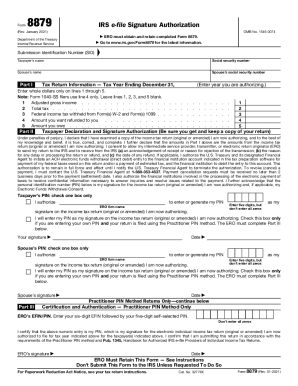

Get the free irs letter 2626c

Show details

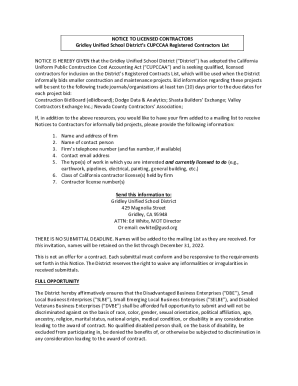

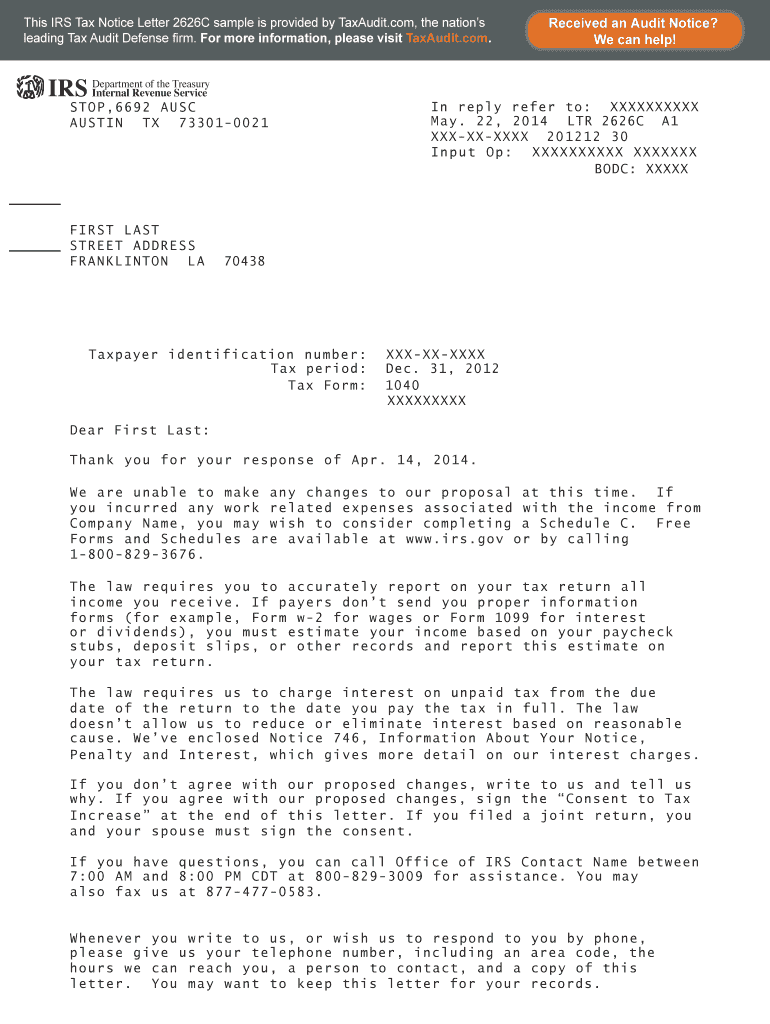

This IRS Tax Notice Letter 2626C sample is provided by TaxAudit.com, the nations leading Tax Audit Defense firm. For more information, please visit TaxAudit.com. IRS Department of the Treasury Internal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs letter 2626c

Edit your irs letter 2626c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs letter 2626c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs letter 2626c online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs letter 2626c. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs letter 2626c

How to fill out irs letter 2626c?

01

Begin by reading the instructions provided with the letter. It is crucial to understand the purpose of the letter and the specific information required.

02

Gather all the necessary documents and information. This may include tax returns, forms, schedules, and any other supporting documentation mentioned in the letter.

03

Carefully complete the requested sections of the letter, making sure to provide accurate and up-to-date information. Follow the given instructions and double-check for any errors or missing details.

04

If any sections require additional explanation or clarification, attach any supporting documents or provide a detailed explanation in the designated space.

05

Review the completed letter thoroughly for any mistakes or omissions. Ensure that all the required information is included and that it is organized in a clear and concise manner.

06

Make a copy of the completed letter, along with any supporting documents, for your records. It is always important to keep copies of all communication with the IRS.

07

Sign and date the letter, as instructed, before sending it to the appropriate IRS address provided in the instructions. Consider sending it via certified mail or with a return receipt to ensure delivery and to have proof of submission.

Who needs irs letter 2626c?

01

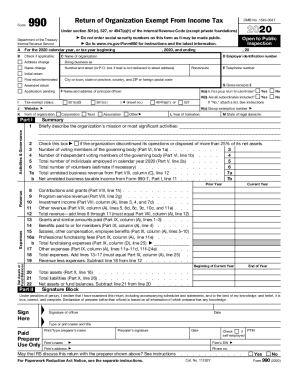

Taxpayers who have received a notice from the IRS requesting additional information or documentation may need to fill out irs letter 2626c. This letter is typically sent when the IRS requires further details to process a tax return accurately.

02

Individuals or businesses who have submitted certain forms or schedules with errors or missing information may also receive this letter. The IRS uses it as a means to obtain the necessary data to resolve any discrepancies and properly assess the taxpayer's tax liability.

03

In some cases, taxpayers who have been selected for an audit or examination may be asked to provide additional information using irs letter 2626c. This is part of the IRS's regular procedure to ensure compliance with tax laws and regulations.

Fill

form

: Try Risk Free

People Also Ask about

Why would the IRS send a certified letter?

Usually, the IRS sends certified letters to inform taxpayers of issues that need attention. Some common reasons for certified letters include an outstanding balance, refund issues, return questions, identification verification, missing information, return changes, and processing delays.

Is IRS letter 2645C an audit letter?

Q: Is IRS Letter 2645C an Audit Letter? A: An IRS Letter 2645C is not a notice of audit. It is simply an acknowledgement that they have received documentation or information from a taxpayer or their authorized representative.

Does a certified letter from the IRS mean an audit?

Just because you receive a letter from the IRS doesn't mean you're being audited. In many cases, the IRS will send a letter simply asking for additional information or clarification of details listed on your tax return. An IRS audit letter will come to you by certified mail.

What does IRS audit mail look like?

The IRS audit letter will arrive via certified mail and list your full name, taxpayer ID or social security number, the form number, and the Information they are reviewing. It will also provide the IRS agent's contact information for more information or questions on the process or specific case.

What is letter 2645 C from the IRS?

You or your representative sent information to the IRS. The IRS sends Letter 2645C to let you know they are waiting on information or need more time to review the information you or your representative sent.

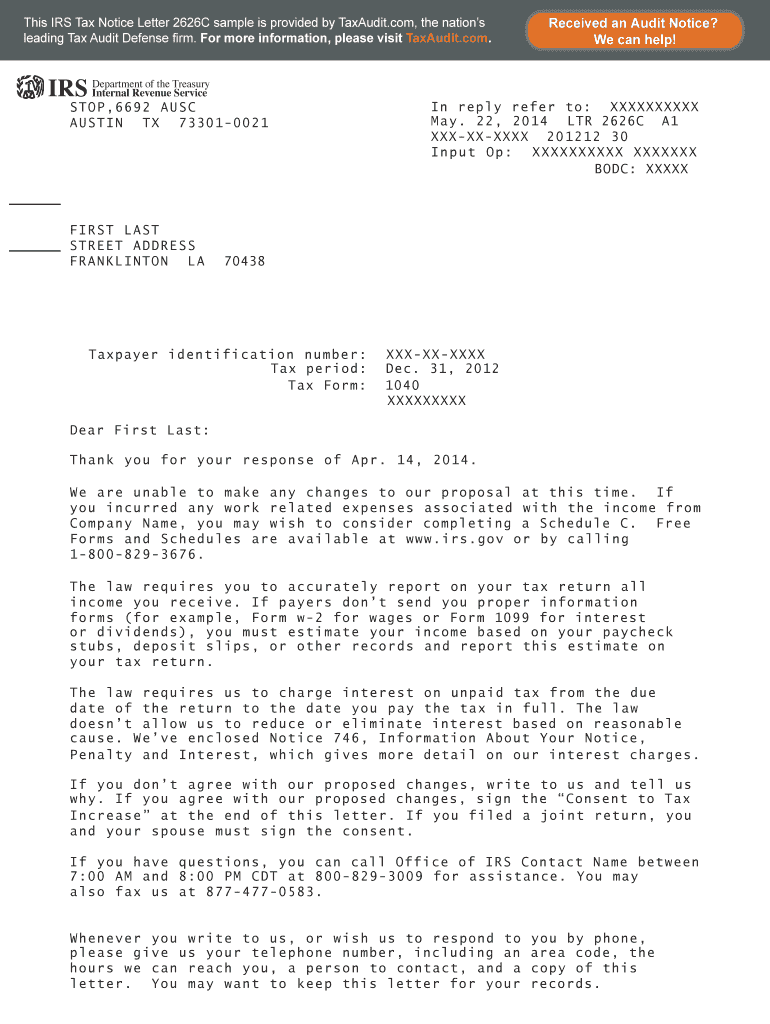

What is IRS letter 2626C?

Letter 2626C is issued by the IRS Automated Underreporter Unit (AUR) to inform you that additional information or further explanation is required to complete the examination process regarding your underreported income case.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit irs letter 2626c from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your irs letter 2626c into a dynamic fillable form that you can manage and eSign from anywhere.

How do I execute irs letter 2626c online?

pdfFiller has made it easy to fill out and sign irs letter 2626c. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit irs letter 2626c on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign irs letter 2626c. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is irs letter 2626c?

IRS Letter 2626C is a notification from the Internal Revenue Service that provides information about the status of a taxpayer's account, specifically relating to adjustments or changes to their tax records.

Who is required to file irs letter 2626c?

Taxpayers who receive IRS Letter 2626C are required to respond or provide additional information as indicated in the letter. This typically includes individuals who may have discrepancies in their tax filings or are undergoing review.

How to fill out irs letter 2626c?

Filling out IRS Letter 2626C involves following the specific instructions provided in the letter itself, which may include confirming details listed or providing additional documentation as required.

What is the purpose of irs letter 2626c?

The purpose of IRS Letter 2626C is to inform taxpayers about updates or inquiries related to their tax account, helping ensure that taxpayers remain compliant with IRS regulations.

What information must be reported on irs letter 2626c?

Information required on IRS Letter 2626C may include taxpayer identification details, adjustments to taxable income, additional documentation to support claims, and any other relevant tax-related information as specified by the IRS.

Fill out your irs letter 2626c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Letter 2626c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.