Get the free information about your notice penalty and interest

Show details

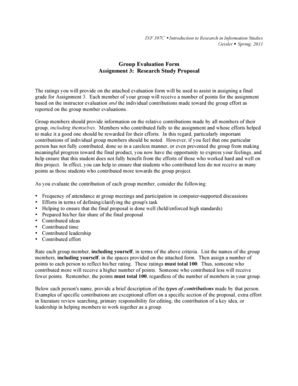

Information About Your Notice Penalty and Interest The interest rates on underpayment and overpayment of taxes are as follows Periods Percentage Rates Underpayment January 1 2003 through September 30 2003. Notice 746 Rev. 10-2011 Catalog Number 63146F Department of the Treasury Internal Revenue Service www.irs.gov Estimated Tax Safe Harbor for Higher Income Individuals - IRC 6654 d For tax years after 1993 if your adjusted gross income in the pre...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign information about your notice

Edit your information about your notice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your information about your notice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit information about your notice online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit information about your notice. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out information about your notice

How to fill out information about your notice:

01

Start by providing your personal details such as your full name, address, and contact information.

02

Next, specify the purpose of your notice. Whether it is a job resignation, a public announcement, or a legal notice, clearly state the reason for the notice.

03

Include relevant dates and times. If applicable, mention the effective date of the notice or any deadlines associated with it.

04

Provide any additional details or instructions that are necessary for the recipient to understand the notice. This may include specific actions they need to take or any relevant information they need to be aware of.

05

Double-check all the information you have provided to ensure accuracy and clarity.

06

Submit the notice according to the preferred method of delivery, whether it is via email, mail, or in-person delivery.

07

Keep a record of your notice for future reference.

Who needs information about your notice?

01

The intended recipient of the notice needs this information to understand the content and purpose of the notice.

02

If the notice is meant for a specific group of people or the public, anyone who comes across the notice needs this information to be informed.

03

In some cases, legal authorities or regulatory bodies may require information about your notice for compliance purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send information about your notice to be eSigned by others?

When you're ready to share your information about your notice, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find information about your notice?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the information about your notice in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out information about your notice on an Android device?

Use the pdfFiller app for Android to finish your information about your notice. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is information about your notice?

Information about your notice is a document or communication sent to inform individuals or entities about a particular matter or issue.

Who is required to file information about your notice?

The entity or individual responsible for the information or issue mentioned in the notice is required to file it.

How to fill out information about your notice?

You can fill out information about your notice by providing accurate details and following any instructions included in the notice.

What is the purpose of information about your notice?

The purpose of information about your notice is to inform recipients about a specific matter and potentially take action based on the information provided.

What information must be reported on information about your notice?

The specific information required on a notice may vary, but typically includes details relevant to the matter being communicated.

Fill out your information about your notice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Information About Your Notice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.