TT NIBTT NI 187 2011-2025 free printable template

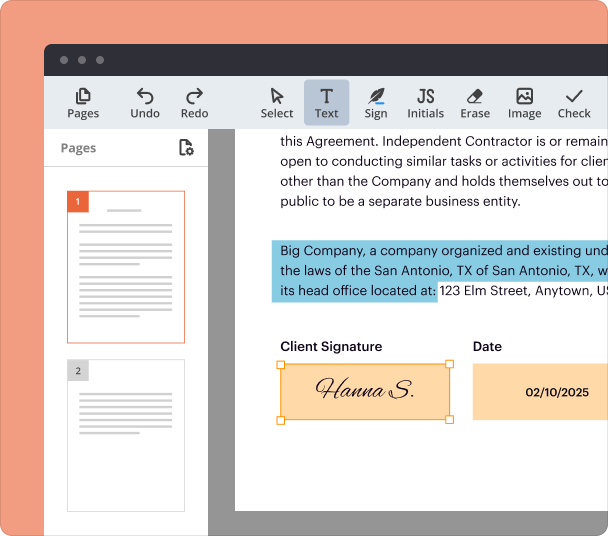

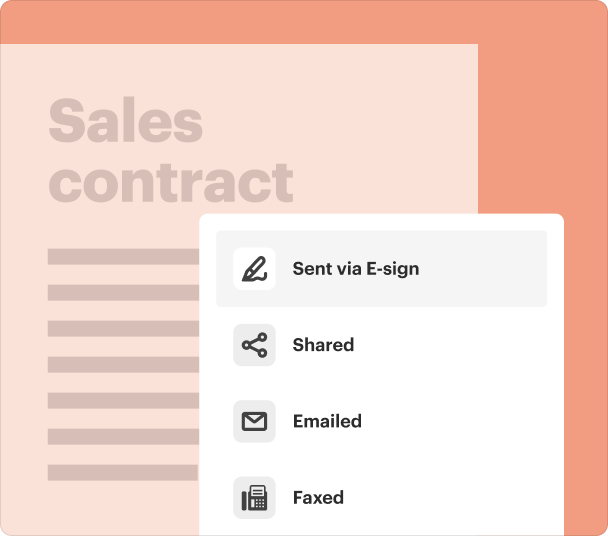

Fill out, sign, and share forms from a single PDF platform

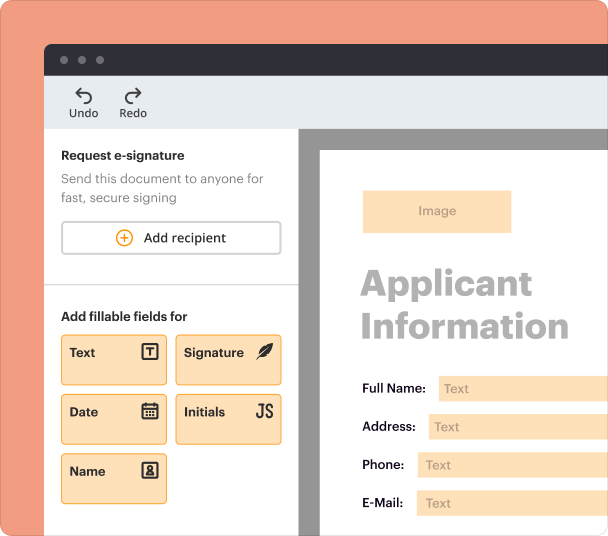

Edit and sign in one place

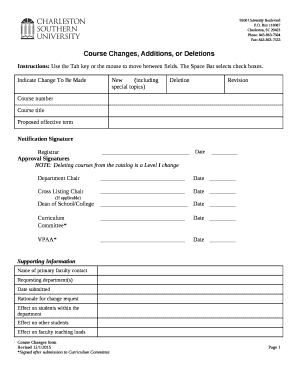

Create professional forms

Simplify data collection

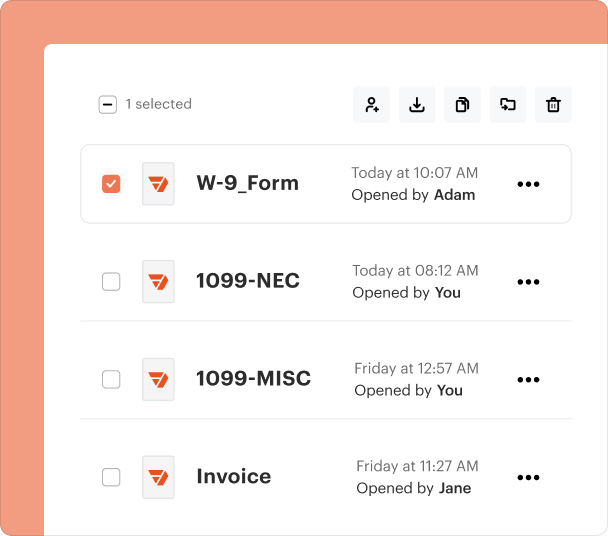

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Understanding the TT NIBTT NI 187 Form

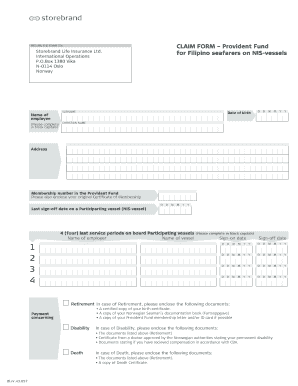

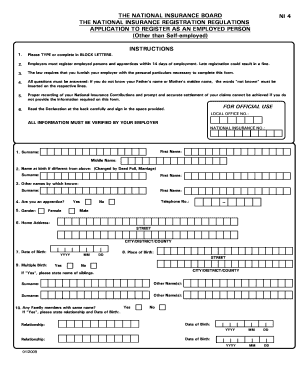

What is the TT NIBTT NI 187 Form?

The TT NIBTT NI 187 form is a declaration issued by the National Insurance Board. It summarizes the national insurance contributions that are due or in arrears for employers. It is crucial for ensuring compliance with national insurance obligations in the United States, ensuring that both employees and employers are contributing appropriately.

Key Features of the TT NIBTT NI 187 Form

This form includes essential sections for employer information, contributions due, payment methods, and a certificate of declaration. It details employee counts, payment periods, and total amounts, including any penalties or interest applicable. Each section is designed to facilitate accurate reporting and ensure that all necessary information is captured.

When to Use the TT NIBTT NI 187 Form

Employers should utilize the TT NIBTT NI 187 form during specific periods when reporting national insurance contributions, particularly when contributions are overdue. It serves to formally declare the contributions owed and to ensure compliance with national regulations governing employee insurance obligations.

How to Fill the TT NIBTT NI 187 Form

Filling out the TT NIBTT NI 187 form requires careful attention to detail. Employers need to input their trade name, contact information, and the registration number. Additionally, it is necessary to list the number of employees, the relevant pay periods, and the contributions due. Ensure all payment methods and amounts are clearly stated.

Common Errors and Troubleshooting

When completing the TT NIBTT NI 187 form, common errors often arise from incorrect data entry, such as miscalculating contribution amounts or providing incorrect employee counts. It is helpful to cross-check all figures against payroll records to ensure accuracy. Employers should also be mindful of submission deadlines to avoid penalties.

Security and Compliance for the TT NIBTT NI 187 Form

Ensuring the security of sensitive information when filling out the TT NIBTT NI 187 form is critical. Employers must follow compliance guidelines to protect personal and financial data. Using secure digital platforms for submission can mitigate the risks associated with data breaches or unauthorized access.

Frequently Asked Questions about nis forms ni 187

Why is the TT NIBTT NI 187 Form important?

The form is important as it ensures that employers accurately report their national insurance contributions, helping to maintain compliance with legal obligations related to employee benefits.

What happens if I submit incorrect information on the TT NIBTT NI 187 Form?

Submitting incorrect information can lead to penalties. It is advisable to review all entries carefully and correct any mistakes before submission.

pdfFiller scores top ratings on review platforms