IRS 13844 2012 free printable template

Show details

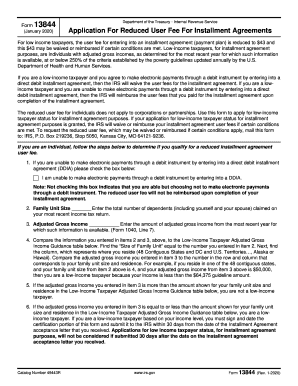

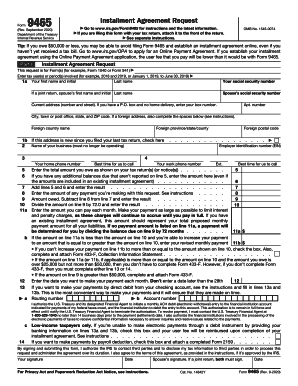

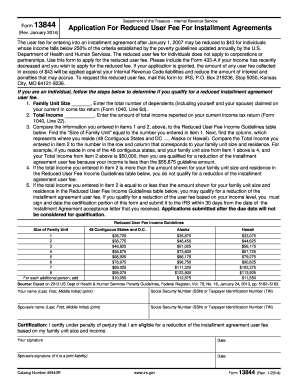

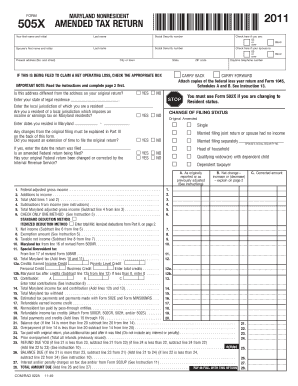

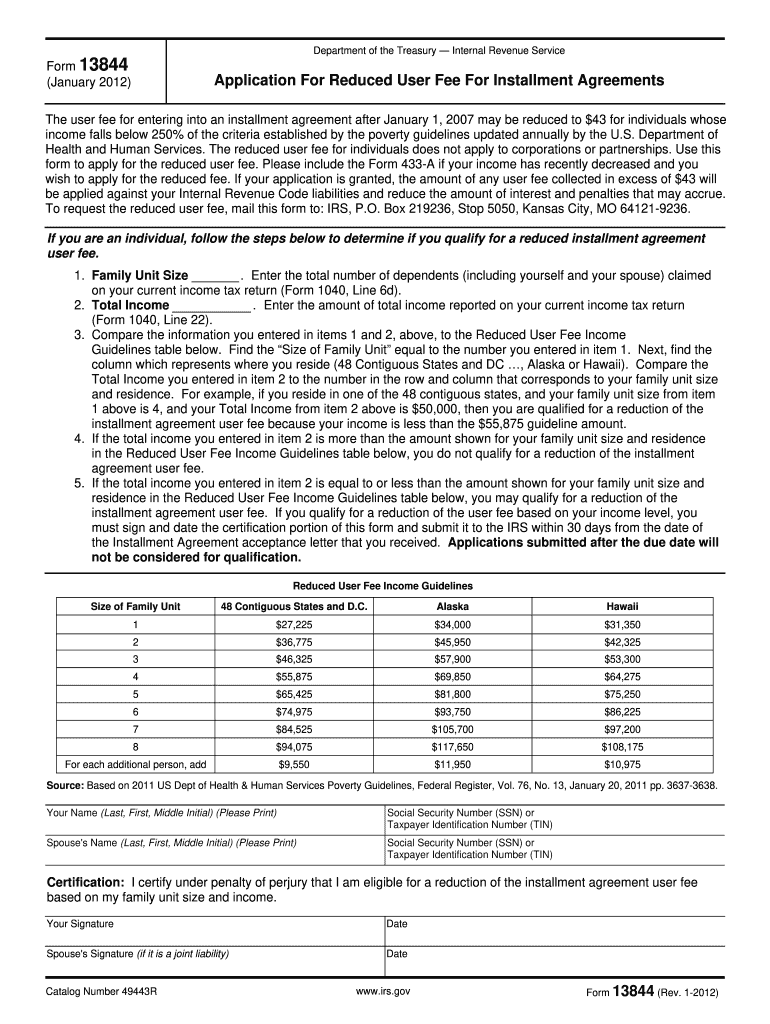

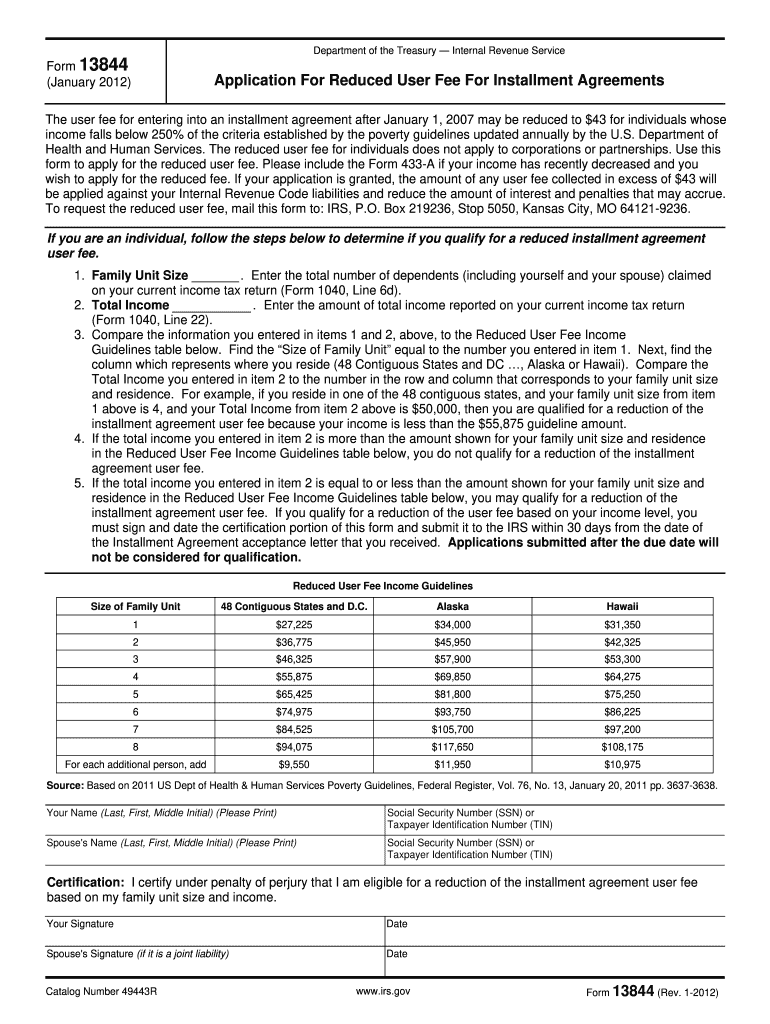

Your Signature Date Spouse s Signature if it is a joint liability Catalog Number 49443R www.irs.gov Form 13844 Rev. 1-2012. Department of the Treasury Internal Revenue Service Form 13844 January 2012 Application For Reduced User Fee For Installment Agreements The user fee for entering into an installment agreement after January 1 2007 may be reduced to 43 for individuals whose income falls below 250 of the criteria established by the poverty gui...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 13844

Edit your IRS 13844 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 13844 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 13844 online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 13844. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 13844 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 13844

How to fill out IRS 13844

01

Download IRS Form 13844 from the IRS website.

02

Read the form instructions carefully to understand the requirements.

03

Fill in your personal information at the top of the form, including your name, Social Security number, and address.

04

Indicate the type of tax credit you are applying for by checking the appropriate box.

05

Fill out the details regarding your eligibility for the credit in the designated sections.

06

Attach any required documentation to support your claim.

07

Review the form for accuracy and completeness before signing.

08

Submit the completed form to the IRS by the deadline indicated in the instructions.

Who needs IRS 13844?

01

Individuals who qualify for certain tax credits offered by the IRS.

02

Taxpayers looking to claim a specific tax benefit that requires Form 13844.

03

Those who have received a notice from the IRS requesting them to complete this form.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS hardship exemption?

A hardship distribution is a withdrawal from a participant's elective deferral account made because of an immediate and heavy financial need, and limited to the amount necessary to satisfy that financial need. The money is taxed to the participant and is not paid back to the borrower's account.

What is the IRS fee waiver form?

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

Does the IRS have a hardship program?

Apply With the New Form 656 An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability or doing so creates a financial hardship.

How do I ask the IRS for hardship?

Request an expedited refund by calling the IRS at 800-829-1040 (TTY/TDD 800-829-4059). Explain your hardship situation; and. Request a manual refund expedited to you.

What happens if you don't pay IRS installment agreement?

If you qualify for a short-term payment plan you will not be liable for a user fee. Not paying your taxes when they are due may cause the filing of a Notice of Federal Tax Lien and/or an IRS levy action. See Publication 594, The IRS Collection ProcessPDF.

How long do I have to pay IRS for an installment agreement?

There are two types of Streamlined Installment Agreements, depending on how much you owe and for what type of tax. For both types, you must pay the debt in full within 72 months (six years), and within the time limit for the IRS to collect the tax, but you won't need to submit a financial statement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IRS 13844?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific IRS 13844 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit IRS 13844 in Chrome?

Install the pdfFiller Google Chrome Extension to edit IRS 13844 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit IRS 13844 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share IRS 13844 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is IRS 13844?

IRS 13844 is a form used by taxpayers to claim a refund for the premium tax credit.

Who is required to file IRS 13844?

Taxpayers who received health insurance coverage through the Health Insurance Marketplace and wish to reconcile their premium tax credit must file IRS 13844.

How to fill out IRS 13844?

To fill out IRS 13844, taxpayers must provide personal information, details of health coverage, income information, and calculate the premium tax credit based on their eligibility.

What is the purpose of IRS 13844?

The purpose of IRS 13844 is to allow taxpayers to report their health insurance coverage and claim the premium tax credit, ensuring they receive the correct amount based on their income and household size.

What information must be reported on IRS 13844?

Information that must be reported on IRS 13844 includes personal identification details, income details, family size, months of coverage, and the amount of premium tax credit claimed.

Fill out your IRS 13844 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 13844 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.