Who needs a fillable Tax Court Petition Form?

Anyone who has received an IRS notice of deficiency or notice of determination and wants to start a case in the Tax Court should file the IRS Tax Court Petition form. Also, the form can be filed in the event when a claim with the IRS for relief from joint and several liabilities was submitted and no determination answer was received within six months from the submission. If a submitter was married during the tax year, the couple should file a joint petition specifying the names of both.

What is the Tax Court Petition for?

In short, the meaning of this petition is reduced to the disagreement of the submitter with the decision of the IRS. The submitter shall clearly indicate the errors which, as it seems to them have been made by IRS in the notice of deficiency or the notice of determination. The applicant must reinforce their position with facts, which are also set out in this Tax Court Petition form.

Is the Tax Court Petition accompanied by other forms?

First, the form is accompanied by an account for payment of $60 fee which is petition filing price. Second, you must attach a copy of the notice of deficiency or the notice of determination to the petition. You do not have to accompany your petition with any other documents, including a copy of tax declaration or other evidence.

When is Tax Court Petition Form due?

The petition must be received by the Court in a period, which is specified in the Internal Revenue Code. Also, time for filing the petition is usually indicated in a notice of deficiency. It will be sufficient if the envelope in which you send petition is stamped the day, which still gets within the term.

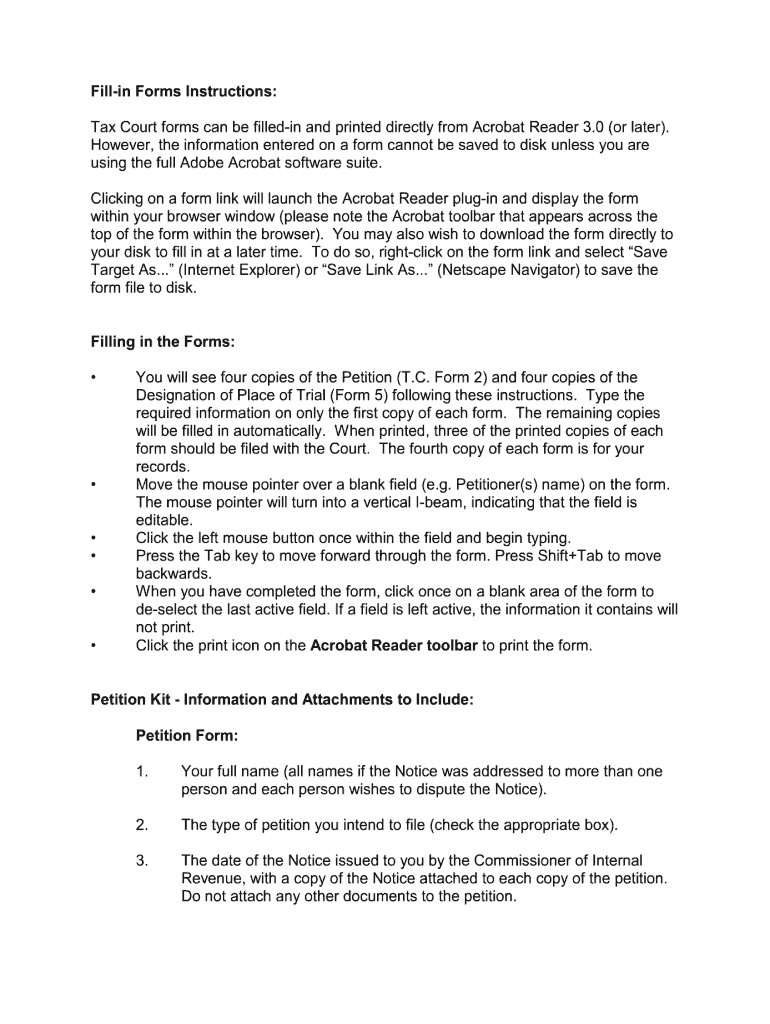

How do I fill out Tax Court Petition Form?

You need to fill in personal information, select the required items from the questionnaire and justify your position, referring to the facts. Filling out the form is not difficult, but you have to make sure that the information you provide, accurate and substantiated.

Where do I send Tax Court Petition Form?

The completed and signed original and two copies should be sent to: United States Tax Court, 400 Second Street, NW, Washington, DC 20217-0002.