PH BIR 1700 2001 free printable template

Show details

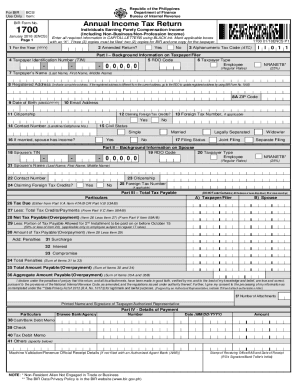

(To be filled up by the BIR) DAN: Republican NG Filipinas Catamaran NG Pananalapi BIR Form No. Hawaiian NG Rental Internal For Individuals Earning Compensation Income (Including Non-Business / Non-Profession

We are not affiliated with any brand or entity on this form

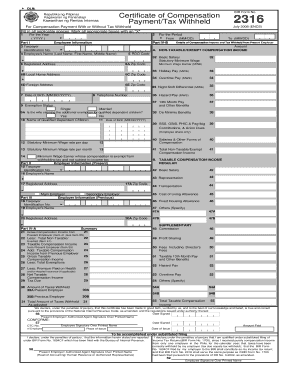

Get, Create, Make and Sign 2316 generator 2001 form

Edit your 2316 generator 2001 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2316 generator 2001 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2316 generator 2001 form online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2316 generator 2001 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH BIR 1700 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2316 generator 2001 form

How to fill out PH BIR 1700

01

Obtain the PH BIR Form 1700 from the BIR website or your local BIR office.

02

Fill out your personal information in the designated sections, including your name, address, and Tax Identification Number (TIN).

03

Declare your sources of income in the appropriate sections, specifying whether it is from employment, business, or other sources.

04

Calculate your total gross income and any allowable deductions as instructed in the form.

05

Complete the tax calculation section to determine your tax liability based on your income and deductions.

06

Provide any additional information required, such as payment details or tax credits, if applicable.

07

Review the completed form for accuracy and completeness.

08

Submit the form to the BIR, either online or in person, before the deadline.

Who needs PH BIR 1700?

01

Individuals earning income from various sources, including employees, self-employed individuals, and business owners, need to file PH BIR 1700.

02

Taxpayers who are not classified as corporations and whose income does not exceed a certain threshold must also use this form.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between BIR Form 1700 and 1701?

1700 while self-employed individuals should file either the Annual Income Tax Return for Individuals Earning Purely from Business or Profession (BIR Form No. 1701A) or the Annual Income Tax Return for Individuals including Mixed Income Earner, Estates and Trusts (BIR Form No. 1701).

What is the penalty for 1701?

Apart from your tax due, you have to pay a 25% surcharge, a 20% interest per annum, and a compromise penalty. If you choose to neglect to file the return, there is a penalty of 50% of the tax due.

What is BIR Form 1701 and 1701A?

1701 is for those with mixed-income (eg. someone who is both a freelance writer and a teacher), while 1701A is for those whose income is only coming from his/her business or profession (eg. a full-time freelance writer or a bakery owner).

What is the filing date for 1701?

1701 form needs to be filed on or before April 15th annually, and it should cover all those income from the previous tax year.

How to file BIR Form 1701 online?

Procedures Fill-up applicable fields in the BIR Form No. 1701. Pay electronically by clicking the “Proceed to Payment” button and fill-up the required fields in the “eFPS Payment Form” then click “Submit” button. Receive payment confirmation from eFPS-AABs for successful e-filing and e-payment.

What is a BIR Form 1701?

Description. BIR Form No. 1701 shall be filed by individuals who are engaged in trade/business or the practice of profession including those with mixed income (i.e., those engaged in the trade/business or profession who are also earning compensation income) in ance with Sec. 51 of the Code, as amended.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2316 generator 2001 form directly from Gmail?

2316 generator 2001 form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit 2316 generator 2001 form in Chrome?

2316 generator 2001 form can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit 2316 generator 2001 form on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as 2316 generator 2001 form. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is PH BIR 1700?

PH BIR 1700 is a tax form used in the Philippines for individuals, particularly for those who are self-employed or receiving income primarily from personal services, to report their annual income and calculate the income tax due.

Who is required to file PH BIR 1700?

Individuals who are self-employed, professionals, and those receiving compensation income who do not need to file other forms or who meet certain conditions are required to file PH BIR 1700.

How to fill out PH BIR 1700?

To fill out PH BIR 1700, taxpayers need to provide personal information, details of income received, and deductions. The form should be filled out accurately and completely, following the guidelines set by the Bureau of Internal Revenue (BIR).

What is the purpose of PH BIR 1700?

The purpose of PH BIR 1700 is to fulfill tax obligations by reporting annual income and calculating the corresponding tax due, allowing individuals to declare their income accurately to the Bureau of Internal Revenue.

What information must be reported on PH BIR 1700?

PH BIR 1700 requires reporting information such as taxpayer's name, Tax Identification Number (TIN), address, sources of income, deductions, and the total tax payable.

Fill out your 2316 generator 2001 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2316 Generator 2001 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.