TX 5506-NAR 2013 free printable template

Show details

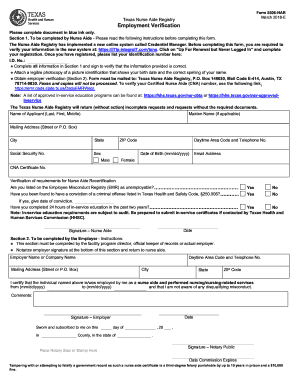

Texas Department of Aging and Disability Services Form 5506-NAR August 2013-E Texas Nurse Aide Registry Employment Verification Section 1. Obtain employer verification Section 2. Form must be mailed to Texas Nurse Aide Registry P. O. Box 149030 MC E-414 Austin TX 78714-9030. Faxes and copies will not be processed. Note You will not receive a new certificate if you are only updating your certification expiration date. To verify your CNA number or that your expiration date has been extended...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form 5506 - dads form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 5506 - dads form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 5506 - dads online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 5506 - dads. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

TX 5506-NAR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 5506 - dads

01

To fill out form 5506, begin by obtaining the form from the appropriate source. This may include downloading it from a government website or requesting a physical copy from a relevant agency.

02

Next, carefully read the instructions provided with the form. These instructions will guide you through the specific requirements and steps for completing the form accurately.

03

Gather all the necessary information and documentation that will be required to fill out form 5506. This may include personal details, financial information, or supporting documents related to the purpose of the form.

04

Start by entering your personal information in the designated sections of the form. This may include your name, address, contact details, and any identification numbers that are required.

05

Proceed to the sections of the form that require specific information related to its purpose. Depending on the nature of the form, this could involve providing details about your income, taxes, assets, liabilities, or any other relevant information.

06

Take extra care to ensure accuracy when filling out the form. Double-check your entries, especially when providing numerical information, to avoid any mistakes that could delay or complicate the processing of the form.

07

Once you have completed all the required sections of form 5506, review it thoroughly to ensure everything is accurate and complete. Make any necessary corrections or additions before finalizing the form.

08

Sign and date the form in the designated areas, following the provided instructions for signature requirements. In some cases, you may require a witness or notary public to authenticate your signature.

Who needs form 5506:

01

Form 5506 may be needed by individuals or entities who are required to provide certain information or meet specific obligations as outlined by the governing authorities.

02

The need for form 5506 can vary depending on the purpose of the form. It may be required for tax filings, financial reporting, regulatory compliance, or any other legal or administrative requirements.

03

The specific individuals or entities who need to fill out form 5506 will depend on the applicable laws, regulations, or circumstances surrounding the purpose of the form. It is important to consult the relevant authorities or seek professional advice to determine if you are mandated to submit form 5506.

Instructions and Help about form 5506 - dads

Fill form : Try Risk Free

What is texas form 5506 nar?

Form 5506-NAR, Texas Nurse Aide Registry Employment Verification, is a form that has to be completed by a nurse aide and their employer to verify employment. To remain on active status and to provide services in nursing facilities, nurse aides have to do such verifications at least every two years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 5506?

There does not appear to be a specific form 5506 in common use. The Internal Revenue Service (IRS) uses form numbers for various tax-related forms, but form 5506 is not listed among them. It is possible that form 5506 may be specific to certain states, organizations, or industries, but without more context it is unclear what it pertains to.

Who is required to file form 5506?

There is no specific form named "Form 5506" in the Internal Revenue Service (IRS) forms. However, there is a form called "Form 5500" which is used for filing an annual report for employee benefit plans. This form must be filed by the plan administrator or the plan sponsor of the employee benefit plan.

How to fill out form 5506?

Form 5506 is not a commonly known or referenced form, and there is no official Form 5506 provided by the Internal Revenue Service (IRS). It's possible that you are referring to a specific form used by a particular organization or industry, in which case you would need to provide further context or details.

However, if you are referring to a hypothetical form and need guidance on how to complete it, here are some general steps to follow:

1. Read instructions: Begin by carefully reading the form instructions, if any are provided. The instructions usually include important details on how to complete the form correctly and any specific requirements.

2. Gather necessary information: Collect all the necessary information and documents that are required to complete the form. This may include personal details, financial information, or other specific details related to the purpose of the form.

3. Start filling out the form: Begin by entering your personal details like your name, address, social security number or taxpayer identification number, and other required information in the appropriate fields.

4. Follow the form sections: Forms typically have different sections to be filled out. Take it step-by-step and ensure you provide accurate information in each section. Be mindful of any specific instructions mentioned for each section.

5. Attach supporting documents (if required): If the form requires you to include any attachments or supporting documents, make sure you include them as per the instructions. These documents may vary widely based on the purpose of the form.

6. Review and double-check: Before submitting the form, review it thoroughly to ensure you have filled in all the required fields accurately. Check for any missing information or errors that need to be corrected to avoid any delays or complications in processing.

7. Sign and date: Once you have completed the form, make sure you sign and date it in the designated area. Unsigned forms or forms submitted without a date may be considered invalid.

8. Make copies: Before sending the form, make copies of it for your records. Maintaining a copy helps in case any issues arise or if you need to refer back to the information provided.

9. Submit the form: Determine where to submit the completed form, following the instructions given in the form or by referring to the organization or agency that provided the form.

Remember, these steps are general guidelines, and you need to adapt them to the specific form you are dealing with. If you are unsure about any aspect of completing the form, it is recommended to seek assistance from a professional or contact the relevant organization to provide guidance.

What is the purpose of form 5506?

Form 5506 is used by the United States Postal Service (USPS) to apply for a change of mailing address for a business location or an authorized employee. The purpose of this form is to notify the USPS of the new mailing address and to update their records accordingly. It is important for businesses to update their mailing address with the USPS to ensure that important mail and packages are delivered to the correct location.

What information must be reported on form 5506?

Form 5506, also known as the "Practitioner's Declaration of Electronic Filing of Petition for a Nonimmigrant Worker," is used to report the attorney, representative, or accredited non-attorney practitioner information when electronically filing specific petitions with the U.S. Citizenship and Immigration Services (USCIS).

The information required to be reported on form 5506 includes:

1. Case Information: This section includes the USCIS receipt number, petitioner information (name, address, and phone number), and beneficiary information (name, date of birth, and citizenship).

2. Practitioner Information: This section requires reporting the attorney, representative, or accredited non-attorney practitioner's information, including name, firm, address, telephone number, email address, and USCIS signature block information.

3. G-28 or EOIR-28 Information: If applicable, practitioners must provide information about the Form G-28 (Notice of Entry or Appearance as Attorney or Accredited Representative) or the EOIR-28 (Notice of Entry of Appearance as Attorney or Representative before the Executive Office for Immigration Review) if one has been submitted.

4. Electronic Filing Information: This section requires practitioners to mention the specific form being filed electronically, the USCIS Online Account Number (if applicable), the date of the electronic filing, and the email notification they wish to receive.

5. Certification: This section is for the authorized representative to certify that they are authorized to submit the form on behalf of the petitioner and that they have provided all necessary information accurately.

It is important to note that Form 5506 should only be submitted if the related petition is filed electronically.

How can I modify form 5506 - dads without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including form 5506 - dads, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make edits in form 5506 - dads without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your form 5506 - dads, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my form 5506 - dads in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your form 5506 - dads and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your form 5506 - dads online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.