Get the free Montana Mortgage Lender Licensee Surety Bond - mortgage nationwidelicensingsystem

Show details

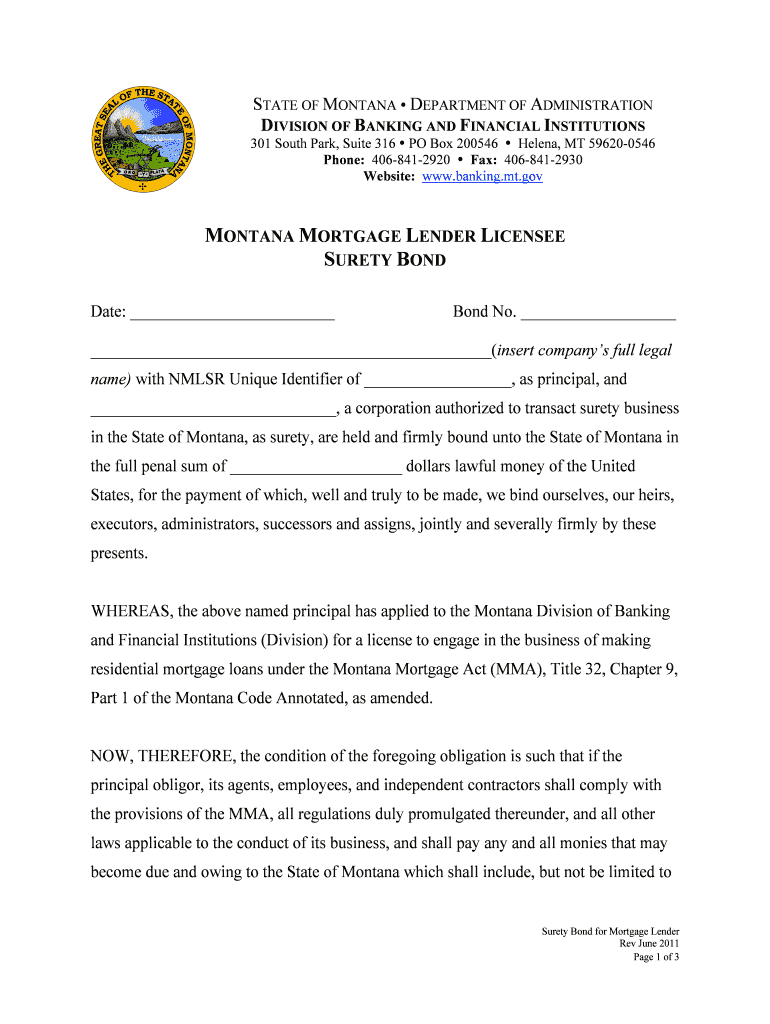

This document serves as a surety bond for a mortgage lender in Montana, binding the principal and surety to ensure compliance with the Montana Mortgage Act and payment of any dues to the State of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign montana mortgage lender licensee

Edit your montana mortgage lender licensee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your montana mortgage lender licensee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing montana mortgage lender licensee online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit montana mortgage lender licensee. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out montana mortgage lender licensee

How to fill out Montana Mortgage Lender Licensee Surety Bond

01

Obtain the surety bond form from the Montana Division of Banking and Financial Institutions or a licensed surety company.

02

Complete the bond form with the required details, including your business name, address, and license number.

03

Specify the bond amount as required by the Montana regulations.

04

Provide information about the surety company, including their name and contact details.

05

Have the bond signed by an authorized representative from the surety company.

06

Ensure the bond is notarized if necessary, as per Montana requirements.

07

Submit the completed bond to the Montana Division of Banking along with any additional required documentation.

08

Keep a copy of the bond for your records.

Who needs Montana Mortgage Lender Licensee Surety Bond?

01

Individuals or businesses seeking to obtain a mortgage lender license in Montana are required to have a Mortgage Lender Licensee Surety Bond.

Fill

form

: Try Risk Free

People Also Ask about

What is a $75000 surety bond?

Most Common $75,000 Surety Bonds Some motor vehicle dealerships in states including Utah and Iowa require a $75,000 bond. This protects buyers from financial loss caused by auto dealers.

What is a surety bond in the amount of $500,000?

$500,000 surety bonds typically cost 0.5–10% of the bond amount, or $2,500–$50,000.. Highly qualified applicants with strong credit might pay just $2,500 to $5,000 while an individual with poor credit will receive a higher rate.

How much is a surety bond in Montana?

The cost of a surety bond in Montana depends on the bond type and amount required, ranging from $250 to $10,000.

What is a surety bond in Montana?

Montana surety bonds are like insurance policies that are intended to protect clients from contractors or commercial salespeople who fail to fulfill their obligations to them. Bonds are essentially a contract between three parties: a principal, an obligee and a surety.

What is the minimum surety bond for a mortgage broker?

The bond amount needed for a mortgage broker bond ranges from $50,000 to $200,000. The exact amount an individual needs is based on their loan activities in the prior calendar year. If they employ others, it is the sum of all their activities. This amount is referred to as aggregate loans.

Are surety bonds easy to get?

No, not everyone is eligible for a surety bond. Being eligible for a surety bond typically depends upon two important things: whether claims have been made against your past bonds and your credit history.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

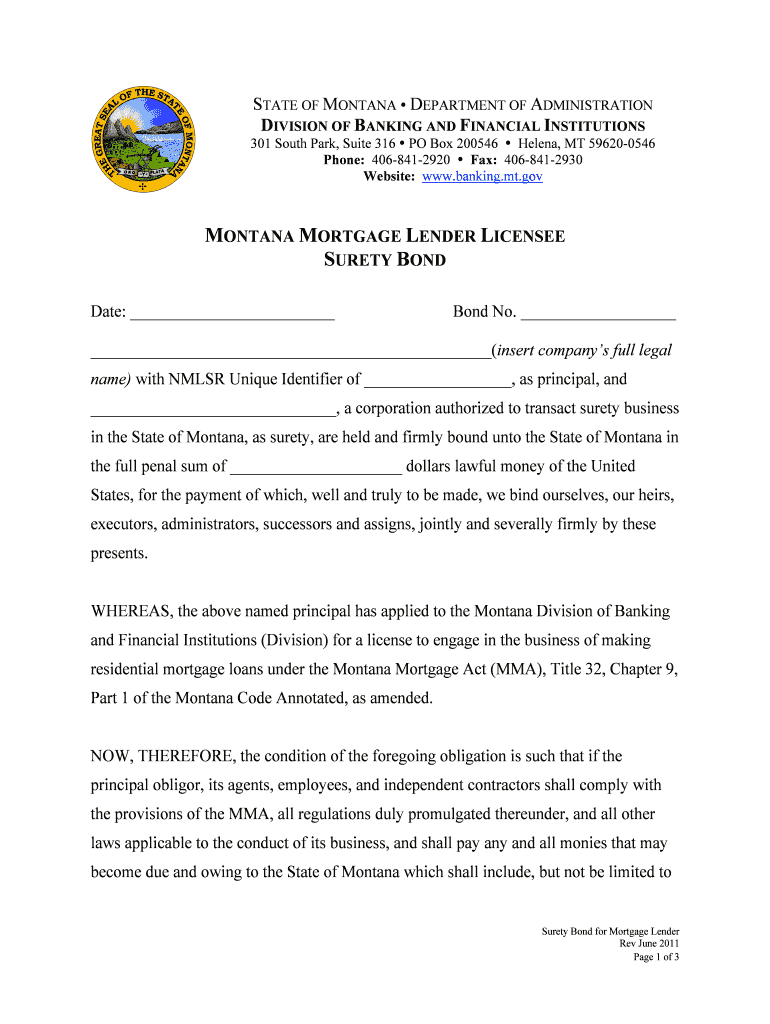

What is Montana Mortgage Lender Licensee Surety Bond?

The Montana Mortgage Lender Licensee Surety Bond is a legal financial instrument that ensures mortgage lenders comply with state laws and regulations, protecting consumers from potential misconduct.

Who is required to file Montana Mortgage Lender Licensee Surety Bond?

Individuals or entities engaged in the mortgage lending business in Montana are required to file the bond as part of the licensing process.

How to fill out Montana Mortgage Lender Licensee Surety Bond?

To fill out the bond, the applicant must complete the required sections with their business details, bond amount, and other relevant information, and then have it signed by a surety company.

What is the purpose of Montana Mortgage Lender Licensee Surety Bond?

The purpose of the bond is to provide a financial guarantee that the lender will adhere to state laws and regulations, ensuring protection for consumers against potential losses.

What information must be reported on Montana Mortgage Lender Licensee Surety Bond?

The bond must report information such as the name and address of the mortgage lender, the bond amount, the surety company details, and any relevant license numbers.

Fill out your montana mortgage lender licensee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Montana Mortgage Lender Licensee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.