UK HMRC AAG1 2013-2025 free printable template

Show details

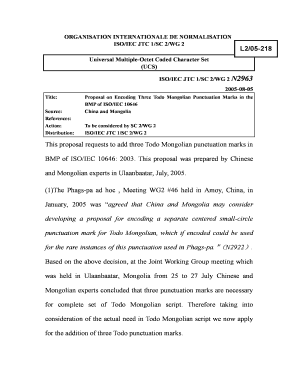

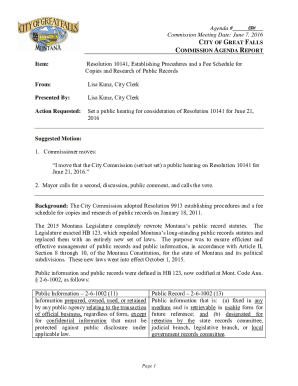

Disclosure of avoidance scheme (Notification by scheme promoter) Scheme reference number Who should use this form? This form is for use by a scheme promoter notifying under: (for HMRC official use

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK HMRC AAG1

Edit your UK HMRC AAG1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC AAG1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK HMRC AAG1 online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UK HMRC AAG1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out UK HMRC AAG1

How to fill out UK HMRC AAG1

01

Obtain the HMRC AAG1 form from the official HMRC website or your local tax office.

02

Read the guidance notes carefully to understand the purpose of the form.

03

Fill out your personal information, including your name, address, and National Insurance number.

04

Provide information regarding your employment history in the relevant section.

05

Indicate any sources of income you wish to declare on the form.

06

Complete the section on your tax situation, providing details of any tax relief claims if applicable.

07

Sign and date the declaration at the end of the form.

08

Submit the completed form to the specified HMRC address as per the instructions.

Who needs UK HMRC AAG1?

01

Individuals who have variable income and want to claim tax relief.

02

Self-employed individuals needing to report income fluctuations.

03

People with additional sources of income needing clarification for tax purposes.

04

Those who receive benefits that may require tax adjustments.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax avoidance arrangement?

What tax avoidance is. Tax avoidance involves bending the rules of the tax system to try to gain a tax advantage that Parliament never intended. It often involves contrived, artificial transactions that serve little or no purpose other than to produce this advantage.

What is an example of tax evasion in the UK?

Examples of Tax Evasion Missing trader fraud/carousel fraud: importing goods VAT-free, selling them to customers with added VAT, then failing to report VAT charged to HMRC. Tax-allowable expenditure claim: some expenditure carries tax breaks – such as spending on film production or an eco-forest.

How do I report tax evasion UK?

Reporting tax fraud Anyone with information about tax fraud should report it online or call our Fraud Hotline on 0800 788 887.

What are the US anti tax avoidance rules?

The general anti-avoidance rule, or GAAR, is an enforcement mechanism that gives a country's taxing authority broad power to deny a taxpayer tax benefits associated with any transaction.

How much money do you have to owe the IRS before you go to jail?

In fact, the IRS cannot send you to jail, or file criminal charges against you, for failing to pay your taxes.

Are you required to declare a tax avoidance scheme UK?

DOTAS — scheme user obligations — SRN If you have used the scheme and received the SRN from a promoter or supplier, you must tell HMRC that you have used the scheme. You must do so by reporting the SRN to HMRC, usually when submitting a tax return, or by using form AAG4, AAG4( IHT ), AAG4( SDLT ) or AAG4( ATED ).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit UK HMRC AAG1 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign UK HMRC AAG1 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete UK HMRC AAG1 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your UK HMRC AAG1 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I fill out UK HMRC AAG1 on an Android device?

Complete UK HMRC AAG1 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is UK HMRC AAG1?

UK HMRC AAG1 is a form used by the Her Majesty's Revenue and Customs (HMRC) in the United Kingdom for reporting certain tax information, specifically related to tax avoidance schemes.

Who is required to file UK HMRC AAG1?

Entities or individuals that have been involved in tax avoidance schemes that meet the criteria set by HMRC are required to file UK HMRC AAG1.

How to fill out UK HMRC AAG1?

To fill out UK HMRC AAG1, you should complete the required sections with accurate information about the tax avoidance scheme, including details on participation, scheme references, and relevant financial data.

What is the purpose of UK HMRC AAG1?

The purpose of UK HMRC AAG1 is to ensure transparency and compliance in the reporting of tax avoidance schemes, allowing HMRC to monitor and manage these activities effectively.

What information must be reported on UK HMRC AAG1?

Information required on UK HMRC AAG1 includes the names of the parties involved in the scheme, scheme references, financial information related to the scheme, and any other details necessary to assess the tax implications.

Fill out your UK HMRC AAG1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC aag1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.