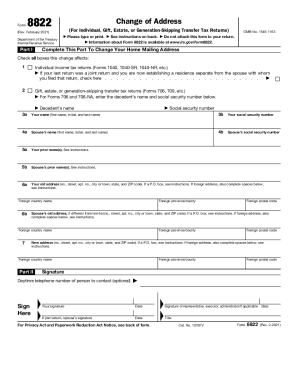

CA DL 65 ETP Part II 2011-2025 free printable template

Show details

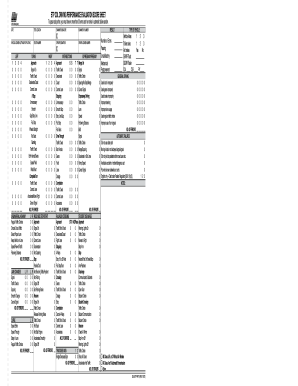

Date SKILL RESULT Vehicle license no./trailer license no. ETP CDL DRIVING PERFORMANCE EVALUATION Scoresheet number Of errors: Passing Unsatisfactory Route no. to pass the SKILLS TESTS you must have

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign dmv driving test rubric form

Edit your florida road test checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your florida road test point system form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit road test score sheet online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit florida road test score sheet form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

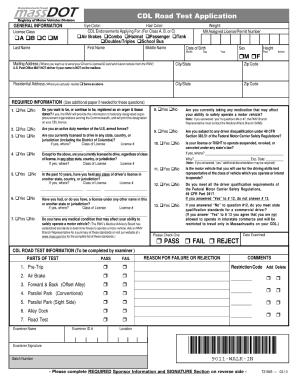

How to fill out georgia road test score sheet form

How to fill out CA DL 65 ETP Part II

01

Obtain the CA DL 65 ETP Part II form from the California DMV website or a local DMV office.

02

Read the instructions on the form carefully before beginning.

03

Fill out your personal information, including your full name, address, and contact details.

04

Provide information about your driving history and any relevant violations or accidents.

05

Complete the section regarding your vehicle details if applicable.

06

Sign and date the form to certify the information is accurate.

07

Submit the completed form to the appropriate DMV office either in person or by mail.

Who needs CA DL 65 ETP Part II?

01

Individuals applying for an exemption from the Initial Proof of Completion requirement for driver education.

02

Drivers who have specific circumstances, such as out-of-state licenses or special situations, that necessitate this form.

03

Applicants participating in the California driver's education or training programs.

Video instructions and help with filling out and completing tax sales state

Instructions and Help about dmv road test sheet

Fill

fees state form

: Try Risk Free

People Also Ask about florida dmv road test score sheet

How much is tax in usa?

The U.S. currently has seven federal income tax brackets, with rates of 10%, 12%, 22%, 24%, 32%, 35% and 37%. If you're one of the lucky few to earn enough to fall into the 37% bracket, that doesn't mean that the entirety of your taxable income will be subject to a 37% tax. Instead, 37% is your top marginal tax rate.

What are the 4 main taxes?

Types of Taxes Income tax: This tax stems from revenue earned through a job or a personal venture. Payroll tax: This tax is deducted from an employee's paycheck. Capital gains tax. Estate tax: This tax is imposed after an individual dies and their property is transferred to a living person.

Will I get a bigger tax refund in 2023?

(WWLP/Nexstar) — Taxpayers may need to prepare for smaller tax refunds in 2023. ing to the Internal Revenue Service, refunds could be smaller because taxpayers didn't receive stimulus payments this tax year.

How much is tax in usa 2022?

When it comes to federal income tax rates and brackets, the tax rates themselves aren't changing from 2022 to 2023. The same seven tax rates in effect for the 2022 tax year – 10%, 12%, 22%, 24%, 32%, 35% and 37% – still apply for 2023.

What is the purpose of tax?

The main purpose of taxation is to raise revenue for the services and income supports the community needs. Public revenues should be adequate for that purpose.

How early can you file taxes 2022?

Even though taxes for most are due by April 18, 2022, you can e-file (electronically file) your taxes earlier. The IRS likely will begin accepting electronic returns anywhere between Jan. 15 and Feb. 1, 2022, when taxpayers should have received their last paychecks of the 2021 fiscal year.

When can I file my taxes 2023?

The filing deadline for the regular tax season will be April 18th, 2023 given that the normal April 15th deadline falls on the weekend and the Emancipation day holiday (April 17th) in DC. Approved extension filings will be due by October 18th, 2023.

What are the 4 types of taxes?

Types of Taxes Income tax: This tax stems from revenue earned through a job or a personal venture. Payroll tax: This tax is deducted from an employee's paycheck. Capital gains tax. Estate tax: This tax is imposed after an individual dies and their property is transferred to a living person.

What are the 5 taxes?

In fact, when every tax is tallied – federal, state and local income tax (corporate and individual); property tax; Social Security tax; sales tax; excise tax; and others – Americans spend 29.2 percent of our income in taxes each year.

What are 5 different types of tax?

In fact, when every tax is tallied – federal, state and local income tax (corporate and individual); property tax; Social Security tax; sales tax; excise tax; and others – Americans spend 29.2 percent of our income in taxes each year.

What are 5 taxes in the US?

Here are seven ways Americans pay taxes. Income taxes. Income taxes can be charged at the federal, state and local levels. Sales taxes. Sales taxes are taxes on goods and services purchased. Excise taxes. Payroll taxes. Property taxes. Estate taxes. Gift taxes.

How much taxes do you pay on $10000?

If you make $10,000 a year living in the region of California, USA, you will be taxed $875. That means that your net pay will be $9,125 per year, or $760 per month.

What are the 5 taxes in the Philippines?

List of Taxes in the Philippines Philippines Capital Gains Tax. Philippines Documentary Stamp Tax. Philippines Donor's Tax. Philippines Estate Tax. Philippines Income Tax. Philippines Percentage Tax. Philippines Value Added Tax (VAT) Philippines Withholding Tax on Compensation.

What is tax and how does it work?

Taxation refers to the fees and financial obligations imposed by a government on its residents. Income taxes are paid in almost all countries around the world. However, taxation applies to all payments of mandatory levies, including on income, corporate, property, capital gains, sales, and inheritance.

When can I file my taxes for 2022 in 2023?

Generally, most individuals are calendar year filers. For individuals, the last day to file your 2022 taxes without an extension is April 18, 2023, unless extended because of a state holiday.

What do taxes mean?

Taxes are mandatory contributions levied on individuals or corporations by a government entity—whether local, regional, or national. Tax revenues finance government activities, including public works and services such as roads and schools, or programs such as Social Security and Medicare.

What does taxes mean in simple words?

: an amount of money that a government requires people to pay ing to their income, the value of their property, etc., and that is used to pay for the things done by the government.

How much taxes do I pay on $7000?

If you make $7,000 a year living in the region of California, USA, you will be taxed $613. That means that your net pay will be $6,388 per year, or $532 per month.

How much salary is tax free in USA?

Do I Need to File Taxes? Not everyone is required to file or pay taxes. Depending on your age, filing status, and dependents, for the 2022 tax year, the gross income threshold for filing taxes is between $12,550 and $28,500.

How do I file my 2022 2023 tax return?

STEP1: -Visit the official Income Tax e-filing portal. STEP2: -Register or login to e-file your returns. STEP3: -Navigate to e-file and then click 'File Income Tax Return' once you have logged in to the portal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify florida cdl skills test score sheet without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including drivers test grading sheet. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an eSignature for the florida dmv score sheet in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your florida road test passing score directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out taxes tax sales on an Android device?

Complete florida driving test score sheet and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is CA DL 65 ETP Part II?

CA DL 65 ETP Part II is a state-specific tax document required for reporting certain types of income and expenses related to employee training programs in California.

Who is required to file CA DL 65 ETP Part II?

Employers who have received funding from the California Employment Training Panel (ETP) for employee training programs are required to file CA DL 65 ETP Part II.

How to fill out CA DL 65 ETP Part II?

To fill out CA DL 65 ETP Part II, employers must provide detailed information about the training conducted, including participant data, hours of training, and associated costs. The form typically requires both quantitative and qualitative details to substantiate the training efforts.

What is the purpose of CA DL 65 ETP Part II?

The purpose of CA DL 65 ETP Part II is to ensure accountability and transparency in the use of funds allocated for employee training programs and to assess the effectiveness of these training initiatives.

What information must be reported on CA DL 65 ETP Part II?

CA DL 65 ETP Part II requires reporting information such as the names of trainees, training dates, training topics, number of training hours, cost of the training, and employer details regarding the training program.

Fill out your tax sales state form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cdl Road Test Score Sheet is not the form you're looking for?Search for another form here.

Keywords relevant to georgia driving test score sheet

Related to dmv road test points

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.