Get the free Student Off-Campus Insurance Claim Form

Show details

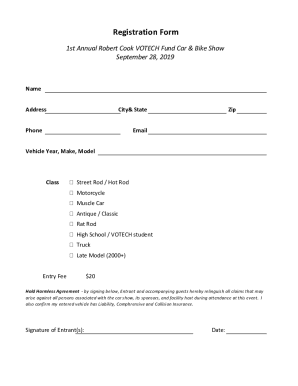

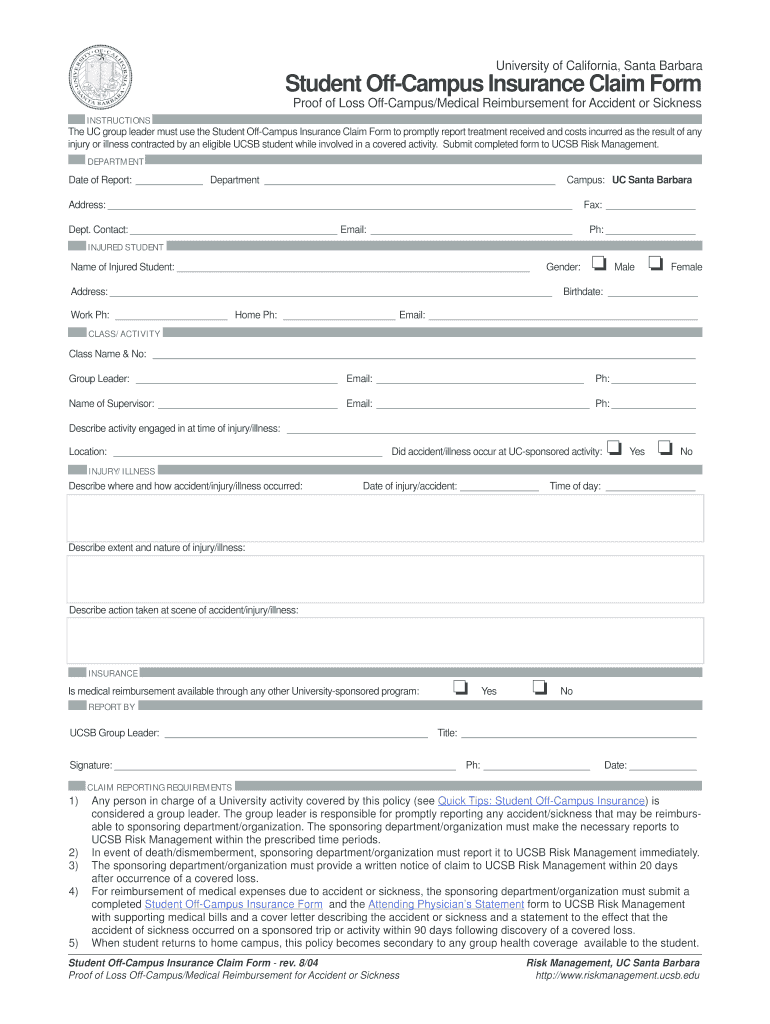

This form is used to report treatment received and costs incurred by UCSB students for injuries or illnesses contracted during covered activities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign student off-campus insurance claim

Edit your student off-campus insurance claim form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your student off-campus insurance claim form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing student off-campus insurance claim online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit student off-campus insurance claim. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out student off-campus insurance claim

How to fill out Student Off-Campus Insurance Claim Form

01

Obtain the Student Off-Campus Insurance Claim Form from your institution or insurance provider.

02

Fill in your personal information including name, student ID, and contact details.

03

Provide details of the incident or medical situation that necessitated the claim.

04

Attach necessary documentation such as medical bills, receipts, and proof of payment.

05

Sign and date the form to confirm that all information provided is accurate.

06

Submit the completed form and documentation to the appropriate claims department via the specified method (email, mail, or in-person).

07

Keep a copy of the submitted form and all attachments for your records.

Who needs Student Off-Campus Insurance Claim Form?

01

Students who have incurred medical expenses while studying off-campus.

02

Students who require reimbursement for medical services or treatments received outside of their institution's health plan.

03

International students who are covered under a specific insurance policy and need to file a claim.

Fill

form

: Try Risk Free

People Also Ask about

How soon after taking out life insurance can you claim?

Yes, you can claim straight away on life insurance. There is a standard exclusion on any claims arising from suicide in the first 12 months applied by most insurers. But other than that any valid claim would be accepted.

What is the time limit for claiming insurance?

The maximum time to claim varies by policy but is generally between 7 and 30 days from the date of treatment or hospital discharge.

How to complete an insurance claim form?

Typical sections of a claim form: Personal information like your name, address and date of birth. Insurance information such as a policy and group number. Reason for your visit including background information about your condition. Provider information including the doctor's name and address.

How do I write an application letter for an insurance claim?

I am writing to file a claim under my policy, number [Your Policy Number], due to goods damaged during [mention the cause: transportation, burglary, fire, etc.], which occurred on [Date of Incident]. As per the terms of my policy, I am entitled to claim for the damages sustained to my property.

What is the longest you can wait to file an insurance claim?

Most policies do not provide a strict deadline or window of time (30 days, 60 days, etc.). Instead, you are usually required to make your claim "promptly" or "within a reasonable time." Some states (especially those that follow a no-fault car insurance system) have passed laws that specifically address this issue.

How long after you take out insurance can you claim?

How quickly can you claim on home insurance policy? In most cases, you can make a claim on your home insurance at any time on or after the policy start date. This applies to damage to both the building and your contents. So if you're wondering “How soon can you claim on contents insurance?”, the answer is the same.

How long after taking out insurance can you claim?

How soon can you claim on insurance? Once you've taken out insurance, you can typically make a claim any time after the start date on the policy. Sometimes the date you paid for the insurance isn't necessarily the official start date, so make sure you check your policy documents, if you're unsure.

How to write a report for an insurance claim?

As property damage reports are used in insurance claims, this should be as detailed as possible. Provide a thorough description of the damage sustained, including any structural issues, cosmetic damage, or other notable observations. Use precise language and avoid making assumptions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Student Off-Campus Insurance Claim Form?

The Student Off-Campus Insurance Claim Form is a document used by students to request reimbursement for eligible expenses incurred while studying off-campus, typically related to medical or health services.

Who is required to file Student Off-Campus Insurance Claim Form?

Students who have incurred health-related expenses while studying off-campus and wish to seek reimbursement through their insurance plan are required to file the Student Off-Campus Insurance Claim Form.

How to fill out Student Off-Campus Insurance Claim Form?

To fill out the Student Off-Campus Insurance Claim Form, students should provide their personal information, details of the incurred expenses, submit supporting documents like receipts, and sign the form to certify the accuracy of the information provided.

What is the purpose of Student Off-Campus Insurance Claim Form?

The purpose of the Student Off-Campus Insurance Claim Form is to facilitate the reimbursement process for students who have paid for eligible medical services while studying away from their home campus.

What information must be reported on Student Off-Campus Insurance Claim Form?

The form typically requires the student's name, student ID, contact information, details of the expenses (including date, service provider, and amount), and any related insurance policy information.

Fill out your student off-campus insurance claim online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Student Off-Campus Insurance Claim is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.