Get the free Distribution Options Document

Show details

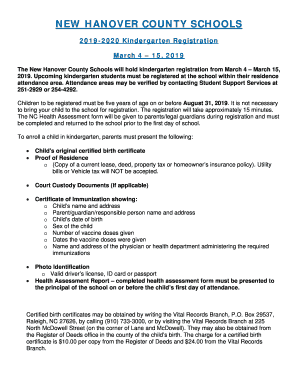

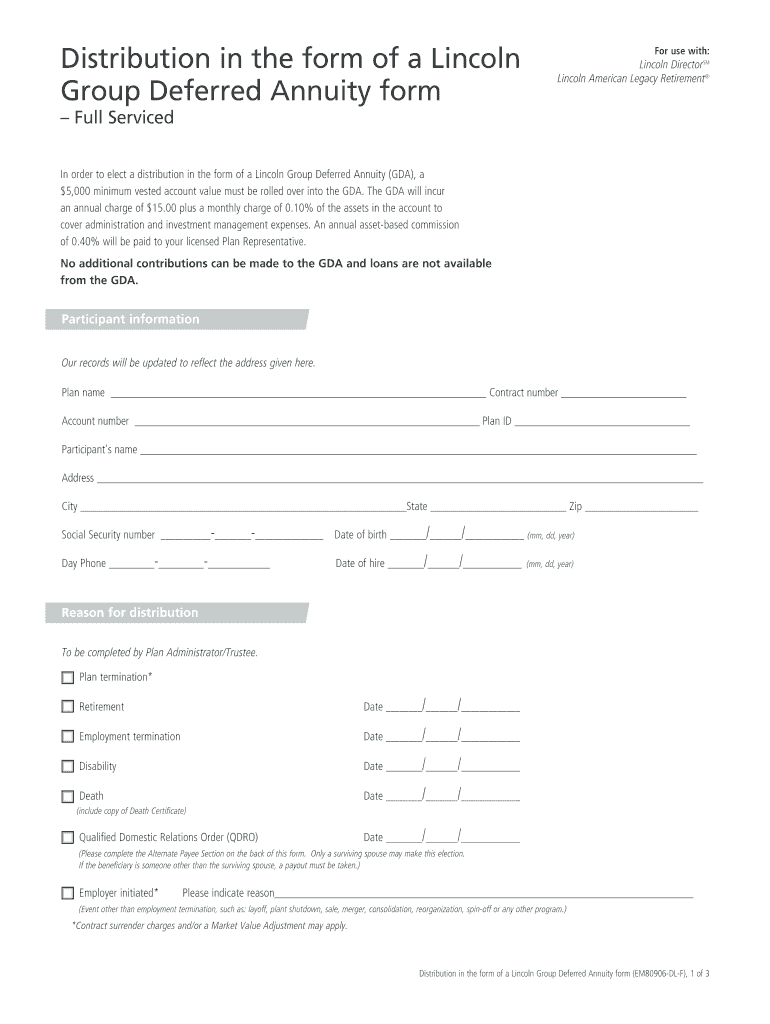

This document outlines the distribution options available for the Lincoln DirectorSM and Lincoln American Legacy Retirement® group variable annuity retirement plans, including detailed information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign distribution options document

Edit your distribution options document form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your distribution options document form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing distribution options document online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit distribution options document. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

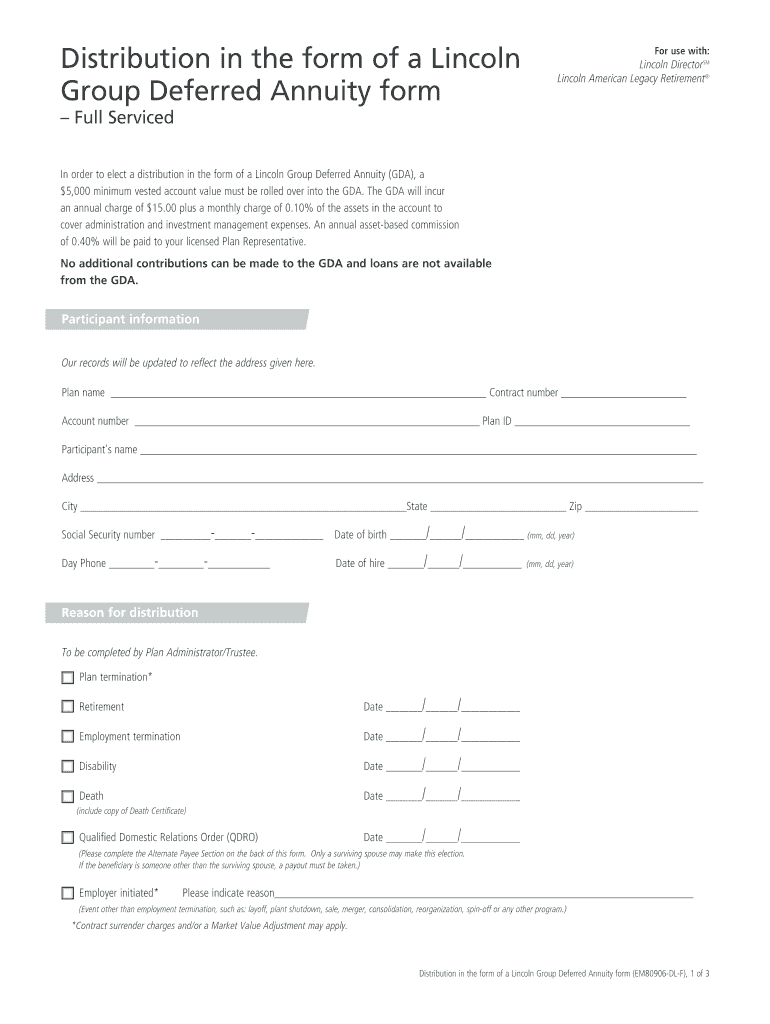

How to fill out distribution options document

How to fill out Distribution Options Document

01

Start by reviewing the introductory section of the Distribution Options Document to understand its purpose.

02

Fill in your contact information at the top of the document, including your name, address, and email.

03

Specify the type of distribution option you are selecting from the provided choices.

04

Indicate any necessary details for your chosen distribution option, such as distribution dates or amounts.

05

Review any terms and conditions related to your selections and acknowledge understanding by signing where indicated.

06

Double-check all of your inputs for accuracy before submitting the document.

Who needs Distribution Options Document?

01

Individuals or entities involved in the distribution of assets or earnings.

02

Financial advisors or planners assisting clients in asset distribution decisions.

03

Legal professionals preparing estate planning documents.

04

Organizations distributing funds, such as nonprofits or corporations.

Fill

form

: Try Risk Free

People Also Ask about

What does distribution mean on my 401k?

A 401(k) distribution is a withdrawal of funds from a participant's retirement account. Distributions can include pre-tax and after-tax contributions, employer contributions, Roth contributions, and investment earnings.

What is a distribution option?

Generally, you have four options: Roll the assets to an Individual Retirement Account (IRA) Leave the funds in your former employer's retirement plan (if allowed) Move savings to your new employer's plan (if allowed) Withdraw or “distribute” the money.

What is an example of a distribution plan?

Direct distribution Selling directly to the end consumer through owned e-commerce channels. Examples include company websites, mobile apps, brick-and-mortar locations, pop-up shops, or catalog/TV sales. This is the strategy where a customer books a hotel room directly through your hotel website.

What are distribution options?

You can: Roll over your money to a new employer plan (if available and if rollovers are permitted) Leave your retirement savings in former employer plan (if permitted) Roll over former employer plan savings to an IRA. Take a lump sum, cash out and pay the required taxes on the distribution.

What are the three main types of distribution?

The three types of distribution strategies are intensive, selective, and exclusive.

What is a plan distribution?

A withdrawal of money from an employer-sponsored retirement plan is generally referred to as a distribution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Distribution Options Document?

The Distribution Options Document is a form used to outline the various options available for the distribution of funds or assets from a retirement plan or investment account.

Who is required to file Distribution Options Document?

Typically, account holders who are eligible to withdraw funds from their retirement accounts, such as 401(k) or IRA plans, are required to fill out a Distribution Options Document.

How to fill out Distribution Options Document?

To fill out the Distribution Options Document, individuals should carefully review the options provided, select their preferred distribution method, complete any required personal information, and submit the form as directed by the financial institution.

What is the purpose of Distribution Options Document?

The purpose of the Distribution Options Document is to clearly communicate an account holder's choices regarding the distribution of their retirement or investment funds, ensuring compliance and proper processing of withdrawals.

What information must be reported on Distribution Options Document?

Necessary information typically includes personal identification details, account information, chosen distribution method, and any tax withholding preferences.

Fill out your distribution options document online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Distribution Options Document is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.