Get the free Rev. Proc. 2004–73

Show details

This revenue procedure updates Rev. Proc. 2003-77 and identifies circumstances under which the disclosure on a taxpayer’s return with respect to an item or a position is adequate for reducing the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rev proc 200473

Edit your rev proc 200473 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rev proc 200473 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rev proc 200473 online

To use our professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rev proc 200473. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

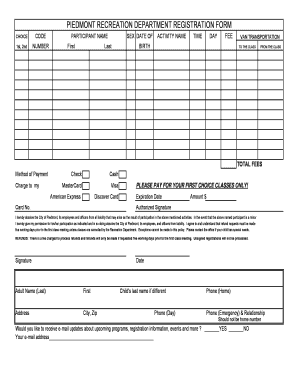

How to fill out rev proc 200473

How to fill out Rev. Proc. 2004–73

01

Obtain a copy of Rev. Proc. 2004-73 from the IRS website.

02

Read the overview of the Rev. Proc. to understand its purpose.

03

Identify the specific section of Rev. Proc. 2004-73 that applies to your situation.

04

Gather the necessary information and documentation required for the filing.

05

Complete the required forms according to the instructions provided in Rev. Proc. 2004-73.

06

Ensure all information is accurate and complete before submission.

07

Submit the completed forms to the appropriate IRS office as indicated in the procedure.

Who needs Rev. Proc. 2004–73?

01

Taxpayers seeking guidance on filing for certain tax reliefs outlined in Rev. Proc. 2004-73.

02

Individuals or entities affected by specific tax situations that Rev. Proc. 2004-73 addresses.

03

Tax professionals assisting clients with compliance under IRS procedures.

Fill

form

: Try Risk Free

People Also Ask about

What do revenue procedures deal with?

Revenue Procedures deal with the internal practice and procedures of the IRS in the administration of the tax laws. They are official statements of procedures relating to sections of the Internal Revenue Code, related statutes, tax treaties, and regulations.

What is the revenue ruling 72 369?

Ruling and analysis v. Commissioner, 70 T.C. 352 (1978). In Revenue Ruling 72-369, the IRS ruled that an organization's regular provision of certain managerial and consulting services to tax-exempt organizations at cost was not a charitable activity under Section 501(c)(3).

What is the revenue ruling?

Revenue ruling It is the conclusion of the IRS on how the law is applied to a specific set of facts. Revenue rulings are published in the Internal Revenue Bulletin for the information of and guidance to taxpayers, IRS personnel and tax professionals.

What is revenue ruling 2004 74?

This ruling addresses how offsets apply for taxpayers filing joint returns and domi ciled in Texas. This ruling makes assump tions about the operation of Texas commu nity property laws which are highly depen dent on facts and circumstances.

What does rev proc mean?

Definition: REV. PROC. is an abbreviation for REVENUE PROCEDURE. REVENUE PROCEDURE is a set of guidelines issued by the Internal Revenue Service (IRS) that provides instructions and procedures for taxpayers to follow when complying with tax laws.

What is revenue ruling 2004 79?

Rul. 2004-79. Corporate distributions of property. This ruling addresses the tax consequences of the distribution by a subsidiary to its parent of parent indebtedness that the subsidiary previously purchased from a party unrelated to the parent.

How to find IRS revenue procedure?

Revenue procedures are published in the Internal Revenue Bulletin & Cumulative Internal Revenue Bulletin. This link is to a list of sources (print and online) offering the Internal Revenue Bulletin & Cumulative Internal Revenue Bulletin.

What is the revenue ruling 2004 72?

This ruling provides guidance regarding the amount of an overpayment from a joint tax return that the IRS may offset against a spouse's separate tax liability for tax payers domiciled in California, Idaho, or Louisiana. California, Idaho, and Louisiana are community property states and, under the respective state laws,

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Rev. Proc. 2004–73?

Rev. Proc. 2004–73 is a revenue procedure issued by the Internal Revenue Service that provides guidance on the treatment of certain tax matters, specifically relating to the filing of requests for a private letter ruling, and clarifies rules regarding certain tax issues.

Who is required to file Rev. Proc. 2004–73?

Taxpayers who wish to obtain a private letter ruling from the IRS regarding specific tax issues outlined in the revenue procedure are required to file Rev. Proc. 2004–73.

How to fill out Rev. Proc. 2004–73?

To fill out Rev. Proc. 2004–73, taxpayers must follow the instructions provided in the procedure, which include completing the required forms, providing specific information about the tax issue, and ensuring that they meet the procedural requirements set forth by the IRS.

What is the purpose of Rev. Proc. 2004–73?

The purpose of Rev. Proc. 2004–73 is to provide consistent guidelines for taxpayers in obtaining private letter rulings from the IRS and to establish a clear framework for the IRS to process these requests efficiently.

What information must be reported on Rev. Proc. 2004–73?

Taxpayers must report information such as the specific tax issue for which they are seeking a ruling, relevant factual details, legal arguments, and any other pertinent information as specified in the IRS guidelines provided in the revenue procedure.

Fill out your rev proc 200473 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rev Proc 200473 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.