Get the free NOTICE OF WITHHOLDING ON PERIODIC PAYMENTS

Show details

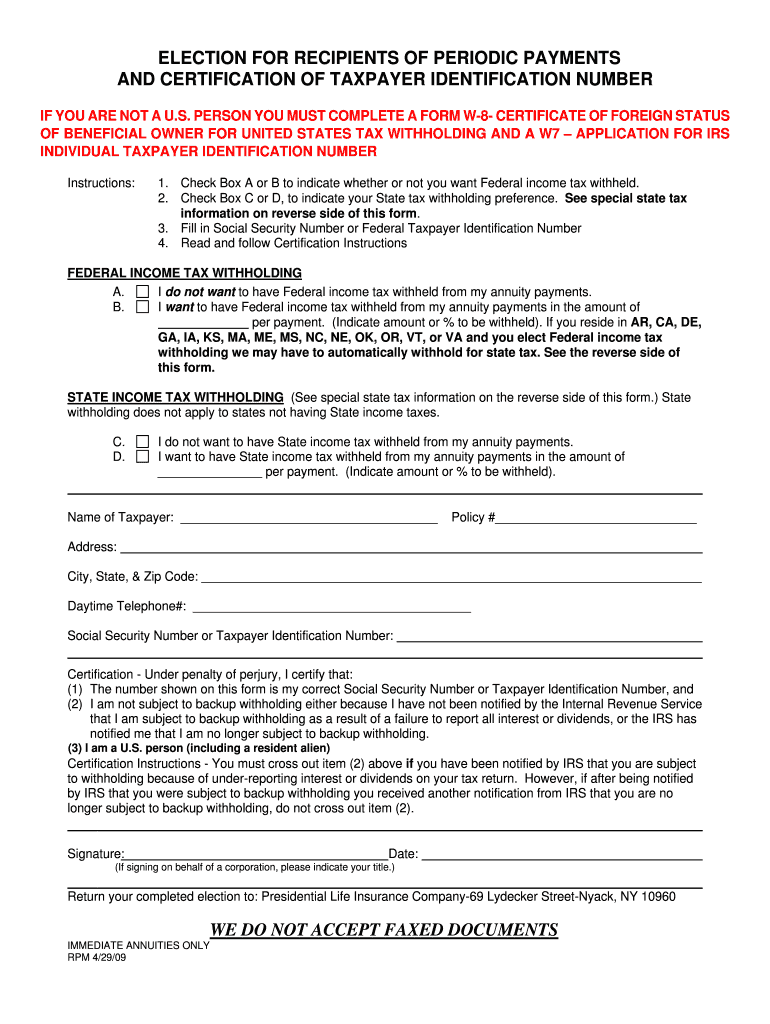

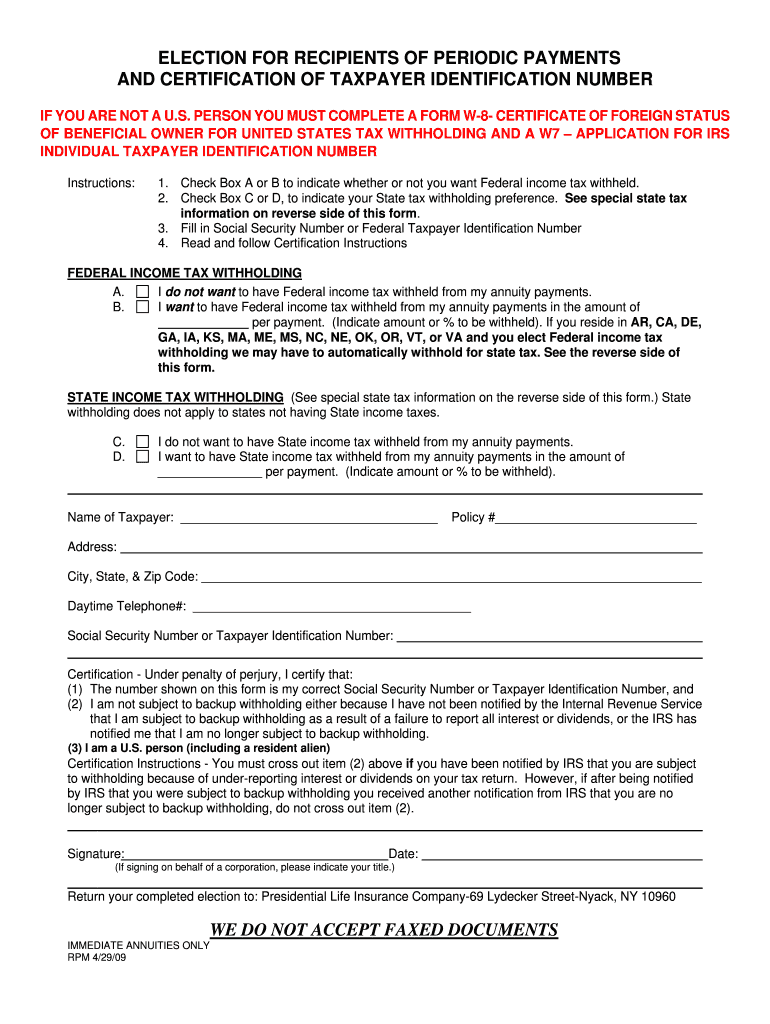

This document outlines the withholding options for Federal and State income tax on annuity payments from Presidential Life Insurance Company, including instructions for election and revocation of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice of withholding on

Edit your notice of withholding on form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice of withholding on form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice of withholding on online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit notice of withholding on. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice of withholding on

How to fill out NOTICE OF WITHHOLDING ON PERIODIC PAYMENTS

01

Obtain the NOTICE OF WITHHOLDING ON PERIODIC PAYMENTS form from the relevant authority or website.

02

Fill in the personal identification information at the top of the form, including your name, address, and Social Security number.

03

Provide the details of the periodic payments being withheld, including the amount and frequency of the payments.

04

Indicate the reason for withholding by checking the appropriate box or providing an explanation.

05

Include the name and contact information of the agency or individual responsible for processing the withholding.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form to the relevant agency or individual as instructed.

Who needs NOTICE OF WITHHOLDING ON PERIODIC PAYMENTS?

01

Individuals receiving periodic payments such as wages, pensions, or government benefits who have had withholding orders placed against them.

02

Employers or organizations responsible for processing these periodic payments.

03

Financial institutions managing accounts from which periodic payments are disbursed.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of tax period?

More Definitions of Tax Period Tax Period or “Taxable Period” means any period prescribed by any Governmental Authority for which a Tax Return is required to be filed or a Tax is required to be paid.

What is a withholdable payment?

Generally, a withholdable payment is a payment of U.S. source fixed or determinable annual or periodical (FDAP) income.

What is the meaning of withholding tax for the period?

Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient.

How to define withholding tax?

Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient.

What is the meaning of withholding tax agent?

A withholding agent is an individual or entity responsible for withholding, reporting, and paying income tax on behalf of a foreign person. This can include corporations, partnerships, trusts, or associations. If you're a business paying a foreign contractor or vendor, you would likely act as the withholding agent.

What is the meaning of withholding tax?

Withholding taxes (WHT) are when tax is withheld from (or deducted from the income due to) the recipient by the payer, and directly paid to the government. In most tax jurisdictions, withholding tax applies to employment income (think of PAYE) but some tax systems withhold tax on other forms of income.

What is the difference between periodic and non periodic payments?

A nonperiodic distribution involves a lump-sum or ad-hoc withdrawal from a retirement or qualified account. This can be contrasted with periodic distributions received in retirement that are paid out on a regular basis for income. Certain nonperiodic distributions may be subject to penalties and taxes due.

Why am I charged withholding tax?

You may be charged withholding tax on your Transaction, At Call investment or Term Deposit account if you do not provide a TFN, ABN or an exemption status when the account is opened. For Term Deposits, you need to provide a TFN, ABN or an exemption status before the term matures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NOTICE OF WITHHOLDING ON PERIODIC PAYMENTS?

The NOTICE OF WITHHOLDING ON PERIODIC PAYMENTS is a legal document used by employers or other payers to notify the government that they will withhold a certain amount from periodic payments made to an individual, typically for tax purposes or to fulfill a court order.

Who is required to file NOTICE OF WITHHOLDING ON PERIODIC PAYMENTS?

Typically, employers or payers who are responsible for making periodic payments such as wages, pensions, or annuities are required to file the NOTICE OF WITHHOLDING ON PERIODIC PAYMENTS when mandated by tax laws or court orders.

How to fill out NOTICE OF WITHHOLDING ON PERIODIC PAYMENTS?

To fill out the NOTICE OF WITHHOLDING ON PERIODIC PAYMENTS, you should provide the payee's personal information, the amount to be withheld, the reason for withholding, payment details, and any relevant identification numbers, ensuring that all fields are completed as required by the specific form.

What is the purpose of NOTICE OF WITHHOLDING ON PERIODIC PAYMENTS?

The purpose of the NOTICE OF WITHHOLDING ON PERIODIC PAYMENTS is to ensure compliance with tax laws, facilitate proper tax withholding from payments, and to fulfill obligations arising from legal judgments or support orders.

What information must be reported on NOTICE OF WITHHOLDING ON PERIODIC PAYMENTS?

The information that must be reported on the NOTICE OF WITHHOLDING ON PERIODIC PAYMENTS includes the payee's name, address, taxpayer identification number, the amount to be withheld, the payment frequency, and any applicable case number or court order information.

Fill out your notice of withholding on online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Of Withholding On is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.