Get the free Certificate of Past Due Taxes

Show details

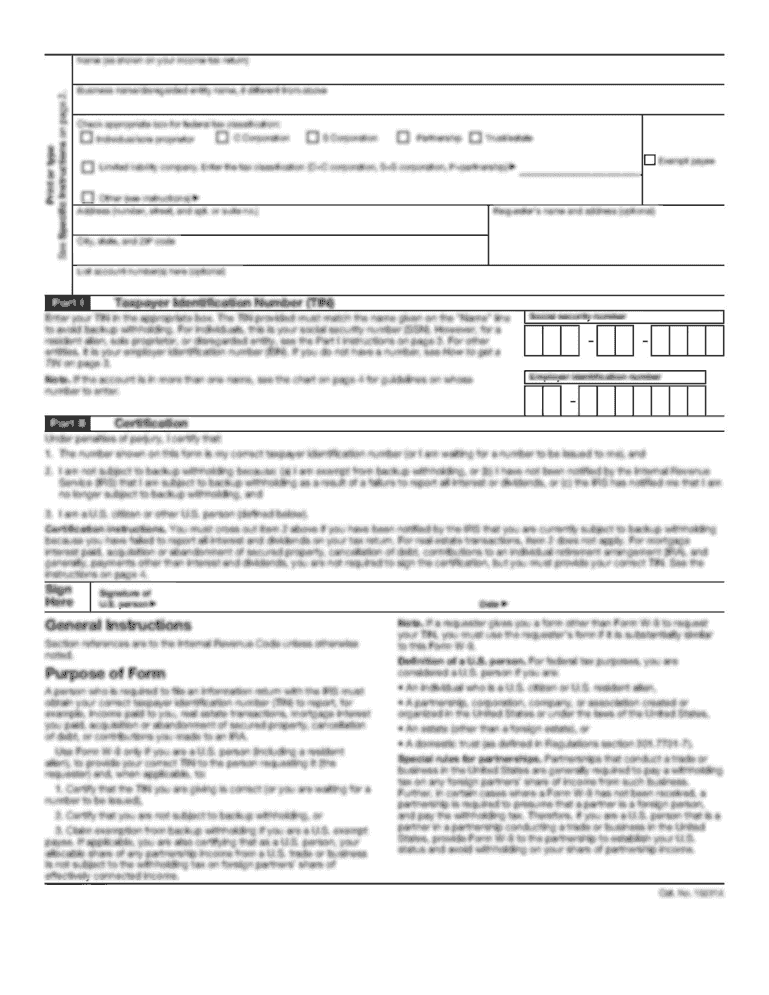

This document is a certification for entities to confirm that they do not have any overdue tax debts at the federal, State, or local level, required to be submitted to Duplin County.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of past due

Edit your certificate of past due form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of past due form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit certificate of past due online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit certificate of past due. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificate of past due

How to fill out Certificate of Past Due Taxes

01

Obtain a copy of the Certificate of Past Due Taxes form from your local tax authority's website or office.

02

Fill in your personal information, including name, address, and tax identification number.

03

Indicate the tax period for which you are requesting the certificate.

04

Provide details of any outstanding taxes, including amounts and relevant accounts.

05

Review the form for accuracy and completeness before submission.

06

Submit the completed form to the tax authority along with any required payment for processing.

Who needs Certificate of Past Due Taxes?

01

Individuals who have unpaid property taxes.

02

Homebuyers who want to verify tax payment history before purchasing a property.

03

Real estate agents assisting clients in property sales.

04

Mortgage lenders requiring a tax certificate for loan approval.

05

Business owners needing to prove tax status for financial transactions.

Fill

form

: Try Risk Free

People Also Ask about

What does a tax certificate do?

It confirms that your business has registered for tax purposes and demonstrates your compliance with tax regulations, serving as evidence of your tax payments and regulatory adherence.

What is a tax card in Finland?

The tax card indicates your tax rate, or how much tax you will pay on your income. If your income or deductions change, your tax rate may be too high or too low. If this happens, request a new tax card with a new tax rate.

What is a tax certificate in Finland?

A certificate stating whether you or the company you represent have unpaid taxes or self-assessed tax returns to give. Finnish Tax Administration.

How to get a tax certificate in Finland?

In MyTax, you can order and print a tax debt certificate yourself, if you have paid your taxes and submitted tax returns of self-assessed taxes on time, and you will be sent a certificate of paid taxes.

What is a tax certificate of residence?

A tax residency certificate is a specific document that indicates the taxpayer's residency. A government issues such a certificate to prevent tax fraud resulting from the incorrect application of the provisions of international treaties on the avoidance of double taxation.

What is an outstanding tax obligation?

If you don't pay your tax liability, you'll face penalties. The outstanding amount will also accrue interest. Penalty relief may be available if it's your first tax penalty or if your ability to pay or file on time was impacted by a serious illness, natural disaster, or other disruptive event.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Certificate of Past Due Taxes?

A Certificate of Past Due Taxes is an official document that certifies the status of tax payments for a property, indicating any unpaid or delinquent taxes.

Who is required to file Certificate of Past Due Taxes?

Property owners or designated representatives are typically required to file a Certificate of Past Due Taxes when there are outstanding tax obligations.

How to fill out Certificate of Past Due Taxes?

To fill out a Certificate of Past Due Taxes, one must provide property details, the owner's information, and specify the amounts of taxes owed, along with any relevant identification numbers.

What is the purpose of Certificate of Past Due Taxes?

The purpose of the Certificate of Past Due Taxes is to inform property buyers, lenders, and government entities about any outstanding taxes owed, which may affect property transactions and financing.

What information must be reported on Certificate of Past Due Taxes?

The Certificate of Past Due Taxes must report the property address, owner's name, tax identification number, amount of taxes due, and any penalties or interest accrued on unpaid taxes.

Fill out your certificate of past due online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Past Due is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.