UK Axis Bank Declaration of Beneficial Ownership for Companies 2015 free printable template

Show details

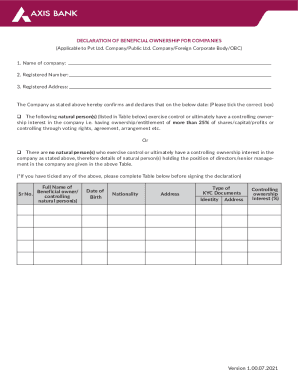

Appendix B DECLARATION OF BENEFICIAL OWNERSHIP FOR COMPANIES (Applicable to Pvt Ltd. Company/Public Ltd. Company/Foreign Ltd. Company/OBC) 1. Name of company : 2. Registered Number : 3. Registered

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK Axis Bank Declaration of Beneficial Ownership

Edit your UK Axis Bank Declaration of Beneficial Ownership form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK Axis Bank Declaration of Beneficial Ownership form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK Axis Bank Declaration of Beneficial Ownership online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit UK Axis Bank Declaration of Beneficial Ownership. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK Axis Bank Declaration of Beneficial Ownership for Companies Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK Axis Bank Declaration of Beneficial Ownership

How to fill out UK Axis Bank Declaration of Beneficial Ownership for Companies

01

Obtain the UK Axis Bank Declaration of Beneficial Ownership form from the bank's website or branches.

02

Fill in the company details, including the name, registration number, and address.

03

Identify all beneficial owners: individuals who own or control a significant percentage of shares or voting rights in the company.

04

For each beneficial owner, provide their full name, date of birth, nationality, and residential address.

05

Clearly specify the nature of ownership or control for each beneficial owner listed.

06

If applicable, indicate any relevant corporate structures or partnerships that relate to beneficial ownership.

07

Review the completed form for accuracy and completeness to ensure all required information is provided.

08

Sign and date the declaration, confirming the information provided is true and accurate.

09

Submit the form to the designated Axis Bank department either in person or through the provided submission method.

Who needs UK Axis Bank Declaration of Beneficial Ownership for Companies?

01

All UK companies and limited liability partnerships that are required to disclose their beneficial ownership information.

02

Companies applying for accounts or services with UK Axis Bank.

03

Entities involved in certain financial transactions that require proof of beneficial ownership.

Fill

form

: Try Risk Free

People Also Ask about

When must a beneficial owner be identified?

With respect to the requirement to obtain beneficial ownership information, financial institutions will have to identify and verify the identity of any individual who owns 25 percent or more of a legal entity, and an individual who controls the legal entity.

What is a beneficial owner 25 %?

ing to the Money Laundering Act (GwG), a beneficial owner is a person who owns more than 25% of the company's shares, controls more than 25% of the voting rights or who can similarly exercise significant control over the company.

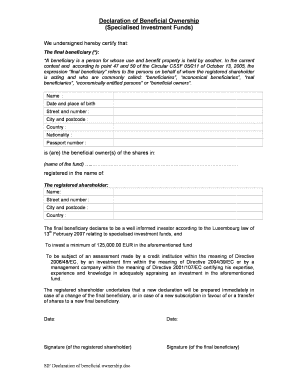

What is a document of beneficial ownership?

The declaration of beneficial owners is a supplement to the company's articles of association, which can either be silent regarding the shareholding or only mention the holding companies. The declaration therefore provides accurate and up-to-date information.

What is the difference between a beneficial owner and a shareholder?

As a shareholder of a public company you may hold shares directly or indirectly: A registered owner or record holder holds shares directly with the company. A beneficial owner holds shares indirectly, through a bank or broker-dealer.

Who qualifies as a beneficial owner?

What is a Beneficial Owner? Each individual with 25% or more equity interest in the legal entity, whether directly or indirectly (for certain clients, Fifth Third will advise if each individual with 10% or more equity interest is required).

How do you prove beneficial ownership?

The most common way to create a beneficial interest is through an express trust. This is where the legal owner signs a trust deed or written agreement declaring that the legal owner holds the property 'on trust' for someone else, the beneficial owner.

How do you confirm beneficial ownership?

A bank must establish recordkeeping procedures for beneficial ownership identification and verification information.At a minimum, the bank must obtain the following identifying information for each beneficial owner of a legal entity customer: Name. Date of birth. Address. Identification number.

What is the minimum number of beneficial owners?

A legal entity will have a minimum of one and a maximum of five beneficial owners. That is the ing the lowest equity interest threshold that FinCEN has established. Banks can have a stricter equity threshold that defines a “beneficial owner,” but that is up to the discretion of individual institutions.

What is the meaning of beneficial ownership?

Beneficial ownership, or the ultimate beneficial owner (UBO), is when any natural person ultimately owns or controls a contracted counterparty or a natural person on whose behalf a transaction or activity is being conducted.

What are the two prongs for identifying a beneficial owner?

The CDD Rule has two “prongs” of beneficial ownership: an ownership prong, and a control prong.

What are the types of beneficial owners?

Types of Beneficial Owners An individual who owns at least 25% of the legal entity. An individual with significant control, management, or direction ability over the legal entity. A trust that owns 25% or more of the legal entity3.

What are beneficial ownership requirements?

Under the final rule, a beneficial owner includes anyone who, directly or indirectly, either exercises substantial control over a reporting company, or owns or controls at least 25% of the ownership interests of a reporting company.

What percentage do you need to be beneficial owner?

Under financial regulations, a beneficial owner is considered anyone with a stake of 25% or more in a legal entity or corporation. Beneficial owners can also be considered anyone with a significant role in the management or direction of those entities, or any trusts that own 25% or more of an entity.

What is an example of a beneficial owner?

One example is when a physical person owns company A, which in turn owns sufficient shares in company B for the person to be considered a beneficial owner of company B. In the example, the person is a direct owner of company A and an indirect owner of company B.

What information is needed for beneficial ownership?

The form requires, among other information, the name, business address or primary residence address, date of birth, Social Security Number (as applicable), the name of the issuing state or country, and number of the passport or driver's license for the Beneficial Owners and Control Person as applicable.

Who is not a beneficial owner?

A non-beneficial owner often holds a share for someone else. Some common examples of non-beneficial owners include parents who hold shares for their children, the executor of a will who owns shares on behalf of an estate, or a trustee who holds shares for the beneficiaries of a trust.

What is beneficial ownership and how is it calculated?

A beneficial owner is defined as any individual who owns—either directly or indirectly—25 percent or more equity interest in a legal entity. What is the definition of an “individual with significant management responsibility”?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send UK Axis Bank Declaration of Beneficial Ownership for eSignature?

Once your UK Axis Bank Declaration of Beneficial Ownership is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out UK Axis Bank Declaration of Beneficial Ownership using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign UK Axis Bank Declaration of Beneficial Ownership and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit UK Axis Bank Declaration of Beneficial Ownership on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign UK Axis Bank Declaration of Beneficial Ownership right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is UK Axis Bank Declaration of Beneficial Ownership for Companies?

The UK Axis Bank Declaration of Beneficial Ownership for Companies is a document that companies are required to submit to declare the individuals who ultimately own or control them, ensuring transparency and compliance with regulations.

Who is required to file UK Axis Bank Declaration of Beneficial Ownership for Companies?

Every company operating in the UK, including foreign companies with a branch in the UK, is required to file the Declaration of Beneficial Ownership.

How to fill out UK Axis Bank Declaration of Beneficial Ownership for Companies?

To fill out the Declaration, companies must provide details such as the names, addresses, and ownership percentage of the persons of significant control (PSCs), and submit it to Axis Bank as part of their regulatory compliance.

What is the purpose of UK Axis Bank Declaration of Beneficial Ownership for Companies?

The purpose of the Declaration is to enhance corporate transparency by identifying individuals who ultimately control a company, thereby helping to prevent financial crimes such as money laundering and fraud.

What information must be reported on UK Axis Bank Declaration of Beneficial Ownership for Companies?

The information that must be reported includes the full names, dates of birth, nationalities, residential addresses, and the nature of control held by the beneficial owners of the company.

Fill out your UK Axis Bank Declaration of Beneficial Ownership online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK Axis Bank Declaration Of Beneficial Ownership is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.