Get the free mechanics lien risk assessment form

Show details

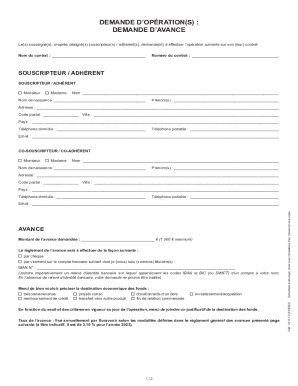

5. Use the Clear Boxes buttons to clear check boxes within a category. Print. Save As. Clear Form MECHANICS LIEN RISK ASSESSMENT This form is to be completed by ATG or ATG Member s office only.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mechanics lien risk assessment

Edit your mechanics lien risk assessment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mechanics lien risk assessment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mechanics lien risk assessment online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mechanics lien risk assessment. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mechanics lien risk assessment

How to fill out mechanics lien risk assessment:

01

Gather all relevant information: Collect detailed information about the project, including the parties involved, the scope of work, the contract terms, and the payment terms. This will help you assess the potential risks associated with filing a mechanics lien.

02

Evaluate the project payment history: In order to assess the risk of non-payment, review the payment history of the project. This includes looking at any past delays or disputes regarding payment on similar projects. This information will help you determine the likelihood of encountering payment issues.

03

Assess the financial stability of the parties involved: Evaluate the financial stability of the property owner, general contractor, and any other parties involved in the project. This can be done by reviewing their financial statements, credit history, and reputation within the industry. A thorough financial assessment will help you gauge the likelihood of receiving payment.

04

Review the project timeline: Analyze the project timeline and identify any potential delays or disruptions that could affect payment. Consider factors such as weather conditions, permits, or changes in scope that may impact the project's progress. This evaluation will help you determine the risk associated with potential payment delays.

Who needs mechanics lien risk assessment:

01

Contractors: Contractors who have completed work on a construction project and are concerned about potential payment issues can benefit from a mechanics lien risk assessment. This assessment will help them evaluate the likelihood of receiving payment and decide if filing a mechanics lien is necessary.

02

Subcontractors: Subcontractors who have not been paid for their work on a project can also benefit from a mechanics lien risk assessment. By assessing the risks associated with filing a mechanics lien, subcontractors can determine their chances of recovering payment through this legal remedy.

03

Suppliers and material providers: Suppliers and material providers who have provided goods or materials to a construction project can use a mechanics lien risk assessment to evaluate the likelihood of receiving payment. This assessment will help them make informed decisions about pursuing a mechanics lien to secure their payment.

In summary, anyone involved in a construction project who is concerned about potential payment issues can benefit from a mechanics lien risk assessment. By thoroughly evaluating the project's payment history, financial stability of the parties involved, project timeline, and other relevant factors, individuals or businesses can make informed decisions about their next steps, including the possibility of filing a mechanics lien.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the mechanics lien risk assessment form on my smartphone?

Use the pdfFiller mobile app to fill out and sign mechanics lien risk assessment. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit mechanics lien risk assessment on an iOS device?

You certainly can. You can quickly edit, distribute, and sign mechanics lien risk assessment on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete mechanics lien risk assessment on an Android device?

Use the pdfFiller Android app to finish your mechanics lien risk assessment and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

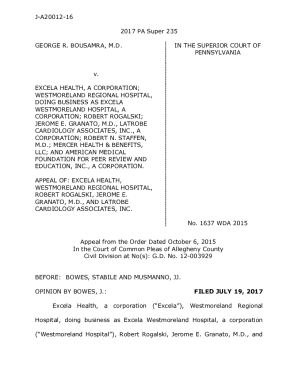

What is mechanics lien risk assessment?

Mechanics lien risk assessment is the process of evaluating the likelihood of a mechanics lien being filed on a construction project due to non-payment or default by one or more parties involved in the project.

Who is required to file mechanics lien risk assessment?

There is no specific requirement to file a mechanics lien risk assessment. However, contractors, subcontractors, suppliers, and other parties involved in a construction project may choose to perform a mechanics lien risk assessment to assess the potential financial risks associated with the project.

How to fill out mechanics lien risk assessment?

Mechanics lien risk assessment can be filled out by gathering relevant information about the construction project, such as the parties involved, project timeline, payment history, and potential sources of risk. This information can then be analyzed to evaluate the likelihood of a mechanics lien being filed.

What is the purpose of mechanics lien risk assessment?

The purpose of mechanics lien risk assessment is to identify and evaluate the potential financial risks associated with a construction project. It helps parties involved in the project make informed decisions and take necessary actions to mitigate or manage these risks.

What information must be reported on mechanics lien risk assessment?

The information reported on mechanics lien risk assessment may vary depending on the requirements of the party conducting the assessment. However, it typically includes details about the project, parties involved, payment history, potential defaults, and the likelihood of a mechanics lien being filed.

Fill out your mechanics lien risk assessment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mechanics Lien Risk Assessment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.