Get the free arm disclosure sample

Show details

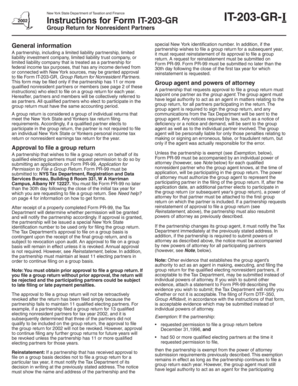

ADJUSTABLE RATE MORTGAGE LOAN DISCLOSURE Non-Convertible 5/1 Year ARM With Interest Only Payments For the First Ten Years 2% Annual Adjustment and 5% Life Cap You have asked the Lender for an application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign arm disclosure sample

Edit your arm disclosure sample form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arm disclosure sample form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit arm disclosure sample online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit arm disclosure sample. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out arm disclosure sample

01

To fill out an arm disclosure sample, you need to follow a step-by-step process.

02

Start by carefully reading the form and understanding its purpose. Familiarize yourself with the information it requires and any instructions provided.

03

Gather all the necessary information that the form asks for, such as your personal details, contact information, and any relevant financial information.

04

Fill in the required fields accurately and honestly. Pay attention to any specific format or requirements for dates, signatures, or other requested data.

05

Double-check all the information you have filled in to ensure accuracy and completeness. Mistakes or omissions may result in delays or complications in the disclosure process.

06

If you are uncertain about any aspect of the form or its contents, consider seeking professional advice or consulting with the appropriate authorities or experts in the field.

07

Once you have completed filling out the arm disclosure sample, review the form one final time to ensure everything is correct. Make sure you haven't missed any sections or left any fields empty.

08

Sign and date the disclosure form as required. Follow any additional submission instructions provided, such as where to send the form or who to contact for further assistance.

09

Keep a copy of the completed and signed disclosure form for your records. This will be useful for future reference or if any questions or disputes arise regarding the disclosed information.

Who needs an arm disclosure sample?

01

Individuals or organizations involved in adjustable-rate mortgage (ARM) transactions may need an arm disclosure sample.

02

This may include borrowers who are applying for or considering an ARM loan, as well as mortgage lenders or brokers who need to provide the necessary disclosure information to borrowers.

03

Additionally, regulatory bodies or financial institutions may require standardized arm disclosure samples as part of their compliance procedures to ensure transparency and consumer protection in lending practices.

04

It is advisable for anyone involved in ARM transactions to familiarize themselves with arm disclosure samples and understand their legal and regulatory implications to ensure compliance and facilitate informed decision-making.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get arm disclosure sample?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the arm disclosure sample in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out the arm disclosure sample form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign arm disclosure sample and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete arm disclosure sample on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your arm disclosure sample, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is arm disclosure sample?

An ARM disclosure sample refers to a sample document that outlines the terms and conditions associated with an adjustable-rate mortgage (ARM). It typically includes details about how the interest rate is determined, any potential changes over time, and the overall terms of the loan.

Who is required to file arm disclosure sample?

Lenders who offer adjustable-rate mortgages are required to provide ARM disclosure samples to borrowers. This ensures that potential borrowers are fully informed about the terms of the loan and the associated risks before finalizing their decision.

How to fill out arm disclosure sample?

To fill out an ARM disclosure sample, lenders must provide specific details about the loan terms, including the initial interest rate, how often the rate will adjust, the index used to determine rate changes, and any caps on adjustments. Borrowers should also review the document to ensure they understand the terms.

What is the purpose of arm disclosure sample?

The purpose of an ARM disclosure sample is to educate borrowers about the nature of adjustable-rate mortgages, including the potential for interest rate increases and the overall mechanics of how the loan works. It aims to promote transparency and protect consumers.

What information must be reported on arm disclosure sample?

An ARM disclosure sample must report information such as the initial interest rate, adjustment periods, index used for rate changes, margin, caps on rate adjustments, estimated payment amounts, and potential for payment changes. It may also include early termination or conversion options.

Fill out your arm disclosure sample online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arm Disclosure Sample is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.