MO Form 104 2005-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

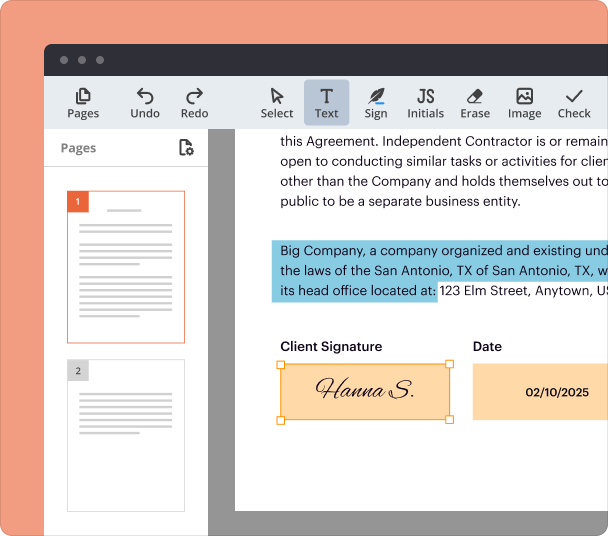

Edit and sign in one place

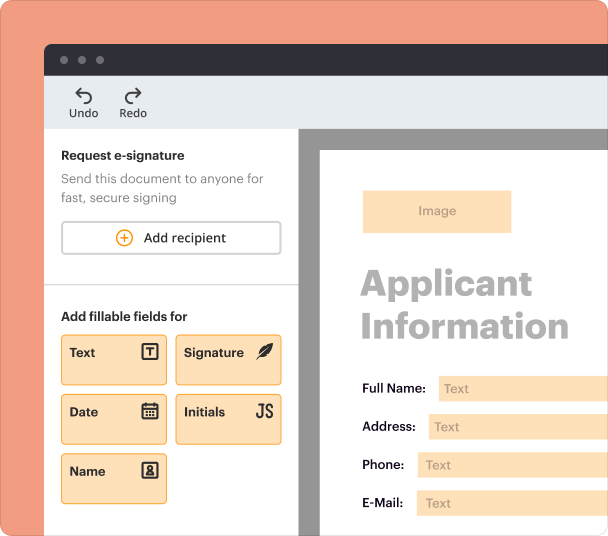

Create professional forms

Simplify data collection

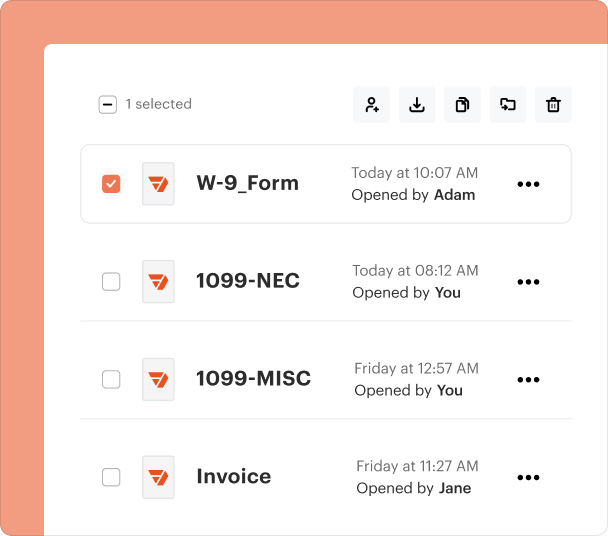

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Understanding the MO Form 104 (2)

What is the MO Form 104?

The MO Form 104 is a tax form used by residents of Missouri to report individual income for the state. It is essential for calculating tax obligations based on income earned during the relevant tax year. This form is a key part of Missouri's tax compliance framework and must be submitted to the state authorities as part of the annual filing process.

Key Features of the MO Form 104

The MO Form 104 includes several important features designed to simplify the tax filing process. Users will find sections that require information about income sources, deductions, and credits applicable to state tax liabilities. Additionally, the form allows for clear calculations of tax owed or refunds due, making it a comprehensive tool for managing individual tax responsibilities in Missouri.

When to Use the MO Form 104

Individuals must use the MO Form 104 annually to report their income to the state. This form is typically completed in the first quarter of the year, corresponding with the federal income tax filing period. It is crucial to submit this form by the state-mandated deadline to avoid penalties or interest charges on unpaid taxes.

Who Needs the MO Form 104?

Any resident of Missouri who earns income during the tax year is required to file the MO Form 104. This includes individuals working for an employer, those who are self-employed, and anyone who receives other taxable income. Exceptions may apply for certain income thresholds or special cases, but generally, this form is a necessity for tax compliance.

Required Documents and Information

To complete the MO Form 104 accurately, taxpayers need to gather several documents and information types. Essential items include W-2 forms representing wages, 1099 forms for miscellaneous income, documentation related to deductions, and any relevant supporting statements. Collecting all necessary information beforehand can streamline the filing process.

Best Practices for Accurate Completion

To ensure the MO Form 104 is filled out accurately, consider following several best practices. First, complete the form in a quiet environment to reduce errors. Double-check calculations and correspondences between federal and state forms. Utilizing a digital platform, like pdfFiller, can also enhance accuracy by allowing users to edit and validate data easily before submission.

Submission Methods for the MO Form 104

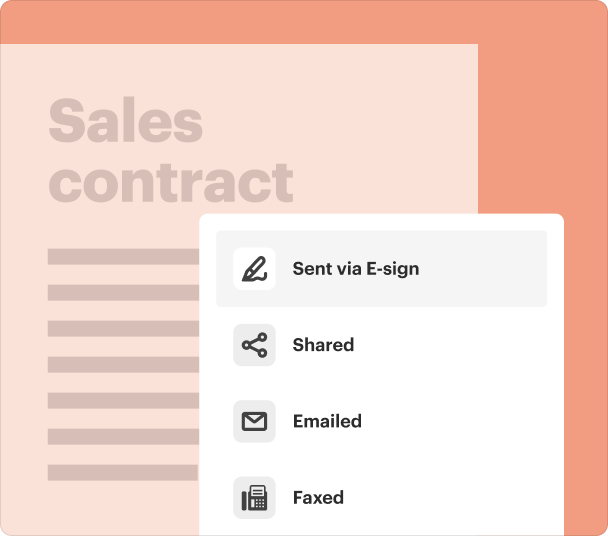

Once the MO Form 104 is completed, it can be submitted using various methods. Taxpayers have the option to file electronically through authorized e-filing platforms or submit a hard copy by mail. If choosing to mail the form, ensure it is sent to the correct address provided by the state to avoid processing delays.

Frequently Asked Questions about xxwxx 2015 tax forms 2023 online

What should I do if I can't complete the MO Form 104 on time?

If you're unable to submit the MO Form 104 by the deadline, it is advisable to file for an extension with the state. However, any taxes owed must still be paid by the original due date to avoid penalties.

Can I amend my MO Form 104 after filing?

Yes, if you discover an error after submitting your MO Form 104, you can file an amendment using the appropriate state form designated for corrections.

pdfFiller scores top ratings on review platforms