ZA CGS08 2015 free printable template

Show details

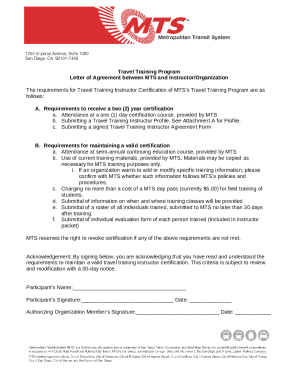

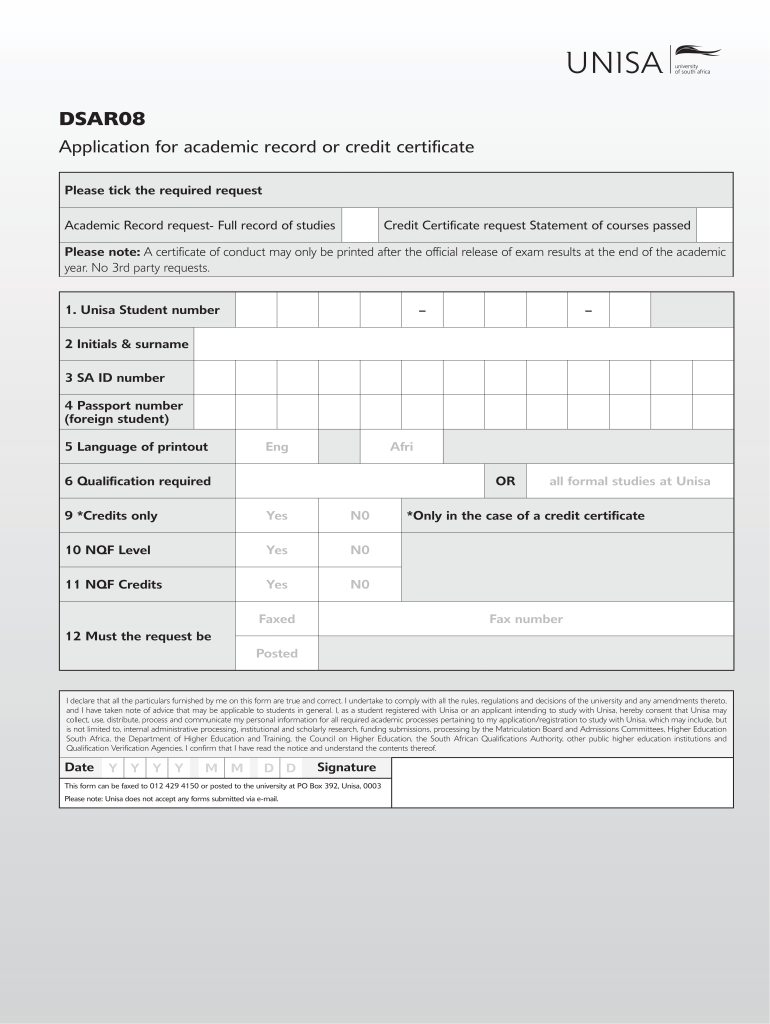

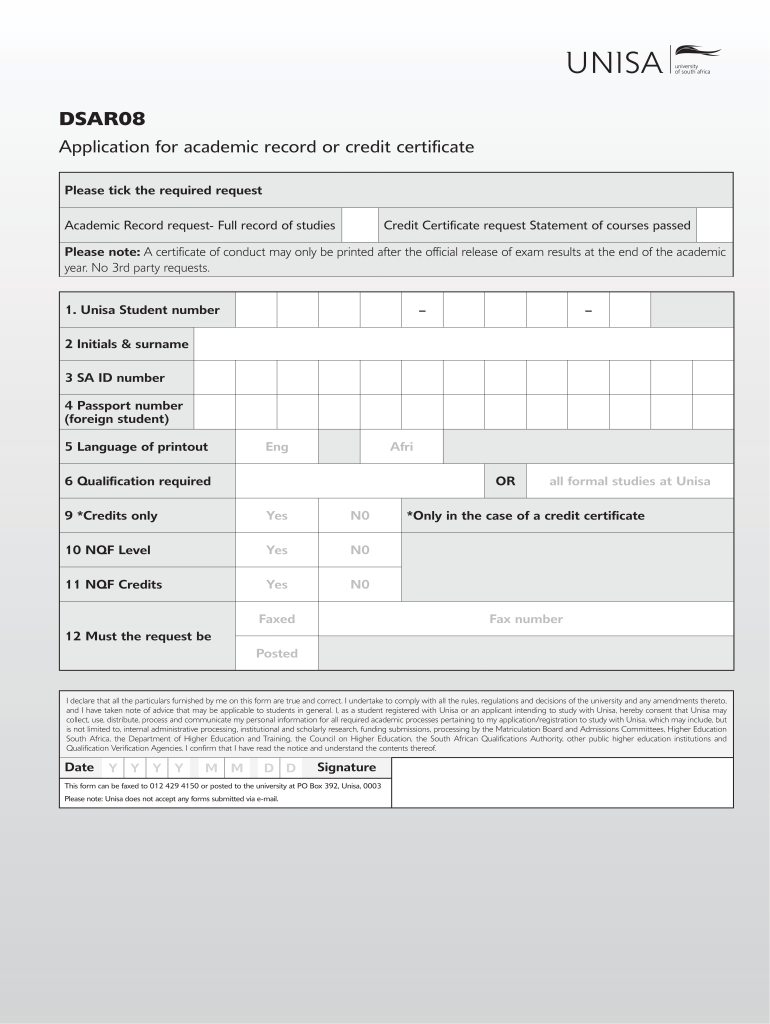

DSAR08 Application for academic record or credit certi cate Please tick the required request Academic Record request- Full record of studies Credit Certi cate request Statement of courses passed Please note year. No 3rd party requests. 1. Unisa Student number 2 Initials surname 3 SA ID number 4 Passport number foreign student 5 Language of printout Eng Afri 6 Quali cation required OR 9 Credits only Yes N0 10 NQF Level 11 NQF Credits all formal studies at Unisa Faxed Only in the case of a...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ZA CGS08

Edit your ZA CGS08 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ZA CGS08 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ZA CGS08 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ZA CGS08. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ZA CGS08 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ZA CGS08

How to fill out ZA CGS08

01

Gather all necessary personal information, including your name, address, and identification number.

02

Collect any financial documents or data required for the form.

03

Start filling out the form ZA CGS08 by carefully following the instructions provided.

04

Complete each section methodically, ensuring that all information is accurate and up to date.

05

Review the form for any errors or omissions before submission.

06

Submit the completed ZA CGS08 form to the appropriate authority as instructed.

Who needs ZA CGS08?

01

Individuals or entities that are required to report certain financial information.

02

Taxpayers who are completing their tax obligations in relation to capital gains.

03

Business owners who need to declare capital gains or losses.

Fill

form

: Try Risk Free

People Also Ask about

How to register at Unisa for 2023?

Visit the Unisa web registration page, click here to open the page. Visit the Unisa web registration page, click here to open the page. Choose the qualification level and then click "Go". Enter your student number in the block provided and the other details as required. Check your personal details on screen.

Is Unisa still open for applications 2022?

Applications and registrations for Short Learning Programmes open from 14 November 2022 to 28 February 2023.

Where can I get Unisa application forms?

Download Unisa Application Form 2023-2024 - .unisa.ac.za.

Is Unisa closed for 2023 applications?

Applications for admission to undergraduate qualifications (higher certificates, advanced certificates, diplomas, advanced diplomas & degrees) for the 2023 academic year are closed.

Is Unisa open for 2022 application?

When must I apply? Applications for admission to Unisa's Short Learning Programmes will be open from 14 November 2022 to 3 February 2023.

Is Unisa still open for applications for 2023?

Applications for admission to master's and doctoral qualifications for the 2023 academic year are closed (some exceptions apply).

Is Unisa open for 2023 registration?

Registration for semester 1 of the 2023 academic year for undergraduate qualifications, honours degrees and postgraduate diplomas is now closed. The final date for initial minimum payments is 28 February 2023.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ZA CGS08 online?

pdfFiller has made filling out and eSigning ZA CGS08 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make edits in ZA CGS08 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your ZA CGS08, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I fill out ZA CGS08 on an Android device?

Complete ZA CGS08 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is ZA CGS08?

ZA CGS08 is a tax form used in South Africa for reporting the capital gains tax activities of individuals and entities.

Who is required to file ZA CGS08?

Individuals, companies, and trusts that have realized capital gains or losses during the tax year are required to file ZA CGS08.

How to fill out ZA CGS08?

To fill out ZA CGS08, taxpayers must provide details of their capital gains and losses, including the acquisition and disposal of assets, as well as any exemptions that may apply.

What is the purpose of ZA CGS08?

The purpose of ZA CGS08 is to report capital gains or losses to the South African Revenue Service (SARS) for the assessment of capital gains tax.

What information must be reported on ZA CGS08?

The information that must be reported on ZA CGS08 includes details of asset acquisitions and disposals, amounts realized, base costs, and any allowable deductions or exemptions.

Fill out your ZA CGS08 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ZA cgs08 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.