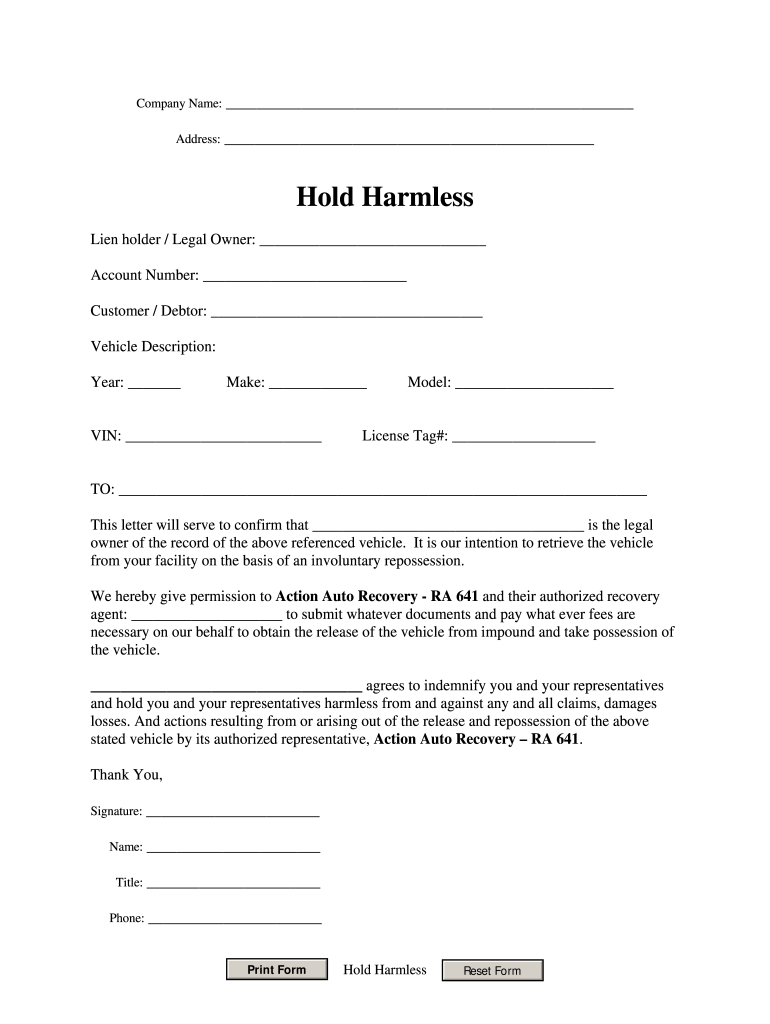

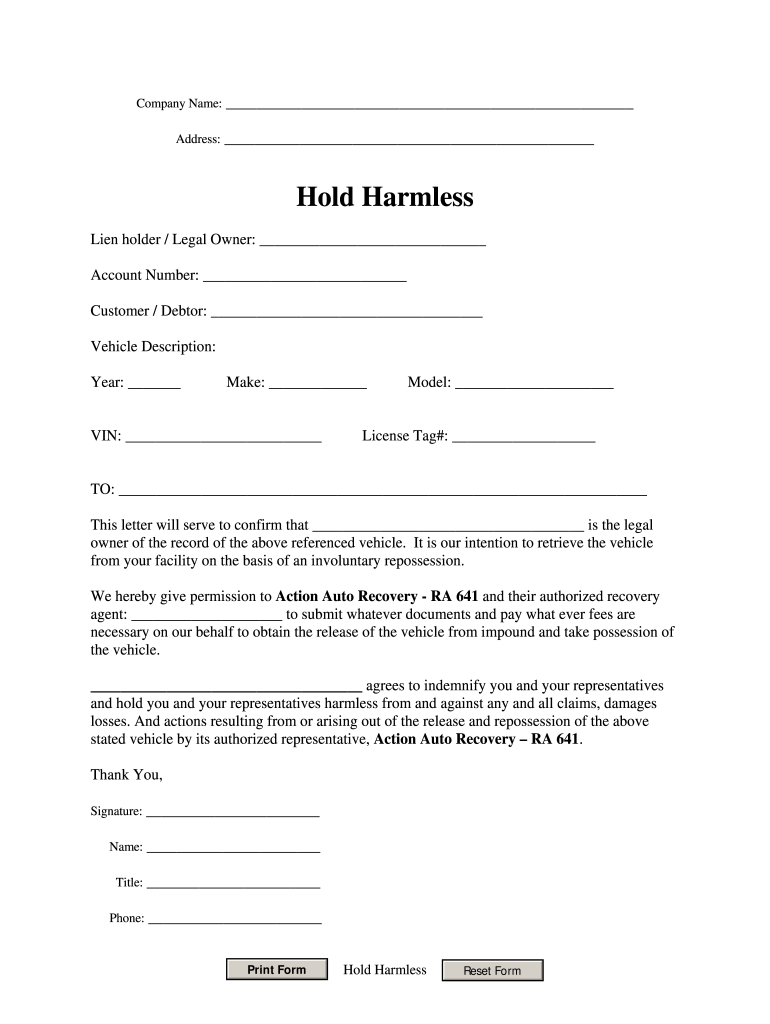

CA Auto Action Recovery Hold Harmless 2003 free printable template

Get, Create, Make and Sign

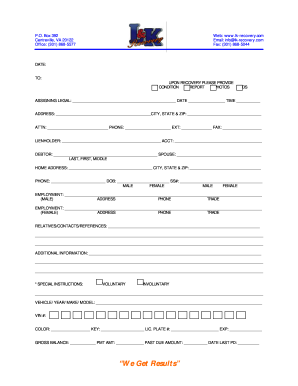

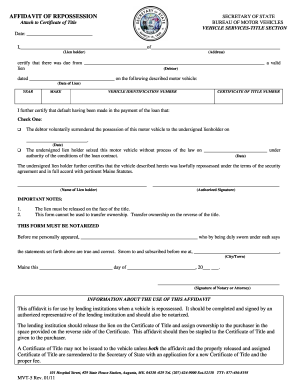

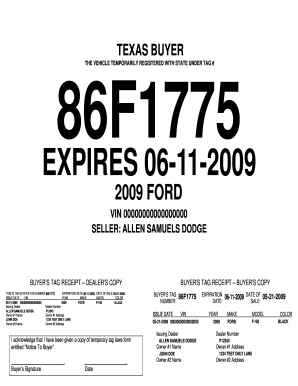

How to edit repo order form online

CA Auto Action Recovery Hold Harmless Form Versions

How to fill out repo order form 2003

How to fill out repo order form?

Who needs repo order form?

Video instructions and help with filling out and completing repo order form

Instructions and Help about blank texas repo order form

Derek is in Chicago welcome to the Dave Ramsey show Derek how can I help I had a few questions me and my wife just kind of started getting on the plan I actually led the Total Money Makeover and I just got our thousand dollars saved up as a last paycheck and got our budget done so last month and their lives we have about 1600 with the money going out there we didn't really a counselor, but my question is my car that I said I have currently my car, and we have one for my wife there's going to be repo'd, and I'm trying to figure out exactly what I should be doing and what I should get I do drive 55 miles each way back and forth to work they're going to be repo'd, yet I'm Melissa the account was closed and just the car that I Drive currently right now the account was closed, so you're so far behind they just said they're coming to pick it up yeah I missed two payments, and they got out of 40 days past due and that was I was their hundred sixty days and how much was your plane without you, it was 380 uh-huh and so how many payments are you behind now that's my building that's not a hundred and forty days at 380 it gets like they just got adding up the payments everyone goes forward was always one pint they just kept adding it up, but eight ten hundred divided by 400 is four months not three I could be off a little too well okay all right, so you're 1800 behind on the car what do you owe on it in total about I think it was twelve thousand five like that and what is it worth maybe five or six who said I looked it up before to see what it would be worse it was only about five or six it's a 2012 Chevy Crude with about 80000 miles on it, you know five or six on the dealer trade or on individual sale I think it was individual sale okay I want you to do some fresh research on it, you've given up on this car, and I'm afraid it's going to make a bigger mess for you then if you could figure out a way to sell it and borrow the difference because they're going to take the car, and they're going to sell it for a lot less than you would sell it for, and they're going to come after you for the whole difference I don't like that plan yeah I called them a couple of months ago when I first missed it and asked because I had started watching the show and I asked them if they would, you know sign a note for the difference and I use one of the bigger credit unions and I called them and said no we can't do that you know the parent that credit wasn't good enough and everything else they didn't really want to work with me at all, and I asked them the people sigh okay well I mean I would look for a different lender then to see if you can find somebody I mean I just I hate for them to come sell this car for 3000 when you could get six maybe four it's yourself because it's an extra three you're going to have to pay them because they're going to come after you for the entire difference you understand that right yeah I know okay all right well as far as what you're going to get...

Fill vehicle repossession templares : Try Risk Free

People Also Ask about repo order form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your repo order form 2003 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.