FinCen 105 2003 free printable template

Show details

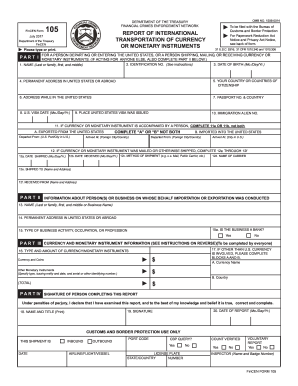

C. Travelers Travelers carrying currency or other monetary instruments with them shall file FinCEN Form 105 at the time of entry into the United States or at the time of departure from the United States with the Customs officer in charge at any Customs port of entry or departure. 19. SIGNATURE 18. NAME AND TITLE Print 20. DATE OF REPORT Mo. /Day/Yr. COUNT VERIFIED CUSTOMS AND BORDER PROTECTION USE ONLY DATE AIRLINE/FLIGHT/VESSEL LICENSE PLATE STATE/COUNTRY NUMBER VOLUNTARY REPORT INSPECTOR...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign FinCen 105

Edit your FinCen 105 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FinCen 105 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FinCen 105 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit FinCen 105. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FinCen 105 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FinCen 105

How to fill out FinCen 105

01

Obtain a blank FinCen Form 105 from the FinCEN website or your financial institution.

02

Fill in your personal information in Section 1, including name, address, and social security number.

03

In Section 2, provide details about your account, including the type of financial institution and account number.

04

Section 3 requires information about the transaction, including the amount of currency involved and the date of the transaction.

05

Complete Section 4 if you are reporting a joint account or more than one account.

06

Review the information for accuracy and completeness.

07

Sign and date the form in Section 5 to certify the information is true and correct.

08

Submit the form to the appropriate financial institution or mail it to the FinCEN address specified in the instructions.

Who needs FinCen 105?

01

Individuals or entities that conduct certain transactions involving currency or monetary instruments totaling over $10,000.

02

Any person who transfers or receives currency in excess of $10,000.

03

Businesses that are required to report large currency transactions.

04

Financial institutions or casinos that engage in cash transactions exceeding the reporting threshold.

Fill

form

: Try Risk Free

People Also Ask about

What is currency or monetary instruments?

Monetary instruments means coins or currency of the United States or of another country, travelers checks, personal checks, bank checks, money orders, and investment securities or negotiable instruments in bearer form or in other form so that title passes upon delivery.

What are monetary instruments?

Monetary instruments are typically purchased to pay for commercial or personal transactions and, in the case of traveler's checks, as a form of stored value for future purchases. The purchase or exchange of monetary instruments can conceal the source of illicit proceeds.

How much money can I carry out of USA?

You may bring into or take out of the country, including by mail, as much money as you wish. However, if it is more than $10,000, you will need to report it to CBP.

How do I submit FinCEN 105?

Recipients—Each person who receives currency or other monetary instruments in the United States shall file FinCEN Form 105, within 15 days after receipt of the currency or monetary instruments, with the Customs officer in charge at any port of entry or departure or by mail with the Commissioner of Customs, Attention:

What is currency and monetary instruments?

"Money" means monetary instruments and includes U.S. or foreign coins currently in circulation, currency, travelers' checks in any form, money orders, and negotiable instruments or investment securities in bearer form.

Can I bring more than 10000 into us?

You may bring large sums of money with you in the form of cash, money order, or traveler's checks. There is no maximum limit, however, any amount exceeding $10,000 USD must be declared upon arrival on both the Form 6059B and FinCEN 105.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send FinCen 105 to be eSigned by others?

To distribute your FinCen 105, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for signing my FinCen 105 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your FinCen 105 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I fill out FinCen 105 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your FinCen 105, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is FinCen 105?

FinCen 105 is a form used to report the transportation of currency or monetary instruments over $10,000 into or out of the United States, as required by the Financial Crimes Enforcement Network.

Who is required to file FinCen 105?

Any person or entity transporting more than $10,000 in currency or monetary instruments into or out of the United States is required to file FinCen 105.

How to fill out FinCen 105?

FinCen 105 must be filled out by providing information such as the filer's identification details, amounts being transported, the method of transport, and the originating and destination locations, along with any other required information as per the form's instructions.

What is the purpose of FinCen 105?

The purpose of FinCen 105 is to assist in the detection and prevention of money laundering and other financial crimes by tracking large amounts of currency and monetary instruments being transported across U.S. borders.

What information must be reported on FinCen 105?

The information that must be reported on FinCen 105 includes the name and address of the filer, the amount of currency or monetary instruments, the method of transportation, details of the trip, and identification documents as applicable.

Fill out your FinCen 105 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FinCen 105 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.