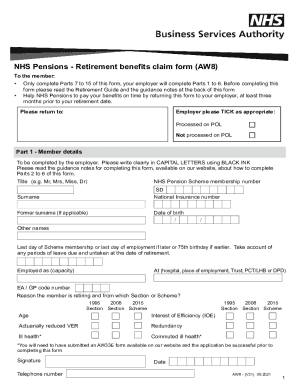

Who Must File Form AW8?

Form AW8 is known as the Retirement Benefits Claim Form. There are several section schemes for members and the requirements for pensions in each of them are different. They are the following:

-

1995 Section Scheme: 55 (men) and 60 (women) years old members;

-

2008 Section Scheme: 65 years old members;

-

2015 Section Scheme: the pension age is the same as in your state.

The time of your retirement directly depends on the section you belong to. If you belong to more than one section, check the NHS guide for more information.

What is Form AW8 for?

This form is created to request the pension. If you do not file this application, you will not receive any amounts after retirement.

When is the Retirement Benefits Claim Form Due?

You must start preparing all documents when you approach the age of retirement according to the scheme you belong to.

Is Form AW8 Accompanied by Other Forms?

The mandate for the payment that was made to the overseas banking institution must be attached to the Retirement Benefits Claim Form.

What Information should I Include in Form AW8?

The form consists of 15 parts. Each part must be properly filled in. The following information is required to be provided in all these form sections:

-

Member details (title and surname, NHS Pension Scheme membership number, date of birth, age, reason the member is retiring, telephone number, signature, etc.);

-

Pensionable pay details;

-

Additional information for part-time members (including part-time specialists);

-

Verification of dates and details;

-

Compensation retirement cases;

-

Certification;

-

Employment details;

-

Allocating part of your pension;

-

Retirement lump sum;

-

About your status;

-

HM Revenue and Customs (HMRC) information;

-

Payment details;

-

Voluntary deductions;

-

Declaration.

Where should I Send Form AW8?

After the form is filled in, send it to the National Health Service department in your state.