MassMutual F6367 2011-2025 free printable template

Show details

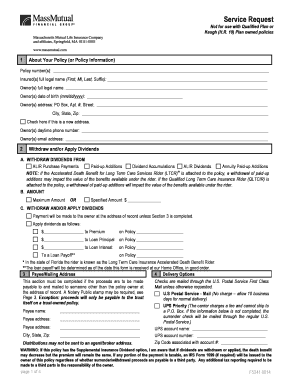

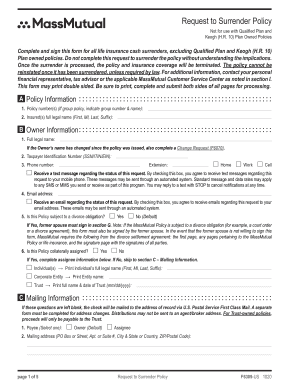

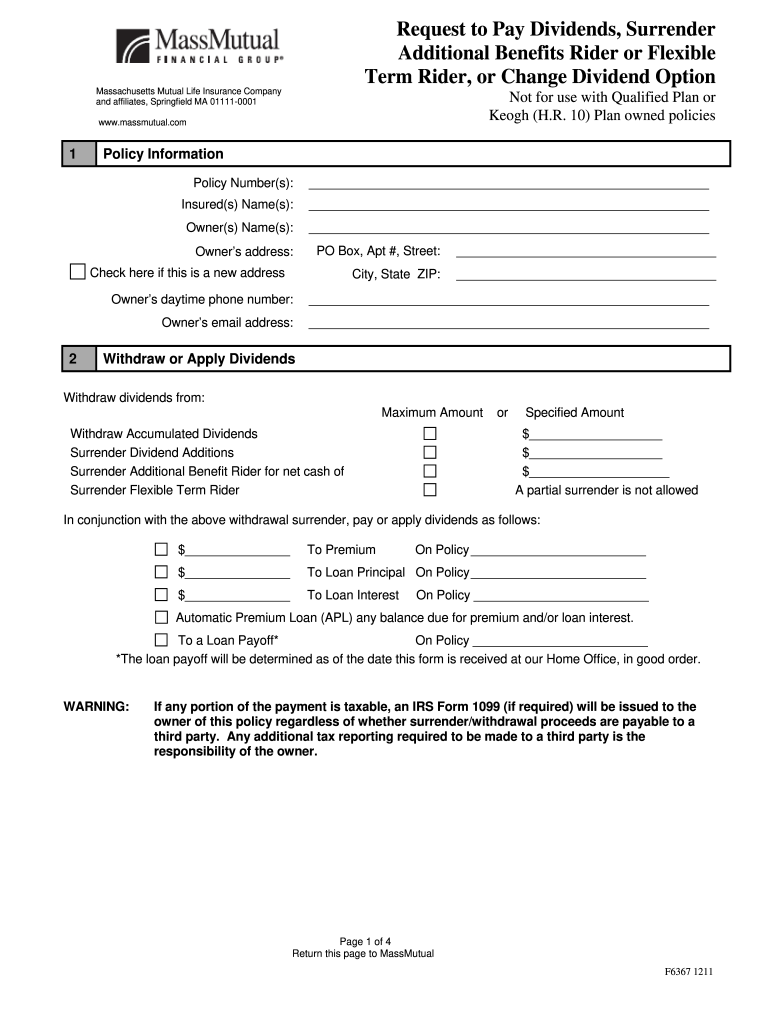

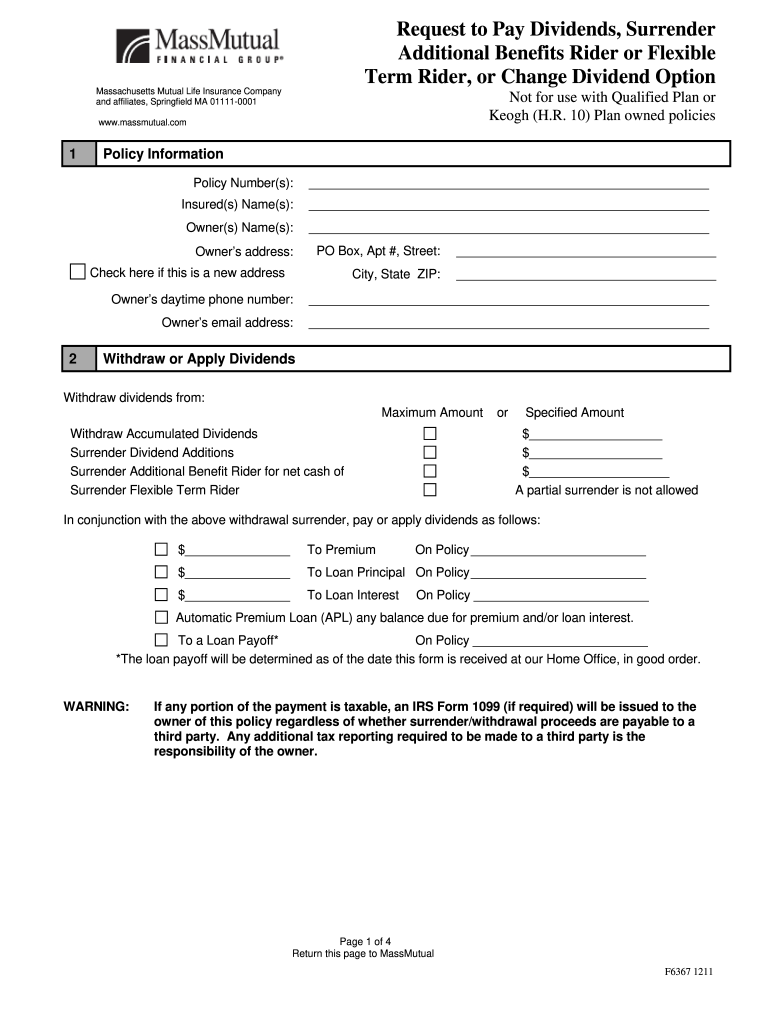

This document is a request form for policy owners to withdraw dividends, surrender additional benefits riders, or change dividend options with Massachusetts Mutual Life Insurance Company.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign massmutual surrender form

Edit your mass mutual surrender form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your massmutual dividend history form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing massmutual annuity withdrawal form online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit massmutual 401k withdrawal form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mass mutual life insurance forms

How to fill out massmutual surrender form:

01

Obtain a copy of the massmutual surrender form from the official website or through the company's customer service.

02

Carefully read and understand the instructions provided with the form, as well as any accompanying documents or requirements.

03

Collect all the necessary information and documents required to complete the form, such as policy number, surrender amount, personal details, and any supporting documents requested.

04

Fill out the form accurately, using clear and legible handwriting or typing, and avoid leaving any sections blank unless instructed otherwise.

05

Review the completed form for any errors or missing information, ensuring that all relevant sections have been addressed.

06

Sign and date the form as required, understanding that this signifies your agreement and consent to the surrender process.

07

Submit the filled-out form along with any supporting documents through the designated channels, such as mailing it to the specified address or submitting it electronically through the company's online portal.

08

Keep a copy of the completed form for your records.

Who needs massmutual surrender form:

01

Policyholders who wish to surrender or cancel their massmutual insurance policies.

02

Individuals or beneficiaries who no longer require the coverage provided by the policy or who have found alternative insurance arrangements.

03

Those seeking to withdraw the cash value or surrender value associated with their massmutual policies for any reason.

Fill

massmutual annuity surrender form

: Try Risk Free

People Also Ask about northwestern mutual 1035 exchange form

Can I take money out of my MassMutual account?

Withdrawals are taken proportionally from your contract value in your selected investment choices. Minimum withdrawal amount is $100. Remaining contract balance: Evolution must be at least $2,000; Transitions Select must be at least $2,000. Withdrawals may be subject to a contingent deferred sales charge (CDSC).

How long does Massmutual take to process a withdrawal?

How long will it take to process my withdrawal request and receive the funds? Once you have submitted the online withdrawal request through your MyGuideStone account or GuideStone has received your completed withdrawal application, the processing time for the withdrawal is typically 5\u20137 business days.

How long does it take for your 401k to be direct deposited?

Depending on your bank, a 401(k) loan direct deposit will take about two or three business days for the funds to reach your bank account. Before going through the 401(k) loan process, talk to your plan's administrator to figure out the quickest and most efficient way to get a 401(k) loan.

How do I close out my MassMutual account?

We would love the opportunity to understand why you want to cancel your policy and how we can help. To discuss alternative options or have us assist you with closure, please call 1-800-272-2216 or reach out to your financial professional.

Is MassMutual better than New York life?

MassMutual is most highly rated for Work/life balance and New York Life is most highly rated for Work/life balance.Overall Rating. Overall Rating3.73.7Work/life balance3.73.6Compensation and benefits3.53.4Job security and advancement3.13.1Management3.33.41 more row

Can I cancel my life insurance policy?

Can you cancel a life insurance policy at any time? Yes, you can, although the only way to get back all your premium payments is to do so during the initial “free look” period.

How long does 401k withdrawal take?

Depending on who administers your 401(k) account (typically a brokerage, bank or other financial institution), it can take between three and 10 business days to receive a check after cashing out your 401(k).

What reasons can you withdraw from 401k without penalty?

Here are the ways to take penalty-free withdrawals from your IRA or 401(k) Unreimbursed medical bills. Disability. Health insurance premiums. Death. If you owe the IRS. First-time homebuyers. Higher education expenses. For income purposes.

Can I withdraw money from Massmutual?

Withdrawal Options. Minimum withdrawal amount is $100. Remaining contract balance: Evolution must be at least $2,000; Transitions Select must be at least $2,000. Withdrawals may be subject to a contingent deferred sales charge (CDSC).

Is MassMutual owned by Fidelity?

Colorado-based Empower, the second-largest recordkeeper behind Fidelity, acquired MassMutual's retirement plan business in January 2021. The latest news raised interesting points about plan sponsor responsibilities as the retirement plan industry consolidates.

How long does MassMutual take to process a withdrawal?

How long will it take to process my withdrawal request and receive the funds? Once you have submitted the online withdrawal request through your MyGuideStone account or GuideStone has received your completed withdrawal application, the processing time for the withdrawal is typically 5\u20137 business days.

Can I take money out of my retirement account?

You can withdraw money from your IRA at any time. However, a 10% additional tax generally applies if you withdraw IRA or retirement plan assets before you reach age 59½, unless you qualify for another exception to the tax.

How do I withdraw money from my 401k?

By age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401(k) without having to pay a penalty tax. You'll simply need to contact your plan administrator or log into your account online and request a withdrawal.

Can you withdraw from empower retirement?

In Service Withdrawals: If the plan allows, actively employed participants may take withdrawals when they reach retirement age (as defined by the IRS) or when they experience a plan-defined qualifying event.

Is MassMutual a reputable company?

Out of a total of 91 insurance companies we reviewed, MassMutual is one of only eight that has an A++ rating. In addition, MassMutual is rated above average for overall customer satisfaction in J.D. Power's 2021 U.S. Individual Life Insurance Study.

What is the new name for MassMutual?

CINCINNATI – October 3, 2022 – Great American Life Insurance Company announced today that it will now do business as MassMutual Ascend Life Insurance Company (MassMutual Ascend). The rebrand comes as a result of the company's acquisition by Massachusetts Mutual Life Insurance Company (MassMutual) in May 2021.

How long has MassMutual been paying dividends?

1, 2022 – Massachusetts Mutual Life Insurance Company (MassMutual) today announced that its 2023 dividend payout, estimated at $1.9 billion, will set a new record for the company for the third year in a row. The company has paid dividends to eligible participating policyowners every year since 1869.

How do I cancel my MassMutual policy?

To cancel your MassMutual insurance Subscription, follow these easy steps: Call customer service on (800) 272-2216. Ask to speak with a representative. Provide them with your policy number and customer details. Request cancellation of your coverage and recurring payments. You will receive a confirmation letter or email.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the massmutual ascend withdrawal form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your massmutual annuity forms and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I edit complete the form on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing northwestern mutual 1035 exchange form pdf right away.

How do I edit mass mutual beneficiary form on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign northwestern mutual surrender form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

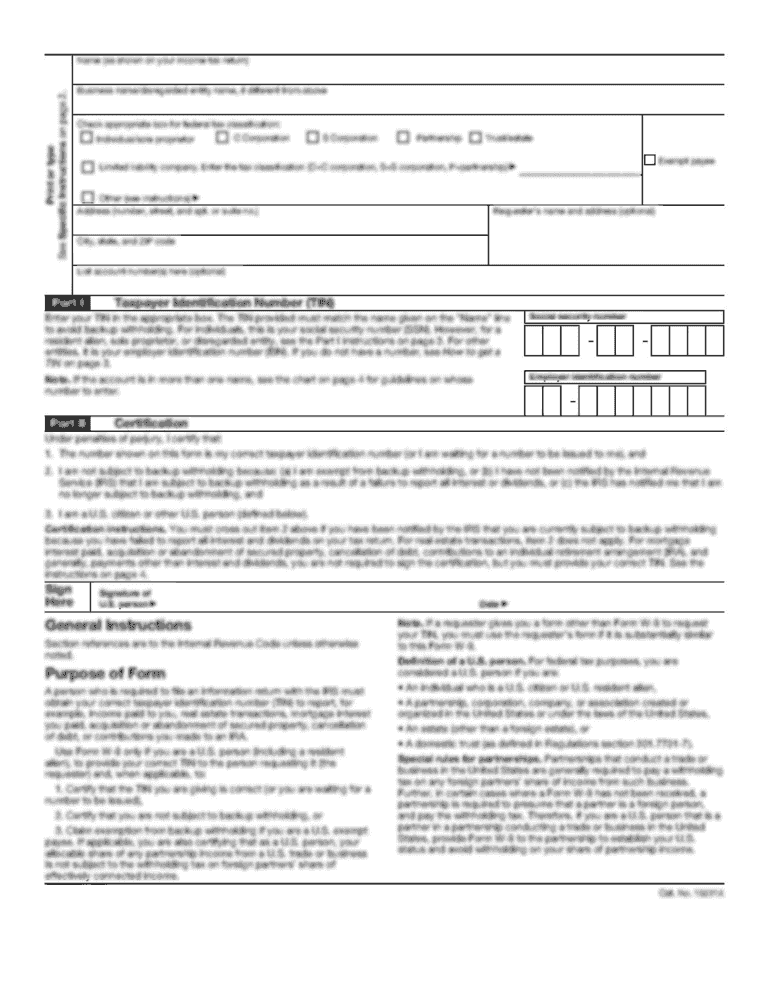

What is MassMutual F6367?

MassMutual F6367 is a specific form used for reporting financial data related to insurance policies and other financial instruments provided by Massachusetts Mutual Life Insurance Company.

Who is required to file MassMutual F6367?

Individuals or entities holding certain insurance policies or financial accounts with MassMutual that meet specific criteria may be required to file the MassMutual F6367.

How to fill out MassMutual F6367?

To fill out MassMutual F6367, follow the instructions provided with the form, ensuring to include all required information such as policy numbers, financial data, and any other relevant details.

What is the purpose of MassMutual F6367?

The purpose of MassMutual F6367 is to collect information related to insurance policies and financial transactions for reporting and compliance purposes.

What information must be reported on MassMutual F6367?

Information reported on MassMutual F6367 typically includes policy details, financial performance data, and other relevant disclosures related to the insured assets or financial instruments.

Fill out your MassMutual F6367 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Massmutual Retirement Plans is not the form you're looking for?Search for another form here.

Keywords relevant to mass mutual email format

Related to cash surrender form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.