UK IHT403 2015 free printable template

Show details

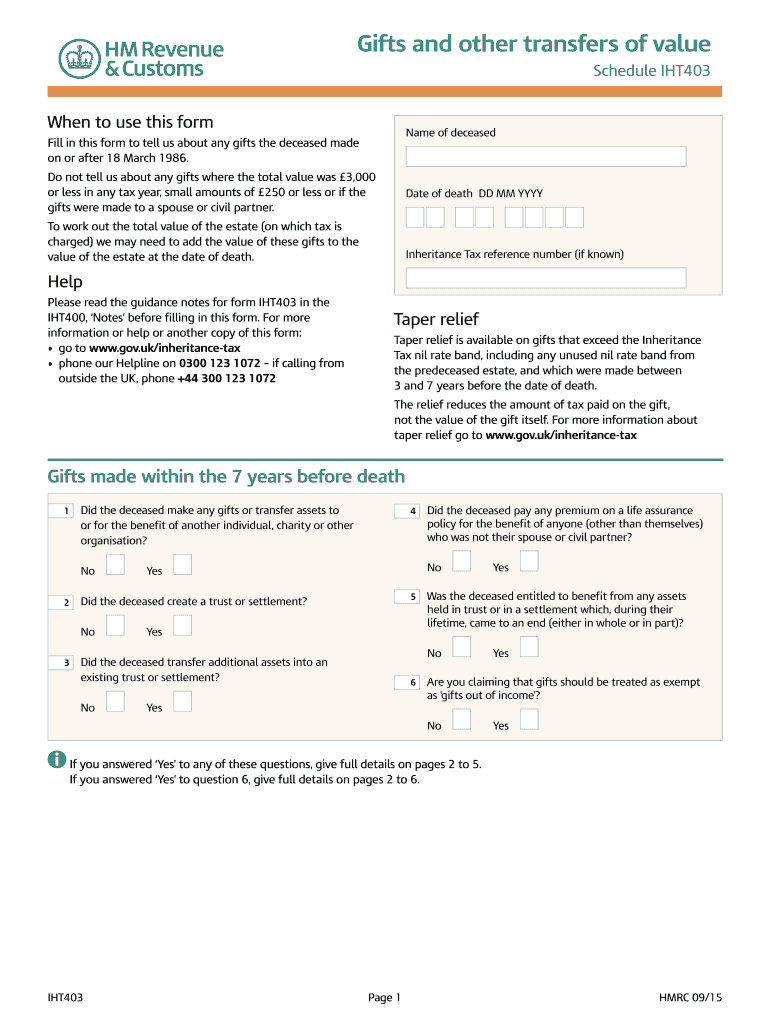

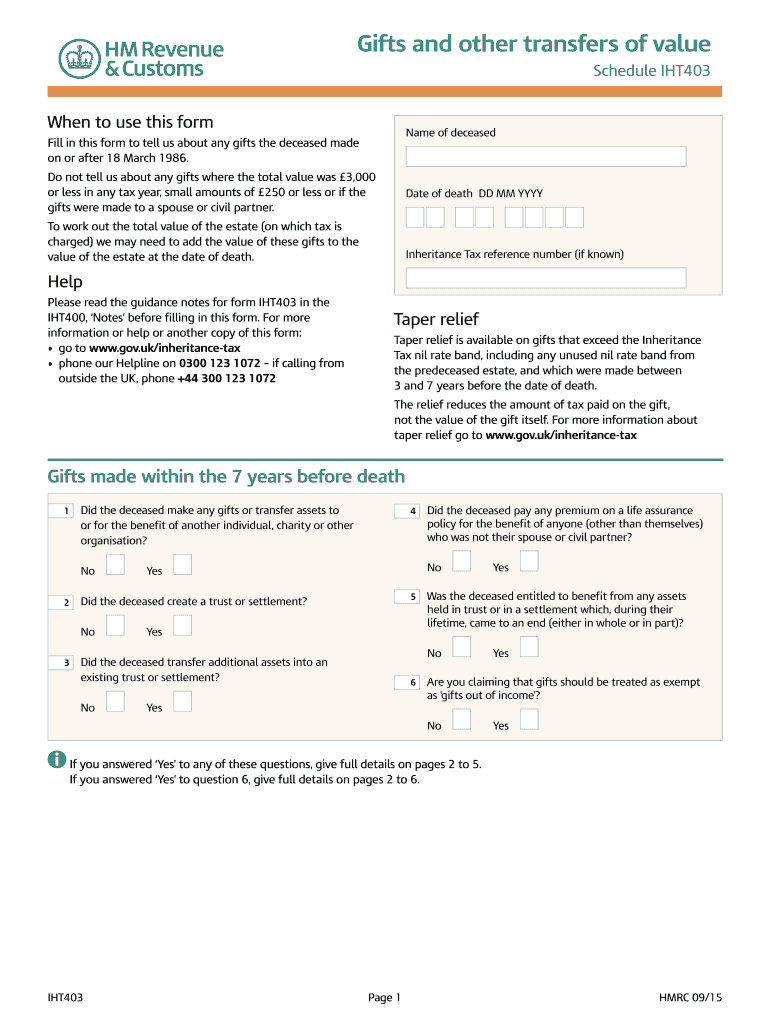

Gifts and other transfers of value Schedule IHT403 When to use this form Name of deceased Fill in this form to tell us about any gifts the deceased made on or after 18 March 1986. IHT403 Page 1 HMRC 09/15 If you are deducting charity exemption enter the full name of the charity the country of establishment and the HM Revenue and Customs charities reference if available in column B. Inheritance Tax reference number if known Help Please read the guidance notes for form IHT403 in the IHT400...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK IHT403

Edit your UK IHT403 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK IHT403 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK IHT403 online

Follow the steps below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UK IHT403. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK IHT403 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK IHT403

How to fill out UK IHT403

01

Gather all necessary information about the deceased's assets, liabilities, and gifts.

02

Obtain the death certificate of the deceased.

03

Complete the details of the deceased in section 1 of the form, including their name, address, and date of death.

04

Fill out section 2, providing details about the value of the estate, including properties, bank accounts, investments, and other assets.

05

In section 3, list any debts or liabilities that must be deducted from the total estate value.

06

Complete section 4 by detailing any gifts made by the deceased within the last seven years.

07

Review and confirm all information is accurate and complete.

08

Sign and date the form at the end.

09

Submit the completed IHT403 to HM Revenue and Customs (HMRC) as part of the inheritance tax process.

Who needs UK IHT403?

01

Individuals who are the executors or administrators of an estate.

02

Anyone managing the estate of a deceased person whose estate exceeds the inheritance tax threshold.

03

Heirs or beneficiaries dealing with the estate of a deceased relative.

04

Professionals assisting in the probate process for estates subject to inheritance tax.

Fill

form

: Try Risk Free

People Also Ask about

What is a lifetime gift?

A lifetime gift is a gratuitous transfer of ownership of any property between living persons and not made in expectation of death. In contrast, gifts made in contemplation of death may qualify as deathbed gifts or donatio mortis causa.

Do I have to inform HMRC if I inherit money UK?

for deaths on or after 1 January 2022 you do not need to fill in a HMRC form however you must give details of the assets you need a Grant of Representation for and extra information for Inheritance Tax on the Estate Summary Form (NIPF7) below. if Inheritance Tax is due or full details are needed HMRC use form IHT400.

Do I need to fill in Inheritance Tax form UK?

for deaths on or after 1 January 2022 you do not need to fill in a HMRC form however you must give details of the assets you need a Grant of Representation for and extra information for Inheritance Tax on the Estate Summary Form (NIPF7) below. if Inheritance Tax is due or full details are needed HMRC use form IHT400.

How do I claim transferable nil rate band?

Use the IHT402 with form IHT400 to transfer any unused nil rate band from the deceased spouse or civil partner to the deceased's estate.

How do I submit IHT400?

You need to download and complete form IHT400. Send it to the address on the form. You can read guidance on how to complete form IHT400. You can ask HMRC to work out how much Inheritance Tax is due if you're filling in the form without the help of a probate professional, such as a solicitor.

How does lifetime gift tax work?

The lifetime gift tax exemption is the amount of money or assets the government permits you to give away over the course of your lifetime without having to pay the federal gift tax. This limit is adjusted each year. For 2023, the lifetime gift tax exemption as $12.06 million.

How do I avoid gift with reservation of benefit?

ing to section 102 of the Finance Act 1986, if the property is gifted away and the donor derives a benefit from the asset that was given away, the gifted property is deemed to remain part of the estate of the donor for IHT purposes, in short, there is no IHT benefit of the gift, irrespective of when it was made.

How can I avoid inheritance tax?

How to avoid inheritance tax Make a will. Make sure you keep below the inheritance tax threshold. Give your assets away. Put assets into a trust. Put assets into a trust and still get the income. Take out life insurance. Make gifts out of excess income. Give away assets that are free from Capital Gains Tax.

What is a potentially exempt transfer?

What is a Potentially Exempt Transfer? A Potentially Exempt Transfer (PET) enables an individual to make gifts of unlimited value which will become exempt from Inheritance Tax (IHT) if the individual survives for a period of seven years.

Do I need to complete IHT400?

You must complete the form IHT400, as part of the probate or confirmation process if there's Inheritance Tax to pay, or the deceased's estate does not qualify as an 'excepted estate'. You can use the notes and forms IHT401 to IHT436 to support you.

Do I need to fill in IHT400?

You must complete the form IHT400, as part of the probate or confirmation process if there's Inheritance Tax to pay, or the deceased's estate does not qualify as an 'excepted estate'. You can use the notes and forms IHT401 to IHT436 to support you.

Who is responsible for paying the gift tax?

The rates range from 18% to 40%, and the giver generally pays the tax. There are, of course, exceptions and special rules for calculating the tax, so see the instructions to IRS Form 709 for all the details.

How long does it take to complete IHT400?

processing form IHT400s within 15 working days of receipt. issuing the form IHT421 within 15 working days of receiving the form IHT400 or payment of the tax due on delivery of the account, whichever is later.

Are lifetime gifts taxable?

The gift tax only kicks in after lifetime gifts exceed $12.06 million in 2022. The first thing to know about the federal gift tax is that gift givers—not gift recipients—have to pay it. Thankfully, you won't owe the tax until you've given away more than $12.06 million in cash or other assets during your lifetime.

What is the nil rate band for inheritance tax?

For IHT there is a tax threshold, known as the nil rate band, and below this limit you pay no tax as the rate is set at 0%. For 2022/23 the basic threshold is £325,000.

Who pays Inheritance Tax on lifetime gifts?

Simply put, so long as you live for more than seven years after you make this gift, your children or family won't have to pay Inheritance Tax on your gift when you die. However, any income or gains made from this gift could have tax implications for the beneficiary, for example, Capital Gains Tax.

Is the lifetime gift tax exemption per person?

1 You can give up to this amount in money or property to any individual per year without filing a gift tax return. The exclusion is per person, per year. So, your gifts can total $32,000 for the year if you want to give two people each the annual exclusion amount.

What happens after submitting IHT400?

Fill out and send form IHT400 and form IHT421 to HMRC and wait 20 working days before applying for probate. You normally have to pay at least some of the tax before you'll get probate. You can claim the tax back from the estate, if you pay it out of your own bank account.

What is form IHT403?

Schedule IHT403. When to use this form. Fill in this form to tell us about any gifts the deceased made on or after 18 March 1986. Do not tell us about any gifts where the total value was £3,000 or less in any tax year, small amounts of £250 or less or if the gifts were made to a spouse or civil partner.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my UK IHT403 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your UK IHT403 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I execute UK IHT403 online?

pdfFiller has made filling out and eSigning UK IHT403 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit UK IHT403 in Chrome?

UK IHT403 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is UK IHT403?

UK IHT403 is a form used for reporting the value of a deceased person's estate in relation to Inheritance Tax (IHT) in the United Kingdom.

Who is required to file UK IHT403?

UK IHT403 must be filed by the executors or administrators of an estate when the estate's value exceeds the IHT threshold, or when it includes certain types of assets.

How to fill out UK IHT403?

To fill out UK IHT403, you need to provide information about the deceased, assets, debts, and the overall estate valuation, ensuring to follow the instructions provided with the form.

What is the purpose of UK IHT403?

The purpose of UK IHT403 is to calculate the Inheritance Tax owed and to provide the necessary documentation to HM Revenue and Customs (HMRC) regarding the deceased's estate.

What information must be reported on UK IHT403?

UK IHT403 requires reporting of the deceased's personal details, details of the executors, assets and liabilities of the estate, and the final value of the estate for tax purposes.

Fill out your UK IHT403 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK iht403 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.