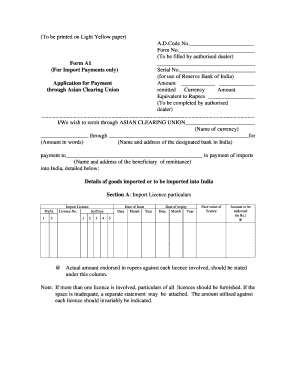

Reserve Bank of India Form A1 free printable template

Fill out, sign, and share forms from a single PDF platform

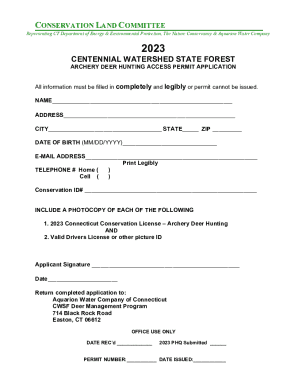

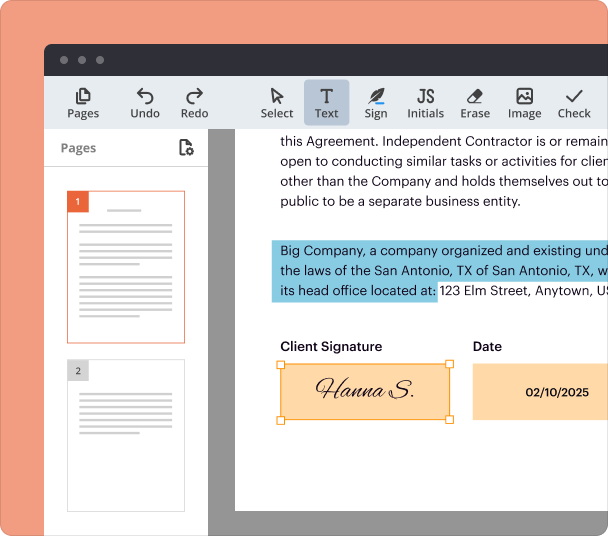

Edit and sign in one place

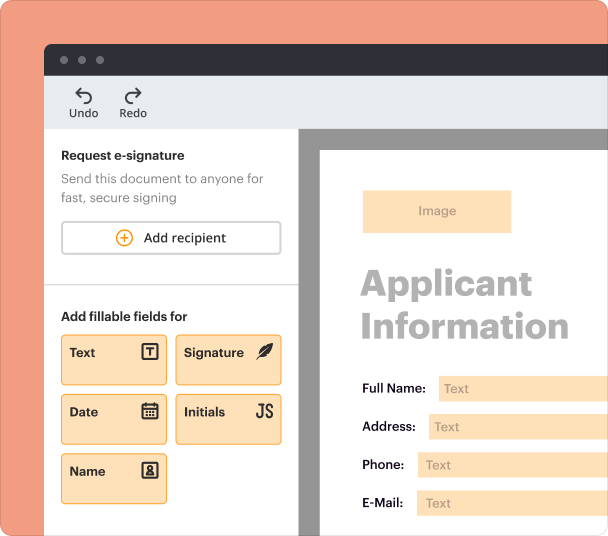

Create professional forms

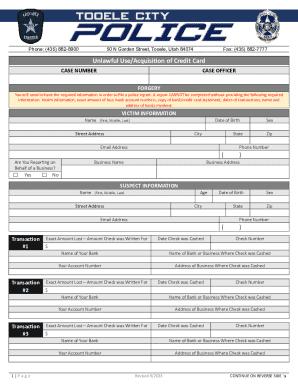

Simplify data collection

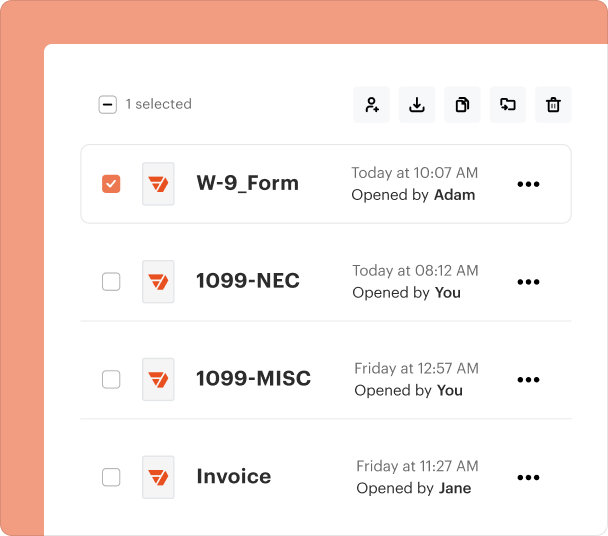

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Reserve Bank of India Form A: A Comprehensive Guide

How to fill out a Reserve Bank of India Form A

Filling out a Reserve Bank of India Form A requires careful attention to detail to ensure compliance with regulatory requirements. Begin by gathering all necessary documents, such as the authorized dealer information and import license specifics. Following the structured sections of the form will help you efficiently complete your import payment process.

What is Form A for Import Payments?

Form A is a vital document used in India for facilitating import payments. Its primary purpose is to standardize the documentation necessary for regulatory bodies, ensuring compliance with the Foreign Exchange Management Act (FEMA). Common users of this form include businesses and individuals engaged in import transactions.

-

Form A provides a structured framework for import payments under Indian law, allowing regulatory authorities to track and manage foreign exchange.

-

Users of Form A typically include individuals, small businesses, and large corporations dealing with overseas imports.

-

The use of Form A is governed by FEMA, which sets the guidelines for foreign exchange and import payments in India.

What are the fields included in Form A?

Understanding the fields in Form A is crucial for accurate completion. Each section is designated for specific information that must be filled out correctly to avoid delays in processing import payments.

-

This includes details about the authorized dealer and the beneficiary involved in the transaction.

-

Instructions on how to correctly fill out the Import License section to ensure all required data is provided.

-

This requires a breakdown of invoice details, as well as specific descriptions of the goods being imported.

How do complete Form A accurately?

Completing Form A requires methodical attention to each section. It's beneficial to follow a step-by-step approach to ensure no detail is overlooked. Knowing common mistakes can significantly decrease the chances of a denied submission.

-

Follow the structured sections carefully while ensuring all information is filled out accurately.

-

Avoid leaving out required fields or providing mismatched information that could lead to processing delays.

-

Double-check all entries against supporting documents to ensure compliance with RBI requirements.

What tools can assist in filling Form A?

Utilizing interactive tools can greatly enhance the experience of filling out Form A. Features like document editing, eSigning, and collaboration can streamline the process.

-

The pdfFiller editor allows users to fill out, edit, and save Form A conveniently and securely online.

-

Ensure legal validity and a faster turnaround by eSigning your completed forms.

-

Whether you're working as a team or individually, pdfFiller’s collaborative tools make working on Form A efficient and transparent.

Where can find official resources related to Form A?

The Reserve Bank of India (RBI) provides various resources for Form A. By navigating to the official website, you can access updated forms, documents, and guidelines.

-

Navigate to the official Reserve Bank of India website for authoritative resources and regulatory documents.

-

All necessary forms, including Form A, should be readily available in the designated sections of the RBI’s website.

-

The RBI site also offers insights into regulations, reports, and guidelines on banking practices in India.

What are the filing requirements for Form A?

Before submitting Form A, it’s essential to understand the mandatory documentation required along with the form. Failure to comply with the filing requirements can lead to penalties.

-

Keep in mind that documents like the import license, invoices, and identification may be needed for submission.

-

Be aware of the submission deadlines to avoid any late penalty fees that could be applicable.

-

Understanding FEMA's stipulations can help ensure that your import transactions remain lawful and recognized.

Frequently Asked Questions about a1 form

What is the primary purpose of Form A?

The primary purpose of Form A is to facilitate import payments while ensuring compliance with the Foreign Exchange Management Act (FEMA). It standardizes the necessary documentation for import transactions.

Who can use Form A?

Form A can be used by both individuals and businesses engaging in import activities. It is crucial for anyone involved in sending payments abroad for goods.

How can pdfFiller assist in filling out Form A?

pdfFiller provides an intuitive online platform that allows users to edit, fill out, and eSign Form A conveniently. Its collaborative features enable multiple users to work on the form simultaneously.

What happens if I miss the submission deadline for Form A?

Missing the submission deadline for Form A can result in penalties, which may complicate your import transactions. It's important to stay informed about deadlines to avoid such issues.

Where can I find the official guidelines for Form A?

Official guidelines and the latest updates for Form A can be found on the Reserve Bank of India’s official website. It hosts all necessary resources related to form submissions and requirements.

pdfFiller scores top ratings on review platforms