CA I&A mileage Form 2013 free printable template

Show details

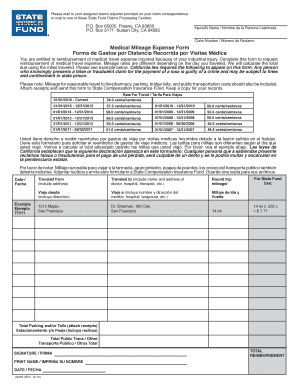

SAVE PRINT CLEAR Injured worker s name / Hombre DE la persona lesions Claim number / Number DE reclaim Medical mileage expense form de Gaston POR distance record POR visits media If you have to travel

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA IA mileage Form

Edit your CA IA mileage Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA IA mileage Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA IA mileage Form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA IA mileage Form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA I&A mileage Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA IA mileage Form

How to fill out CA I&A mileage Form

01

Obtain the CA I&A mileage Form from the official website or your local DMV office.

02

Fill in your personal information at the top of the form, such as your name, address, and driver's license number.

03

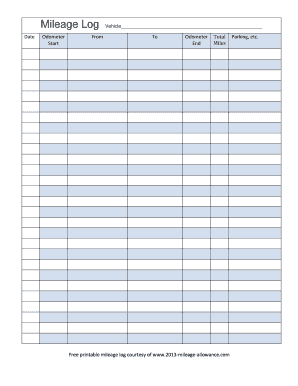

Record the date of each trip in the respective column.

04

Indicate the starting and ending locations for each trip.

05

Calculate the total mileage for each trip and write it in the designated space.

06

Total all the mileage entries and write the sum at the bottom of the form.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form at the specified section before submission.

Who needs CA I&A mileage Form?

01

Individuals claiming mileage reimbursement for business purposes.

02

Employees who were required to use their personal vehicle for work-related travel.

03

Drivers participating in a state program that requires mileage documentation.

Fill

form

: Try Risk Free

People Also Ask about

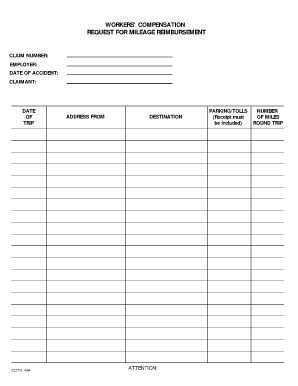

What is the mileage reimbursement for 2022 dir?

Mileage Rate for Medical and Medical-Legal Travel Expenses Increases Effective July 1, 2022. The Division of Workers' Compensation (DWC) is announcing the increase of the mileage rate for medical and medical-legal travel expenses by 4 cents to 62.5 cents per mile effective July 1, 2022.

How do I fill out a mileage reimbursement form?

0:52 2:26 How to Fill out the Medical Mileage Form in Workers Comp - YouTube YouTube Start of suggested clip End of suggested clip Make sure to include the city where they are located for the round-trip miles you will enter theMoreMake sure to include the city where they are located for the round-trip miles you will enter the total number of miles traveled by recording your vehicle's odometer reading at the start.

How does mileage reimbursement work?

To cover employee vehicle costs incurred as part of the job, an employer pays a cents-per-mile rate to employees. The standard mileage rate for 2023 is 65.5 cents per mile, as set by the IRS. You multiply this rate by the number of miles you drive over a payment period, and the result is your mileage reimbursement.

Is it better to write off gas or mileage?

Turns out, the actual car expense method would give you a far greater deduction. If you use the standard mileage method, you could have written off $2,725. But if you deducted your actual car expenses, that number goes all the way up to $3,380. That's an extra $655 in tax write-offs from your car.

How is mileage calculated?

Example: You have driven 1200 business miles in 2022 with your personal vehicle. The IRS mileage rate in 2022 was 62.5 cents per mile (from July 1, 2022) for owning and operating your vehicle for business purposes. [miles] * [rate], or 1200 miles * $0.625 = $750 you can claim as deduction on your tax return.

What is the NYS workers comp mileage reimbursement for 2022?

The mileage rate for reimbursement to injured workers for travel by automobile on or after January 1, 2022, is 58.5 cents per mile, in ance with the Board resolution adopted on February 20, 1990.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete CA IA mileage Form online?

Easy online CA IA mileage Form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make edits in CA IA mileage Form without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your CA IA mileage Form, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I fill out CA IA mileage Form on an Android device?

Use the pdfFiller mobile app to complete your CA IA mileage Form on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

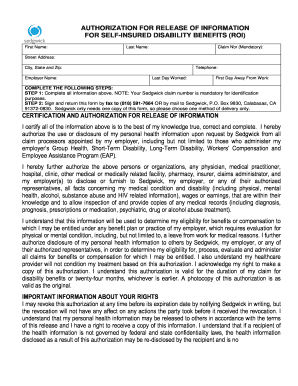

What is CA I&A mileage Form?

The CA I&A mileage Form is a document used to report the number of miles driven for business purposes in California, specifically for the California Income and Allocation mileage claims.

Who is required to file CA I&A mileage Form?

Individuals and businesses that are claiming vehicle expenses and mileage deductions for business use in California are required to file the CA I&A mileage Form.

How to fill out CA I&A mileage Form?

To fill out the CA I&A mileage Form, you need to enter the date of travel, the purpose of the trip, the starting and ending odometer readings, and the total miles driven for each trip along with any additional required information.

What is the purpose of CA I&A mileage Form?

The purpose of the CA I&A mileage Form is to provide the state with accurate records of business mileage driven by individuals and businesses for the purpose of tax deductions.

What information must be reported on CA I&A mileage Form?

The information that must be reported on the CA I&A mileage Form includes the date of each trip, the destination, the purpose of the trip, the odometer readings at the start and end of the trip, and the total miles driven.

Fill out your CA IA mileage Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA IA Mileage Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.