Get the free bir form 1707 example with answer

Show details

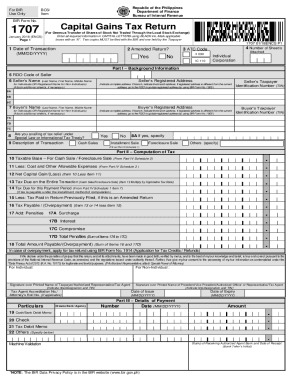

To be filled up by the BIR DLN BIR Form No. Annual Capital Gains Tax Return Republika ng Pilipinas Kagawaran ng Pananalapi Kawanihan ng Rentas Internas 1707-A For Onerous Transfer of Shares of Stock Not Traded Through the Local Stock Exchange July 1999 ENCS Fill in all applicable spaces.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bir form 1707 example

Edit your bir form 1707 example form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bir form 1707 example form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bir form 1707 example online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bir form 1707 example. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bir form 1707 example

How to fill out bir form 1707?

01

Provide the necessary information at the top of the form, such as your name, taxpayer identification number (TIN), registered address, and the taxable year.

02

Indicate the type of taxpayer you are, whether an individual, corporation, partnership, or other entity.

03

Fill out Part I of the form, which requires you to input your gross sales/receipts for the taxable year, including both taxable and exempt sales/receipts.

04

Compute the Gross Income from Operations by subtracting the Cost of Sales and Direct Costs from the gross sales/receipts.

05

Determine your Gross Income from Other Sources, if applicable, and input the amount.

06

Calculate the Total Gross Income by adding the Gross Income from Operations and the Gross Income from Other Sources.

07

Subtract the Total Deductions and Discounts, as provided in Part II of the form, from the Total Gross Income.

08

Determine the Taxable Income by subtracting the Total Non-Deductible Expenses and other deductions from the Total Deductions and Discounts.

09

Compute the Graduated Tax on your Taxable Income, following the prescribed tax rates for the specific range of income.

10

Fill out Part III of the form, which requires you to provide your personal/business information, including your TIN, tax type, and the return period.

11

Calculate and input the Total Tax Due by summing up the Graduated Tax and any applicable penalties.

12

If you made any advance payments or have tax credits, deduct them from the Total Tax Due to determine the Amount of Tax Still Due or the Refundable Amount.

Who needs bir form 1707?

01

Individuals who are engaged in business or exercise their profession and have gross sales/receipts exceeding Php 3,000,000 for the taxable year.

02

Corporations, partnerships, or other entities with gross sales/receipts exceeding Php 3,000,000 for the taxable year.

03

Taxpayers who are required to pay graduated tax rates based on their taxable income.

04

Individuals, corporations, partnerships, or other entities who are registered as a taxpayer with the Bureau of Internal Revenue (BIR) and are required to file the applicable tax returns.

Fill

form

: Try Risk Free

People Also Ask about

What is BIR Form 1707 for?

The Capital Gains Tax Return (BIR Form No. 1707) shall be filed in triplicate by every natural or juridical person, resident or non-resident, for sale, barter, exchange or other onerous disposition of shares of stock in a domestic corporation, classified as capital assets, not traded through the local stock exchange.

Do I have to pay capital gains tax immediately?

You only pay the capital gains tax after you sell an asset. Let's say you bought your home 2 years ago and it's increased in value by $10,000. You don't need to pay the tax until you sell the home.

How do I avoid capital gains tax on primary residence?

How to avoid capital gains tax on real estate Live in the house for at least two years. The two years don't need to be consecutive, but house-flippers should beware. See whether you qualify for an exception. Keep the receipts for your home improvements.

Do I need to prepay capital gains tax?

You should generally pay the capital gains tax you expect to owe before the due date for payments that apply to the quarter of the sale. In 2022, the quarterly due dates are April 18 for the first quarter, June 15 for second quarter, Sept. 15 for third quarter, and Jan. 15 of the following year for the fourth quarter.

What is BIR Form 1701Q?

BIR Form 1701Q, also known as Quarterly Income Tax Return For Self-Employed Individuals, Estates and Trusts (Including those with both Business and Compensation Income) is a tax return intended for professionals and self-employed individuals who are engaged in a sole proprietorship business.

How long can I wait to pay capital gains tax?

You only pay the capital gains tax after you sell an asset. Let's say you bought your home 2 years ago and it's increased in value by $10,000. You don't need to pay the tax until you sell the home.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send bir form 1707 example for eSignature?

When you're ready to share your bir form 1707 example, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find bir form 1707 example?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the bir form 1707 example in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How can I edit bir form 1707 example on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing bir form 1707 example.

What is bir form 1707 example?

BIR Form 1707 is a tax form used in the Philippines for the declaration of capital gains tax on the sale of real property. An example would include reporting the sale of a house or land by an individual or entity.

Who is required to file bir form 1707 example?

Individuals or businesses that sell real property in the Philippines and are subject to capital gains tax are required to file BIR Form 1707. This includes sellers of residential and commercial real estate.

How to fill out bir form 1707 example?

To fill out BIR Form 1707, you need to input details such as the seller's information, buyer's information, description of the property sold, the selling price, and the computed capital gains tax. Accurate values and supporting documents must be attached.

What is the purpose of bir form 1707 example?

The purpose of BIR Form 1707 is to report and declare capital gains tax owed to the Bureau of Internal Revenue for the sale of real estate property, ensuring that tax obligations are met.

What information must be reported on bir form 1707 example?

The information that must be reported includes the seller's name and tax identification number (TIN), buyer's details, property description, sale price, date of sale, and the amount of capital gains tax due.

Fill out your bir form 1707 example online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bir Form 1707 Example is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.