Get the free Source of Capital Injection Form - Evolve Bank Trust

Show details

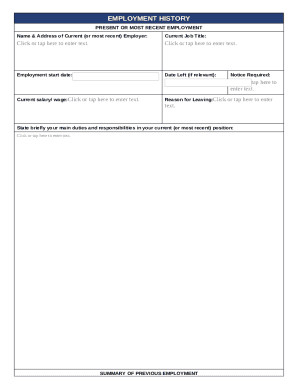

SOURCE OF CAPITAL INJECTION Note: Before a loan application can be processed, it is necessary to establish the source and present location of the funds intended to be invested in a business. DEBT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign source of capital injection

Edit your source of capital injection form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your source of capital injection form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit source of capital injection online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit source of capital injection. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out source of capital injection

How to fill out source of capital injection:

01

Start by identifying the specific source of capital injection you will be using. This could include options such as personal savings, loans from financial institutions, investments from shareholders, or grants from government or private entities.

02

Gather all necessary documents and information related to the chosen source. This may include bank statements, loan agreements, investment agreements, or grant application forms. Ensure that you have a clear understanding of the requirements and criteria for each source.

03

Fill out the relevant forms or applications accurately and completely. Provide all necessary details and support documentation as requested. Double-check your entries to minimize errors or omissions.

04

If applicable, seek professional advice from accountants, lawyers, or financial advisors to ensure compliance with regulations and to optimize your capital injection strategy. They can provide guidance on any legal or financial aspects that need to be considered.

Who needs source of capital injection:

01

Startups or new businesses that require funding to launch operations, develop products, or expand their reach.

02

Existing businesses that need additional capital to support growth initiatives, invest in research and development, upgrade equipment, or enter new markets.

03

Individuals or organizations that require financial support for specific projects, such as infrastructure development, social enterprises, or innovative technologies.

Remember, it is important to carefully assess your capital needs and explore different funding options based on your specific goals and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit source of capital injection online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your source of capital injection to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit source of capital injection straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing source of capital injection.

How do I edit source of capital injection on an Android device?

You can edit, sign, and distribute source of capital injection on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is source of capital injection?

The source of capital injection refers to the origin of funds that are added to a company's balance sheet, typically to support business operations, expansion, or financial stability.

Who is required to file source of capital injection?

Entities such as corporations, limited liability companies (LLCs), and partnerships that receive a capital injection often need to disclose this information during financial reporting or compliance with regulatory agencies.

How to fill out source of capital injection?

To fill out the source of capital injection, one should provide details on the amount injected, the type of capital (equity, debt, etc.), the date of injection, and the source (e.g., individual investors, venture capitalists, or loans from banks).

What is the purpose of source of capital injection?

The purpose of documenting the source of capital injection is to ensure transparency in financial reporting, satisfy regulatory requirements, and provide stakeholders with information on how the company is being funded.

What information must be reported on source of capital injection?

The information that must be reported includes the amount of capital injected, the date of injection, the source of funds, the purpose of the capital, and any related terms or conditions.

Fill out your source of capital injection online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Source Of Capital Injection is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.