What is Form 1040 Line 44?

First, Form 1040 is known as the U.S. Individual Income Tax Return. You must check the instructions to this form to know if you are eligible to file it or not. There are several charts (A, B, C) that help define your status and eligibility. Once you have determined your status, you cannot avoid filling in Line 44 that is devoted to the qualified dividends and capital gains tax.

What is Form 1040 Line 44 for?

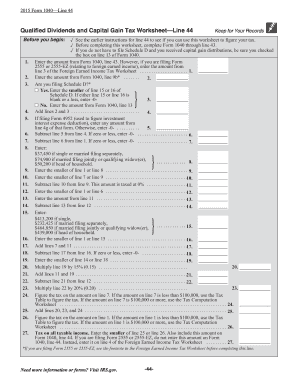

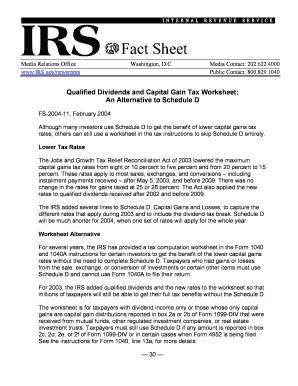

The general purpose of the form is to calculate the tax. Line 44 is one of the fields for completing to figure this total tax. Do not fill it in, unless the other 43 lines are completed. It is designed for the qualified dividends and capital gains tax.

When is Form 1040 Line 44 Due?

As far as the due date of Form 1040 is April 18th, Line 44 must also be filled by this date. Do not skip it. Otherwise, the form will be rejected as the tax will not be calculated and provided in the form.

Is It Accompanied by Other Forms?

Form 8962 may be attached. It is known as the Premium Tax Credit (PTC) and has 5 parts.

What Information do I Include in Form 1040 Line 44?

To count the total income tax, it is necessary to make many calculations. For this, it is better to check the IRS instructions to Line 44. The calculations will be correct if you indicate the right information in the other lines of Form 1040.

Where do I Send Form 1040 Line 44?

When all lines, including Line 44, qualified dividends and capital gains tax, are completed, you must send the form to the IRS.