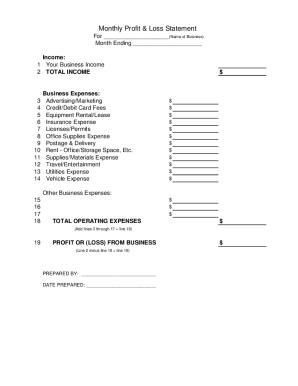

Who needs a Profit and loss statement?

This statement is used by owners of small businesses to summarize the revenues, costs and expenses they had during a month.

What is the Profit and loss statement for?

The statement shows the total profit of the business owner before paying off all taxes. It also gives information about the total amount of sales and total expenses. This data is very important for effective business management.

What documents must accompany the Profit and loss statement?

As a rule, the Profit and statement form is accompanied by the balance sheet and the cash flow statement.

How long does it take to fill the Profit and loss statement out?

The approximate time of completing the form is 15 minutes. The statement should be filled out every month.

What information should be provided in the Profit and loss statement?

The filler has to enter the following information:

- Month and year of the statement

- Month percentage of sales (gross sales and fewer discounts)

- Previous month percentage of sales (gross sales and fewer discounts)

- Total net sales

- Cost of sold goods

- Cost of raw materials, labor, overheads

- Total amount of costs

- Gross profit

- Operating expenses

- Interest amount

- Total expenses

- Pretax profit

If the filler has any additional remarks, they should be noted in the specific box.

The statement must have the name of the individual who prepared it, and it should be dated.

What do I do with the statement after it has been completed?

The statement is sent to the relevant party(IES). The business owner should keep one copy for personal use.