Get the free salvation army donation receipt

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

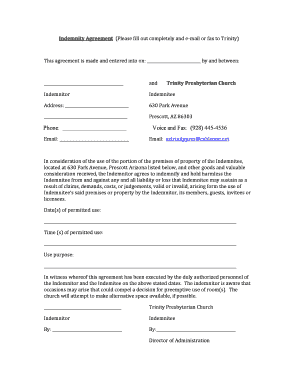

Understanding the Salvation Army Donation Receipt Form

Overview of the Salvation Army Donation Receipt Form

The Salvation Army donation receipt form serves as a crucial document for individuals who make charitable contributions to the organization. This form acknowledges the receipt of donations, which can be utilized for tax purposes. It provides necessary information regarding the donor while confirming the contributions made, often including the amount, date, and purpose of the donation.

Key Features of the Salvation Army Donation Receipt Form

This form includes several key features that enhance its utility for both donors and the Salvation Army. It contains fields for donor information such as name, address, and contact details, alongside a section to specify the amount donated and the date of the contribution. Additionally, it may offer acknowledgment of the donation's specific purpose, reinforcing transparency and accountability.

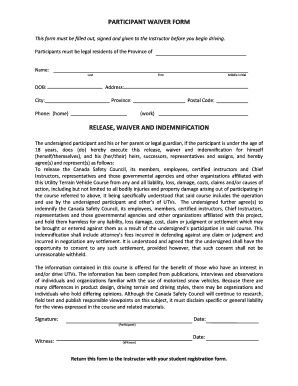

When to Utilize the Salvation Army Donation Receipt Form

The Salvation Army donation receipt form should be filled out whenever a monetary or non-monetary contribution is made. This is particularly useful for individuals who want to ensure their donations are documented for tax deductions. It is recommended that donors complete this form immediately after making a donation to uphold accurate records.

Essential Information Required on the Form

Filling out the salvation army donation receipt form accurately requires specific information. Donors must provide their full name, address, and contact number. Additionally, they need to indicate the total donation amount and the date it was made. An optional section may allow donors to specify the program or campaign their contributions support, thus personalizing their charitable experience.

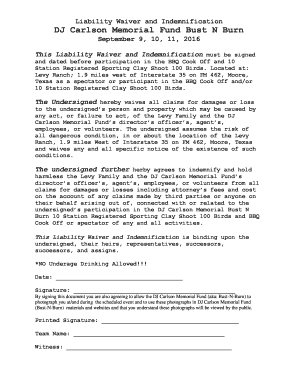

Best Practices for Completing the Donation Receipt Form

To ensure the donation receipt form is filled out accurately, donors should double-check all provided information for completeness. It is important to write clearly and legibly, using permanent ink if filling out the form by hand. Donors are encouraged to retain a copy of the form for their records, particularly when used for tax reporting. Reviewing all details before submission can help prevent common errors.

Benefits of Completing the Salvation Army Donation Receipt Form

Completing the Salvation Army donation receipt form offers numerous benefits for donors. Firstly, it serves as an official record of the donation, which can be crucial for tax deductions. Additionally, having documentation helps in maintaining personal financial records and ensures that the donation is recognized by the organization. The form also provides the nonprofit with insights into donor preferences and contributions, aiding in future fundraising efforts.

Frequently Asked Questions about salvation army receipt form

What information do I need to provide on the Salvation Army donation receipt form?

You will need to provide your name, address, contact number, the donation amount, and the date of the contribution.

How do I use the Salvation Army donation receipt form for tax purposes?

You can use the completed form as proof of your charitable contributions when filing your taxes, ensuring you accurately report your donations.

Can I get a copy of my donation receipt?

Yes, it is advisable to retain a copy of your completed donation receipt form for your personal records.

pdfFiller scores top ratings on review platforms