UK VAT 1 2020 free printable template

Show details

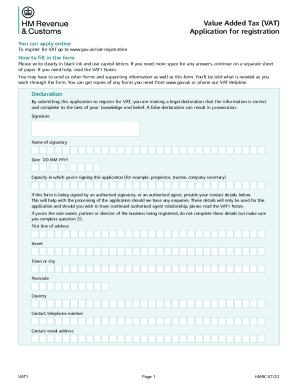

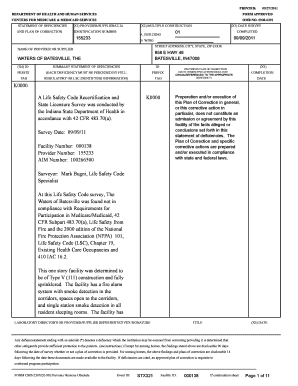

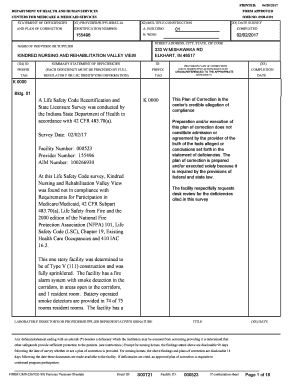

Value Added Tax (VAT)

Application for registration

You can apply online

To register for VAT go to www.gov.uk/vatregistrationHow to fill in the form

Please write clearly in black ink and use capital

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK VAT 1

Edit your UK VAT 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK VAT 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK VAT 1 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UK VAT 1. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK VAT 1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK VAT 1

How to fill out UK VAT 1

01

Gather your business information, including your VAT registration number and accounting records.

02

Begin filling out the UK VAT 1 form, starting with your details in section 1.

03

Provide the total amount of sales and purchases for the relevant accounting period in sections 2 and 3.

04

Calculate the VAT due or reclaimable, and fill this in the appropriate sections.

05

Complete sections regarding any adjustments or corrections if necessary.

06

Check your form thoroughly to ensure all figures are accurate and all required sections are completed.

07

Submit the form by the deadline specified to avoid penalties.

Who needs UK VAT 1?

01

Any business in the UK that is registered for VAT and is required to submit VAT returns.

02

Entities that meet the VAT threshold and deal with taxable supplies and purchases.

03

Businesses that need to adjust their VAT liabilities or reclaim overpaid VAT.

Fill

form

: Try Risk Free

People Also Ask about

Where can I find my VAT number?

You can locate your VAT number on the VAT registration certificate issued by HMRC. Your VAT number will contain nine digits, with the first two digits indicating the country code (‘GB' for UK businesses). You can locate your VAT number on the VAT registration certificate issued by HMRC.

Can I charge VAT without a VAT number?

You can't charge or show VAT on your invoices until you get your VAT number. However, you will still have to pay the VAT to HMRC for any sales you make in this period.

How do I get a VAT number in the US?

You must get help to apply for a VAT number. An application must be submitted to the local tax authorities using the right registration forms. This application should include documentation about your business, evidence of the authority of the legal representative, and detailed information about your planned activities.

How do I find a VAT number for a company?

Where can I find it? When you're looking for the VAT number of another business, your first port of call should be any invoice it has supplied to you. If the business is registered for VAT then its unique ID should be listed on all of their invoices.

How can I find my VAT number online?

Check The Company's Website: Many companies will have their VAT number listed on their website, typically in the footer or on the "Contact Us" page. Check Invoices: If you have recently purchased goods or services from the company, their VAT number should be listed on the invoice.

How do I find my VAT number USA?

VAT number USA Actually there are no VAT numbers in the USA! In the States, there's a different consumption tax system called sales tax. If you're looking to set up a business in Europe, this guide on vat registration numbers and how to acquire one for your expanding business will push you in the right direction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in UK VAT 1?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your UK VAT 1 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in UK VAT 1 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit UK VAT 1 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit UK VAT 1 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing UK VAT 1 right away.

What is UK VAT 1?

UK VAT 1 is a form used by businesses to declare their Value Added Tax (VAT) liability to HM Revenue and Customs (HMRC) in the United Kingdom.

Who is required to file UK VAT 1?

Businesses that are registered for VAT in the UK and have taxable turnover above the VAT threshold are required to file UK VAT 1.

How to fill out UK VAT 1?

To fill out UK VAT 1, businesses need to provide their VAT registration number, accounting period, sales and purchases figures, and the VAT amount due or reclaimable.

What is the purpose of UK VAT 1?

The purpose of UK VAT 1 is to enable businesses to report their VAT liabilities to HMRC and ensure compliance with VAT legislation.

What information must be reported on UK VAT 1?

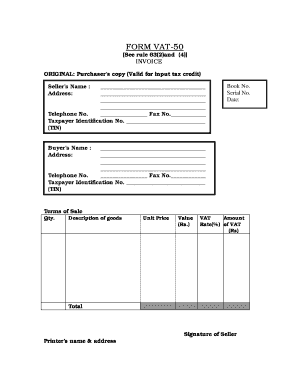

UK VAT 1 must report information including the VAT registration number, accounting period, total sales, total purchases, VAT due, and any VAT being reclaimed.

Fill out your UK VAT 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK VAT 1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.