity or business associate involved, and describe the acts or omissions, you believed violated the requirements of the Privacy, Security, or Breach Notification Rules.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find WI F-13161?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the WI F-13161 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for signing my WI F-13161 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your WI F-13161 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out WI F-13161 on an Android device?

Complete your WI F-13161 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is WI F-13161?

WI F-13161 is a Wisconsin tax form used by individuals and entities to report certain types of income, deductions, and credits for state tax purposes.

Who is required to file WI F-13161?

Individuals and entities who have specific types of taxable income or wish to claim certain deductions and credits in Wisconsin are required to file WI F-13161.

How to fill out WI F-13161?

To fill out WI F-13161, taxpayers should provide personal information, details of income earned, deductions claimed, and any applicable credits, following the instructions provided with the form.

What is the purpose of WI F-13161?

The purpose of WI F-13161 is to ensure accurate reporting of income and deductions to assess the correct state income tax liability for individuals and entities in Wisconsin.

What information must be reported on WI F-13161?

The information that must be reported includes taxpayer identification details, total income, specific deductions, credits claimed, and any other relevant financial information required by the form instructions.

Fill out your WI F-13161 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI F-13161 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.