OH STEC B (Formerly STF OH41575F) 2004 free printable template

Show details

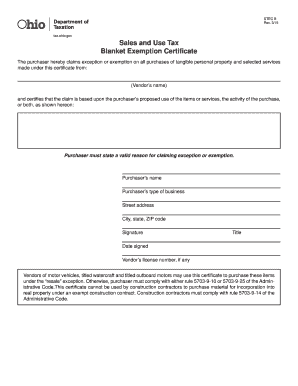

? Sales and Use Tax Blanket Exemption Certificate STEP? B Rev. 3/15/04. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH STEC B Formerly STF OH41575F

Edit your OH STEC B Formerly STF OH41575F form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH STEC B Formerly STF OH41575F form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OH STEC B Formerly STF OH41575F online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit OH STEC B Formerly STF OH41575F. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH STEC B (Formerly STF OH41575F) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH STEC B Formerly STF OH41575F

How to fill out OH STEC B (Formerly STF OH41575F)

01

Begin by downloading the OH STEC B form from the official website.

02

Carefully read the instructions provided on the first page of the form.

03

Fill out your personal information in the designated fields, including your name, address, and contact details.

04

Provide the required identification information, such as a driver's license number or social security number.

05

Complete any sections related to your financial status or assistance needed.

06

Double-check all the information for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form through the appropriate method, whether online or via mail.

Who needs OH STEC B (Formerly STF OH41575F)?

01

Individuals seeking financial assistance or benefits related to the Ohio STEC program.

02

Residents of Ohio who qualify under the specific criteria outlined in the STEC program.

03

Organizations or agencies assisting clients in applying for the STEC program.

Fill

form

: Try Risk Free

People Also Ask about

What does a tax exempt number look like in Ohio?

The State of Ohio does not issue a sales tax exemption number. A vendor's license number is NOT a sales tax exemption number. To claim exemption, you must provide a properly completed exemption certificate to your supplier.

Does a exemption certificate expire?

Certificates are valid for up to three years.

Do tax exempt certificates expire in Ohio?

Ohio Resale Certificates do not expire.

Does Ohio resale certificate expire?

Ohio Resale Certificates do not expire.

How do I exempt my Ohio income tax?

Individual taxpayers whose Ohio taxable income is less than or equal to $10,000 are effectively exempt from the tax since they receive a full credit against the tax otherwise due.

What is the exemption amount for Ohio taxes?

The exemption exists as a credit, in which up to $25,000 of one's home market value is exempt from property taxes. Ohio also offers two credits for those who are 65 and older and who have a modified adjusted gross income (less exemptions) of less than $100,000.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OH STEC B Formerly STF OH41575F to be eSigned by others?

When your OH STEC B Formerly STF OH41575F is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit OH STEC B Formerly STF OH41575F online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your OH STEC B Formerly STF OH41575F to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I complete OH STEC B Formerly STF OH41575F on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your OH STEC B Formerly STF OH41575F by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is OH STEC B (Formerly STF OH41575F)?

OH STEC B (Formerly STF OH41575F) is a state tax form used in Ohio for reporting specific income and tax information related to certain entities, including those categorized under the sales and use tax regulations.

Who is required to file OH STEC B (Formerly STF OH41575F)?

Entities that make taxable sales in Ohio are required to file OH STEC B. This can include businesses that operate in Ohio or have a physical presence in the state.

How to fill out OH STEC B (Formerly STF OH41575F)?

To fill out OH STEC B, gather your sales data, complete the required sections, report taxable sales and the appropriate tax amounts, and ensure all calculations are accurate before submitting the form.

What is the purpose of OH STEC B (Formerly STF OH41575F)?

The purpose of OH STEC B is to facilitate the reporting of sales tax information to the state of Ohio, ensuring compliance with tax laws and regulations for businesses.

What information must be reported on OH STEC B (Formerly STF OH41575F)?

OH STEC B requires reporting of total sales, taxable sales amounts, tax collected, exemptions claimed, and any additional information requested by the Ohio Department of Taxation.

Fill out your OH STEC B Formerly STF OH41575F online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH STEC B Formerly STF oh41575f is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.