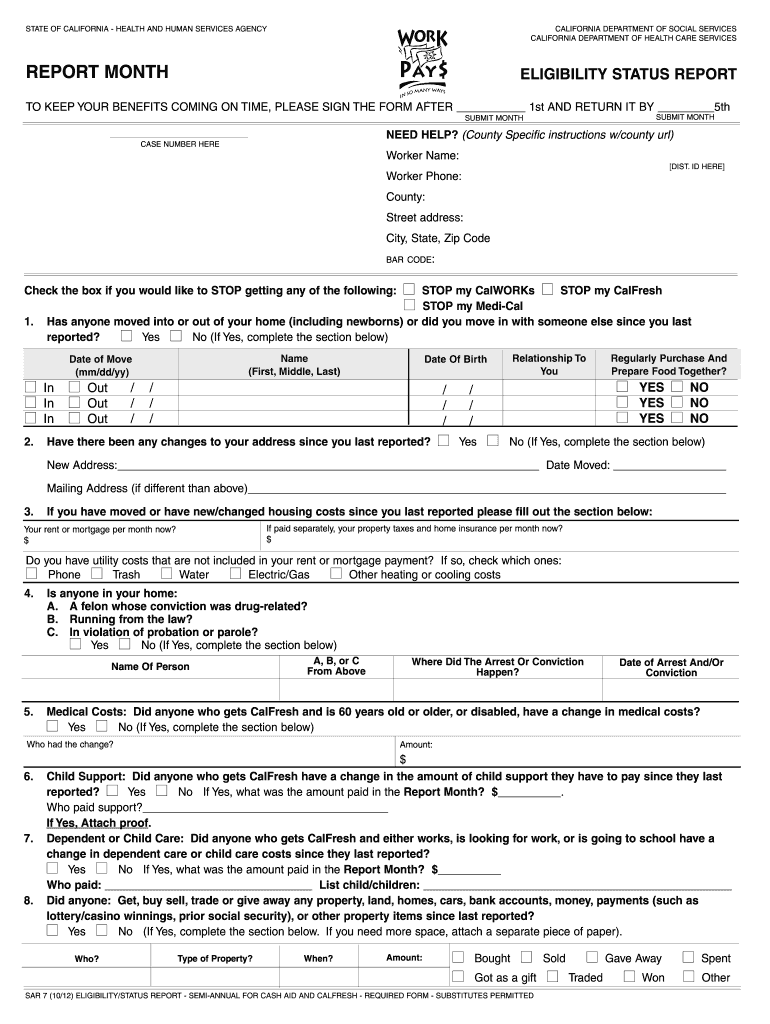

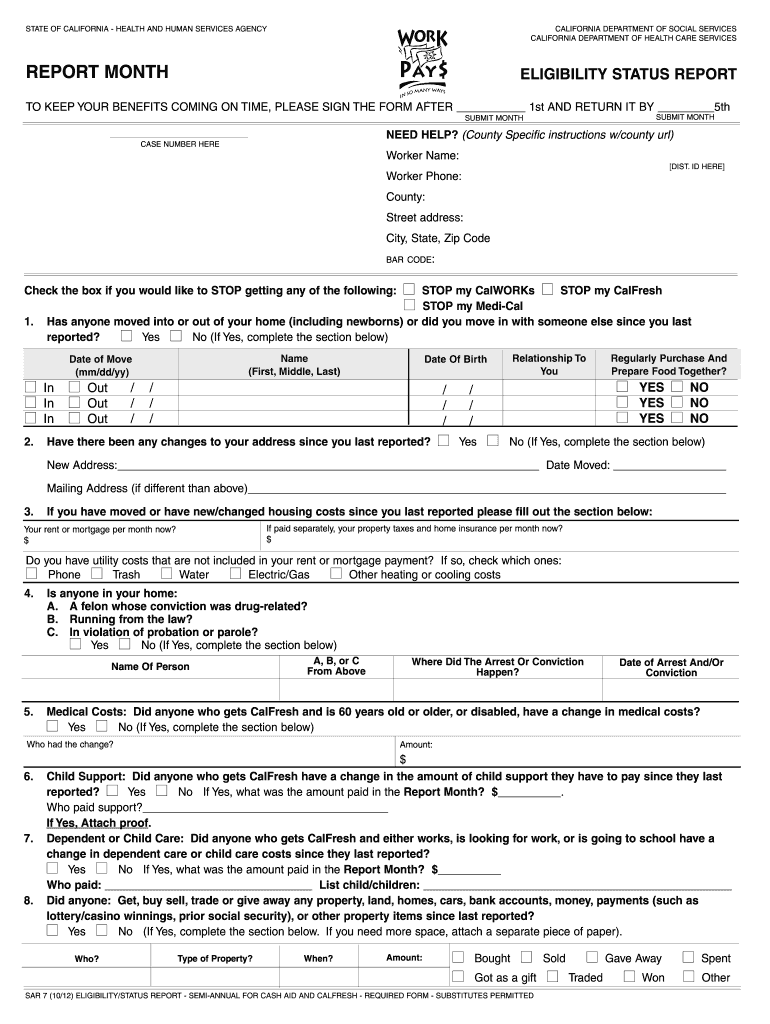

CA SAR 7 2012 free printable template

Get, Create, Make and Sign sar 7 form 2012

How to edit sar 7 form 2012 online

Uncompromising security for your PDF editing and eSignature needs

CA SAR 7 Form Versions

How to fill out sar 7 form 2012

How to fill out CA SAR 7

Who needs CA SAR 7?

Instructions and Help about sar 7 form 2012

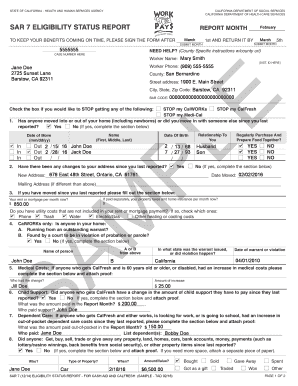

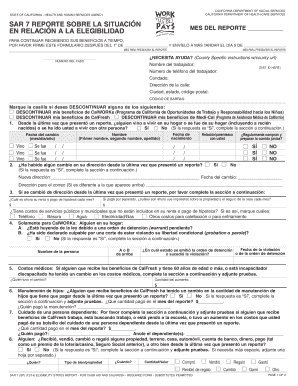

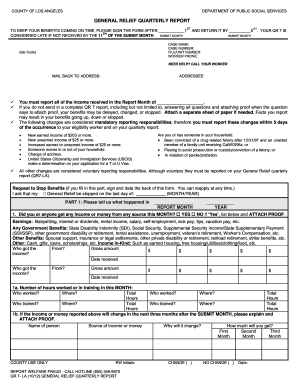

How do I complete the semiannual reporting form SAR seven this video will assist you to complete the SAR seven accurately and will help you understand your responsibilities and reporting changes in income housing costs persons living with you and address changes this video will also teach you when the star seven is due to the county how often the star seven is due what information must be reported what verification documents you will need and the difference between the report month and the submit month the eligibility status report also known as the SAR seven is a form most recipients of Gasworks cash aid and Afresh must complete sign and send to the county along with verifications every six months in order to maintain eligibility to Gasworks and/or Afresh the information you will report will help the county determine your future benefit amount keep your benefits from being stopped or delayed by carefully completing your eligibility status report on time and mailing it with all required verifications in the envelope provided helps ensure your benefits will not be delayed or stopped here's our seven is required for you and your family to continue receiving the benefits you need you will be receiving your star seven in the mail with a prepaid envelope from the county let's do a quick overview of what must be reported on the star seven then we will look at how to answer specific questions you must report and send verification or proof of earnings and/or monies received in the report month on all related persons living with you and all the persons buying and preparing food with you if receiving Afresh benefits you must also report what has happened since you sent the previous report a change in address if you have moved and changes in housing costs information you expect will change in the next six months will you change jobs will your housing cost change will you be getting married it can be confusing to understand, so we will review the definition of report and submit month's report month is the month for which you must report all information to determine your benefits you must report income expenses and what has changed in your household in this example October is the report month therefore you must report what has happened in October and provide proof or verifications for the month of October to submit month is the month you will sign and turn in the SAR 7 this is to submit month the month you were required to submit or sends us our 7 in this example November is to submit month remember the SAR 7 must be signed in this month for example if you submit the SAR 7 in November you will be reporting what has happened during the month of October is the report month and November is to submit month to submit month is the month you will sign and turn in the SAR 7 remember the SAR 7 cannot be signed before the first day of the submit month how often do I send the SAR 7 the SAR 7 report must be sent every six months for Afresh and for Gasworks for example...

What is california form sar 7?

People Also Ask about

Can I print out a SAR 7 online?

What happens if I don't turn in my SAR 7?

What is a SAR 7 status report?

What happens if I don't fill out sar7?

Can I do SAR 7 over the phone?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sar 7 form 2012 in Gmail?

How do I edit sar 7 form 2012 in Chrome?

How do I fill out sar 7 form 2012 using my mobile device?

What is CA SAR 7?

Who is required to file CA SAR 7?

How to fill out CA SAR 7?

What is the purpose of CA SAR 7?

What information must be reported on CA SAR 7?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.