Who needs an IT-2104 form?

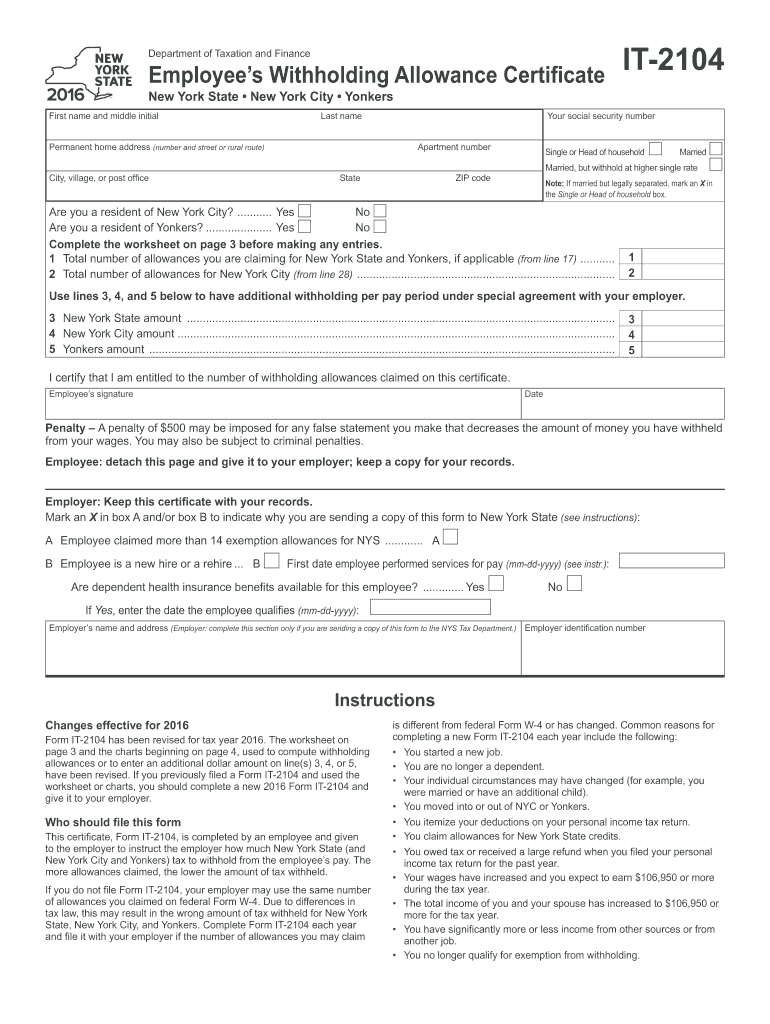

This form is the Employee’s Withholding Allowance Certificate that is filed specifically in New York State and is approved by the local Department of Taxation and Finance. The form must be completed by individuals employed in NY State to indicate how much the employer should withhold from their pay.

What is the purpose of the form?

The form is essential to employees as they can claim allowances to lower the amount of tax due. If the state form is not filed, the employer will have to use the information from submitted federal W-4 forms. This may cause the improper amount of tax withheld for New York State, New York City, and Yonkers.

When is the form due?

The form IT-2104 must be filed at the same time as W-4 form on a yearly basis; alternatively, it should be filed as soon as any of the following conditions are met:

- The individual got employed at a new job;

- The individual’s circumstances have changed;

- The individual moved into or out of NY State;

- The individual has itemized deductions on their personal income tax return,

- The individual claims allowances for New York State credits, etc.

Is the form accompanied by any other documents?

It is necessary to attach the form IT-2104 to the federal W-4 form.

How do I fill out the form?

The IT-2104 requires the following information:

- The employed individual’s full name,

- Address;

- SSN;

- Marital status;

- Whether the filer is a resident of NYC or Yonkers;

- Total number of claimed allowances;

- Employment details (filled out by the employer).

To help calculate the amount of allowances, the form contains a worksheet and instructions on how to properly count the relevant withholding allowances and deductions.

Where do I send the complete form?

Upon completing the form, the employee must deliver the form to the employer.