Get the free Brokerage and Non-Brokerage Accounts

Show details

This document is an application form for opening brokerage and non-brokerage accounts, including details on account types, client information, management fee deductions, trading authorizations, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign brokerage and non-brokerage accounts

Edit your brokerage and non-brokerage accounts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your brokerage and non-brokerage accounts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing brokerage and non-brokerage accounts online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit brokerage and non-brokerage accounts. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out brokerage and non-brokerage accounts

How to fill out Brokerage and Non-Brokerage Accounts

01

Gather necessary personal information such as Social Security number, address, and employment details.

02

Choose the type of account you want to open: brokerage or non-brokerage.

03

For a brokerage account, decide between a cash or margin account.

04

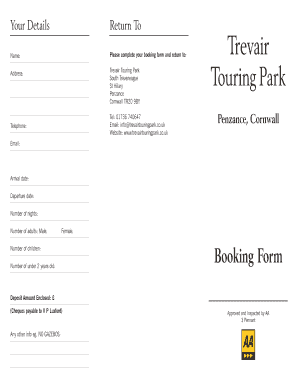

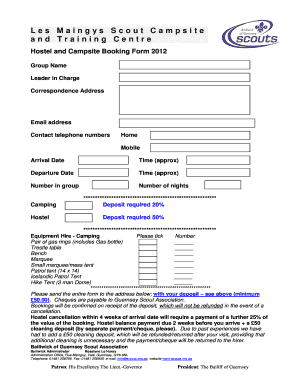

Complete the application form provided by the brokerage.

05

Provide your financial information, including income, net worth, and investment experience.

06

Review and accept the terms and conditions of the account.

07

Submit the application along with any required identification and documentation.

08

Fund your account through a bank transfer or other means.

Who needs Brokerage and Non-Brokerage Accounts?

01

Individuals looking to invest in stocks, bonds, and other securities need brokerage accounts.

02

People seeking to save for retirement may benefit from both brokerage and non-brokerage accounts.

03

Investors who want to manage their portfolios actively through trading need brokerage accounts.

04

Those who prefer safer, tax-advantaged options for saving or investing may choose non-brokerage accounts.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a brokerage and a non-brokerage account?

Brokerage accounts are generally less restrictive than IRAs or retirement accounts: They have no contribution limits, and you can withdraw your money at any time for any reason. However, brokerage accounts are often not tax advantaged — you may have to pay taxes on any earnings you receive.

Why have two brokerage accounts?

One broker may offer low trading commissions but average customer service, while another could have a great trading platform but no discounts for buying and selling mutual funds. Because of these differences, it may make sense for you to have more than one brokerage account.

What are the two types of brokers?

Discount brokers execute trades on behalf of a client, but typically don't provide investment advice. Full-service brokers provide execution services as well as tailored investment advice and solutions.

What is the difference between a Type 1 and Type 2 brokerage account?

Most brokerage firms offer at least two types of accounts. A Quick Course on Account Types: A “cash” account is generally coded as a Type 1 account and a “margin” account is typically coded as a Type 2 account. These codes are explained in the “Disclosures and Definitions” section of your statement.

What are brokerage accounts?

Non-Brokerage Account means an account that is exempted from the definition of Account in this Code, such as the employee's NorthStar 401(k), a retirement plan sponsored by a previous employer, a Family Member's employer sponsored retirement plan, accounts held directly at a mutual fund company, 529 or other college

What are the two types of brokerage accounts?

In a cash account, you are not allowed to borrow funds from your broker to pay for transactions in the account. A margin account is a type of brokerage account in which your brokerage firm can lend you money to buy securities, with the securities in your portfolio serving as collateral for the loan.

Are there different types of brokerage accounts?

When you open a brokerage account, you need to choose between an individual or joint brokerage account. Joint brokerage accounts are beneficial if you're looking to pool your investments with another person, such as a spouse or family member, and can be a way to simplify investment management and/or estate planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Brokerage and Non-Brokerage Accounts?

Brokerage accounts are investment accounts that allow individuals to buy and sell securities through a licensed brokerage firm. Non-brokerage accounts, on the other hand, may involve other types of financial accounts like savings accounts, checking accounts, or investment accounts that do not require the use of a brokerage firm.

Who is required to file Brokerage and Non-Brokerage Accounts?

Individuals and entities who invest in securities, earn interest, or receive dividends are generally required to file brokerage accounts. Non-brokerage accounts may need to be reported by those holding significant assets or generating taxable income.

How to fill out Brokerage and Non-Brokerage Accounts?

To fill out Brokerage accounts, provide your personal information, account number, and tax identification number, along with details of trades and transactions made within the period. Non-brokerage accounts generally require personal identification and tax information, as well as details on interest earned and tax-exempt funds.

What is the purpose of Brokerage and Non-Brokerage Accounts?

The purpose of brokerage accounts is to facilitate buying and selling of stocks and other securities. Non-brokerage accounts serve to hold cash, savings, and other assets, offering different types of liquidity and investment options.

What information must be reported on Brokerage and Non-Brokerage Accounts?

Reported information generally includes account holder details, transaction history, capital gains, losses, income from dividends and interest, and tax identification numbers. It may also include the account balances at the end of the reporting period.

Fill out your brokerage and non-brokerage accounts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Brokerage And Non-Brokerage Accounts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.