Get the free t439 income execution form

Show details

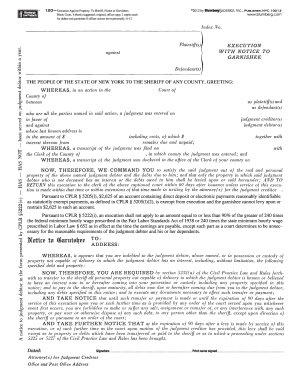

Reset Show Field Borders 439 Income Execution; CPR 5231. Blank Court, 4-15. Purchase — 5 blanks suggested: original: office copy: two copies for debtor and one for garnishee if officer cannot serve

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign t439 income execution form

Edit your t439 income execution form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t439 income execution form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing t439 income execution form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit t439 income execution form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out t439 income execution form

How to fill out t439 income execution form:

01

Start by obtaining the t439 income execution form from the appropriate source. This form is typically available on the website of the government agency or court handling income executions.

02

Read the instructions carefully before filling out the form. Make sure you understand the purpose of each section and the information required.

03

Begin by providing your personal information, including your full name, address, and contact details. This information helps to identify and locate you in relation to the income execution.

04

Next, you will need to provide information about the debtor, which is the person from whom you are seeking to collect a debt. Include their full name, address, and any known contact details.

05

Fill out the details of the income execution, including the court name and case number if applicable. Indicate the total amount of the debt and any interest or fees that may have accrued.

06

Specify the source of income from which you seek to collect the debt. This could be the debtor's salary, wages, or other income. Include details such as the employer's name and address, as well as the debtor's job title or position.

07

If applicable, provide information about any existing court orders or agreements related to the debt, such as a repayment plan or previous income execution.

08

Sign and date the form, certifying that the information provided is accurate to the best of your knowledge. Keep a copy of the completed form for your records.

Who needs t439 income execution form:

01

Individuals or businesses who are owed a debt and have obtained a court judgment allowing them to collect the debt through an income execution.

02

Creditors who wish to enforce a court order or agreement relating to the repayment of a debt through the garnishment of the debtor's wages or salary.

03

Government agencies or courts responsible for overseeing and processing income executions.

Fill

form

: Try Risk Free

People Also Ask about

What are the rules for wage garnishment in NY?

Here are the rules: In New York State, a creditor can garnish the lesser of 10% of your gross wages or 25% of your disposable income to the extent that this amount exceeds 30% of minimum wage. If your disposable income is less than 30 times the minimum wage, it can't be garnished at all.

How do I stop a wage garnishment in New York?

If you disagree with the garnishment, you can file an Order to Show Cause with the appropriate court. After receiving instructions from the Sheriff or Marshal, OPA will suspend the distribution of your deductions until further instructions are received from the City Marshal or Sheriff.

What is the IRS income execution payment?

An income execution is a type of levy that may be issued against your wages if you fail to resolve your tax debt. We will ask you to voluntarily pay up to 10% of your gross wages each time you're paid.

How do I stop income execution in NY?

In order for you to vacate the judgment and be relieved from wage garnishment, you will need to file court papers and appear in court at least once.

How do I stop my NYS tax garnishment?

To resolve a levy, you will need to call us at 518-457-5893 during regular business hours and speak with a representative. Be sure to enter your taxpayer ID when prompted.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify t439 income execution form without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your t439 income execution form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send t439 income execution form for eSignature?

Once your t439 income execution form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete t439 income execution form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your t439 income execution form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is t439 income execution form?

The T439 income execution form is a document used in Canada to facilitate the garnishment of wages for the collection of debts, such as taxes owed to the government.

Who is required to file t439 income execution form?

Typically, creditors who have obtained a judgment against a debtor and wish to collect the debt through wage garnishment are required to file the T439 income execution form.

How to fill out t439 income execution form?

To fill out the T439 income execution form, a creditor must provide information such as the debtor's details, the amount to be garnished, and details regarding the judgment that has been obtained.

What is the purpose of t439 income execution form?

The purpose of the T439 income execution form is to legally authorize the garnishment of a debtor's income to ensure that owed debts are collected efficiently.

What information must be reported on t439 income execution form?

The T439 income execution form requires reporting of the debtor's name and contact information, the amount owed, the court order details, and the creditor's information.

Fill out your t439 income execution form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

t439 Income Execution Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.