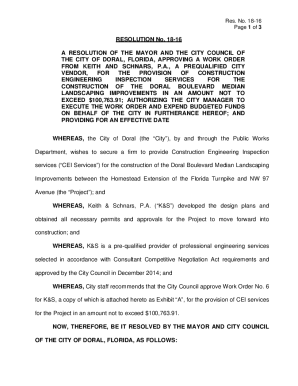

TX LHT Anti-Garnishment Letter 2011-2026 free printable template

Show details

This document serves as an anti-garnishment letter informing the bank that the funds in the account are protected from creditors, especially when the income is exempt, like Social Security.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign stop garnishment letter form

Edit your anti garnishment letter texas form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

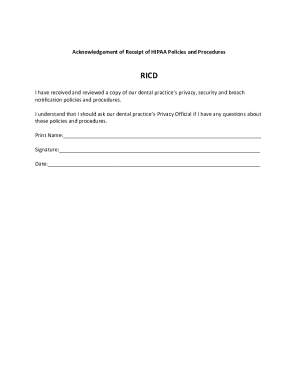

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX LHT Anti-Garnishment Letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX LHT Anti-Garnishment Letter online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX LHT Anti-Garnishment Letter. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out TX LHT Anti-Garnishment Letter

How to fill out TX LHT Anti-Garnishment Letter

01

Start by obtaining the TX LHT Anti-Garnishment Letter template from a reliable source.

02

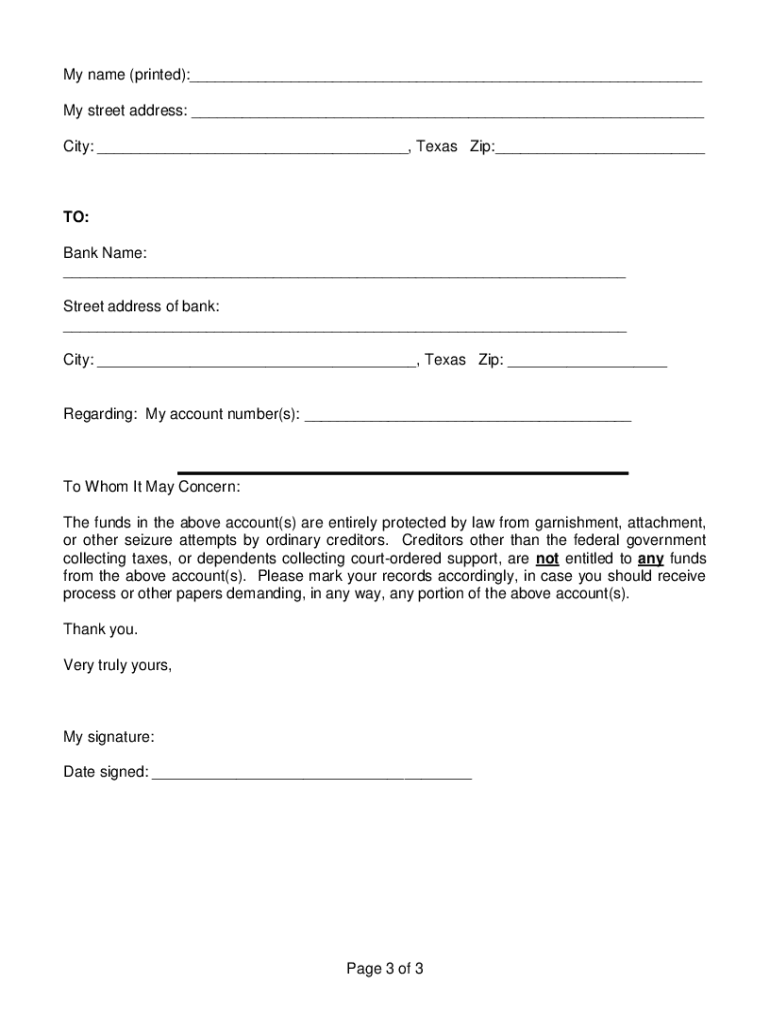

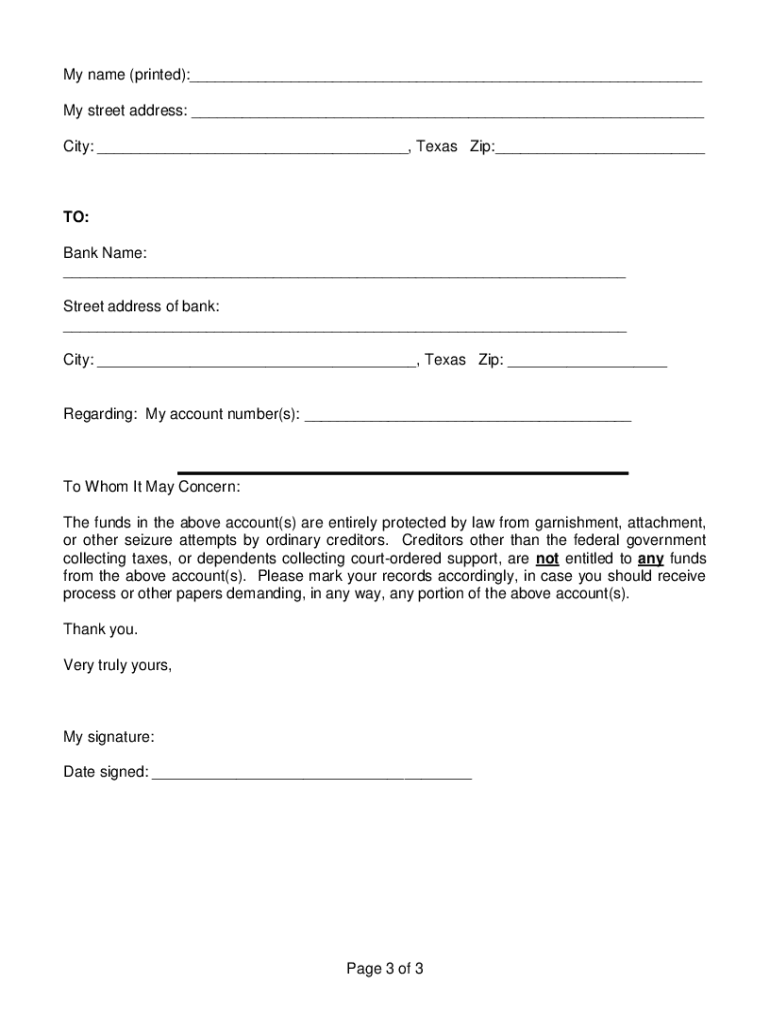

Fill in your personal information, including your name, address, and contact details at the top of the letter.

03

Include the name and address of the creditor or agency to whom the letter is being sent.

04

Clearly state the purpose of the letter, mentioning that it is an anti-garnishment request.

05

Provide any relevant account numbers or identifiers related to the debt.

06

Include a brief explanation of your financial situation and reasons why you believe garnishment should not occur.

07

Add a section for your signature and the date.

08

Make copies of the letter for your records before sending it.

Who needs TX LHT Anti-Garnishment Letter?

01

Individuals facing wage garnishment due to unpaid debts.

02

People who want to protect their wages from being taken by creditors.

03

Anyone who believes that garnishment is unjustified due to their financial circumstances.

Fill

form

: Try Risk Free

People Also Ask about

Can your cash App account be garnished?

Yes, Cash App and similar electronic funds wallets can be garnished. Cash App is run by a company called Block, Inc. The Cash App Terms of service explicitly states that they will adhere to garnishment orders and may freeze, withhold, or give up funds in your account in response to a legal garnishment order.

What prepaid cards Cannot be garnished?

Pre-paid debit cards are different than gift cards. Gift cards, even the Visa or MasterCard gift cards, do not require personally identifying information. So, gift cards cannot be garnished by sending a garnishment order to the issuer.

Can a creditor garnish your Social Security check?

Generally, Social Security benefits are exempt from execution, levy, attachment, garnishment, or other legal process, or from the operation of any bankruptcy or insolvency law.

What type of bank accounts Cannot be garnished?

In many states, some IRS-designated trust accounts may be exempt from creditor garnishment. This includes individual retirement accounts (IRAs), pension accounts and annuity accounts. Assets (including bank accounts) held in what's known as an irrevocable living trust cannot be accessed by creditors.

How can I stop a garnishment on my bank account?

If your wages or bank account have been garnished, you may be able to stop it by paying the debt in full, filing an objection with the court or filing for bankruptcy.5 Ways to Stop a Garnishment Pay Off the Debt. Work With Your Creditor. Challenge the Garnishment. File a Claim of Exemption. File for Bankruptcy.

Can a debt collector take money from my bank account without authorization?

No. Debt collectors can ONLY withdraw funds from your bank account with YOUR permission. That permission often comes in the form of authorization for the creditor to complete automatic withdrawals from your bank account.

How do I write a letter to stop a garnishment?

I understand that our creditors may not garnish these payments. I am requesting that you cease from calling us on the phone which you are required to do by the Fair Debt Collection Act (15 USC Sec. 1692). I have cut up all our credit cards and am sending this letter to each one of our creditors.

How do I protect my Social Security from creditors?

The funds will NOT be protected if you receive a check from SSA and then go to the bank and deposit it into an account. The best way to protect your Social Security Benefits from creditors is to keep a separate account, which only receives direct deposits from Social Security.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my TX LHT Anti-Garnishment Letter directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign TX LHT Anti-Garnishment Letter and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I sign the TX LHT Anti-Garnishment Letter electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your TX LHT Anti-Garnishment Letter in seconds.

Can I create an eSignature for the TX LHT Anti-Garnishment Letter in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your TX LHT Anti-Garnishment Letter and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is TX LHT Anti-Garnishment Letter?

The TX LHT Anti-Garnishment Letter is a document used in Texas to notify creditors that a portion of a debtor's income, such as wages, is exempt from garnishment under state law.

Who is required to file TX LHT Anti-Garnishment Letter?

Individuals who have received wage garnishment orders and believe that a portion of their income is exempt under Texas law are required to file the TX LHT Anti-Garnishment Letter.

How to fill out TX LHT Anti-Garnishment Letter?

To fill out the TX LHT Anti-Garnishment Letter, you need to provide details such as your name, contact information, the name of the creditor, the amount being claimed as exempt, and any supporting documentation that proves your income exemption.

What is the purpose of TX LHT Anti-Garnishment Letter?

The purpose of the TX LHT Anti-Garnishment Letter is to protect certain incomes from being garnished, ensuring that debtors can retain necessary funds for living expenses and obligations.

What information must be reported on TX LHT Anti-Garnishment Letter?

Information that must be reported on the TX LHT Anti-Garnishment Letter includes debtor's personal information, creditor's details, income amount, the specific exemption being claimed, and any relevant documentation supporting the exemption.

Fill out your TX LHT Anti-Garnishment Letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX LHT Anti-Garnishment Letter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.