Who issues 3561 Form?

A 3561 Form, also called the Installment Agreement Financial Statement, is issued by the Franchise Tax Board in the State of California. The form has been created to enable individuals who are experiencing hardship in paying their tax amount in full to request a deferral. In case of the agreement approval, the claiming individual will be able to make monthly payments. However, even though it is acceptable, the California Franchise Tax Board (FT) still recommends borrowing from private sources to pay taxes when due instead of requesting an installment.

Who is eligible for the FT Installment Agreement?

To have the agreement approved, the individual should meet the following requirements:

The owed tax liability is less than $25,000;

All the installment payments should be made within a 60-month period;

The claimant has all required valid personal income tax returns available and in order;

The individual does have any obligations in an active installment agreement.

Should the 3561 Form be accompanied by any other documents?

There is quite a long list of the attachments required with your Installment Agreement Financial Statement consisting of the following:

-

Evidence of Income and expenses for the most recent three months

-

Bank account information for the past three months;

-

Tax Returns;

-

Other documentation explaining other household expenses that may exceed a reasonable amount.

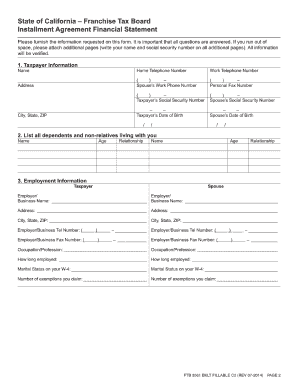

How to fill out the Installment Agreement Financial Statement?

The following details are required to contribute to the favorable decision upon the request indicated in the 3561 booklet:

- Information about the taxpayer;

- Taxpayer’s dependents;

- Employment data;

- Financial information (bank accounts);

- Personal assets (real estate, motor vehicles)

- Life insurance;

- Monthly income & expenses, etc.

Where to send the filled out 3561 Installment Agreement Financial Statement form?

Completed and supported by all the required attachments, the 3561 Form must be directed to the Franchise Tax Board in the State of California. ? He addresses can be found on the form itself.