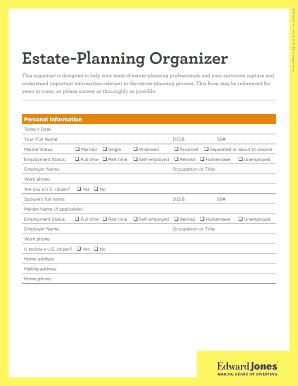

Al P. Trebing & Associates Estate Planning Organizer 2004-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How to fill out an al p trebing associates form form

Understanding the importance of an estate planning organizer

An estate planning organizer simplifies your estate planning process by securing essential information and documentation. Estate planning ensures that your assets are distributed according to your wishes after your death. Using an organizer helps in maintaining clarity and organization, reducing potential confusion and disputes among beneficiaries.

-

It allows you to dictate how your assets are managed and transferred, thereby minimizing legal issues.

-

An organizer centralizes important information, making it easier to fill out necessary forms and access when needed.

-

Professionals like Al P Trebing Associates provide tailored advice, enhancing the effectiveness of your estate plan.

Basic personal information: Who needs to be included?

When completing your estate planning form, it’s vital to include basic personal information for all parties involved, especially spouses. Accurate and complete information is crucial, as it ensures that your plan reflects your current family structure and wishes.

-

Provide full names, dates of birth, and social security numbers for both you and your spouse.

-

Incorrect information can lead to delays and disputes in the future, impacting the distribution of your estate.

-

Using tools like pdfFiller, you can securely manage sensitive data and ensure proper document handling.

How does navigating marital information help your estate planning?

Documenting your marital status, including current and previous marriages, is essential for a robust estate plan. Important details about your marital history can significantly impact how your estate is distributed, especially if you have children from different relationships.

-

All marriages must be documented, including divorce dates and details if applicable.

-

Your estate plan may require different approaches depending on your marital status.

-

Marital history can affect inheritance rights, especially for children from previous unions.

How to list family information: Including children and beneficiaries

Accurately listing children, including adopted and stepchildren, is crucial for ensuring they’re recognized as beneficiaries in your estate plan. Furthermore, it is important to identify other beneficiaries beyond immediate family, which could include friends or charitable organizations.

-

Provide the names and details of all children, making sure to include efficiently adopted and stepchildren.

-

Think beyond immediate family and list any friends or organizations that you wish to include.

-

Utilizing pdfFiller for structured data entry can ensure accuracy and facilitate sharing with family members.

What are the guidelines for articulating your desired disposition of estate?

Clearly expressing your intention regarding how your estate should be managed and distributed helps to avoid disputes among beneficiaries. The use of interactive tools available on platforms like pdfFiller can assist in visualizing your wishes.

-

Vague statements can lead to misunderstandings, so be specific about your wishes.

-

Proper documentation may reduce the risk of family disputes after your passing.

-

Tools provided by pdfFiller help make your intentions clear and accessible to all beneficiaries.

What additional legal papers should be documented in estate planning?

Estate planning goes beyond just filling out a form. It’s also critical to document relevant legal papers like wills, trusts, and powers of attorney. Collecting these documents and understanding their implications can profoundly influence your estate plan.

-

These include wills, trusts, healthcare proxies, and powers of attorney.

-

Use pdfFiller to collect, complete, and submit legal documents securely.

-

Each document type carries different legal implications affecting your estate plan.

How to effectively utilize a step-by-step guide for using the estate planning organizer

Using the estate planning organizer on pdfFiller is straightforward and beneficial. It provides a guided process, ensuring that no critical steps are overlooked and enabling easy collaboration with all relevant parties.

-

Navigate to pdfFiller and locate the estate planning organizer to begin.

-

Invite family members or legal advisers to review and provide input on the document.

-

Use pdfFiller’s eSigning feature for quick and legally binding document execution.

Frequently Asked Questions about estate planning template form

What is an estate planning organizer?

An estate planning organizer is a tool that helps you gather and arrange all necessary information for creating an effective estate plan. It includes key details about your assets, beneficiaries, and any legal documents needed.

How do I use the estate planning organizer?

To use the organizer, simply access it on pdfFiller, follow the prompts to fill out personal information and asset details, and collaborate with others as necessary for input and revisions.

What should I include in my estate planning form?

You should include personal information, details about your marital status, a list of beneficiaries, and any relevant legal documents such as wills or trusts to ensure comprehensive estate planning.

Can I edit my estate planning document after it's been created?

Yes, pdfFiller allows you to edit your estate planning document at any time. You can easily make changes, updates, or revisions as your personal circumstances evolve.

Why is clarity important in my estate planning?

Clarity is crucial to prevent misunderstandings or disputes among beneficiaries. Clearly articulating your intentions helps ensure your wishes are honored after your passing.

pdfFiller scores top ratings on review platforms