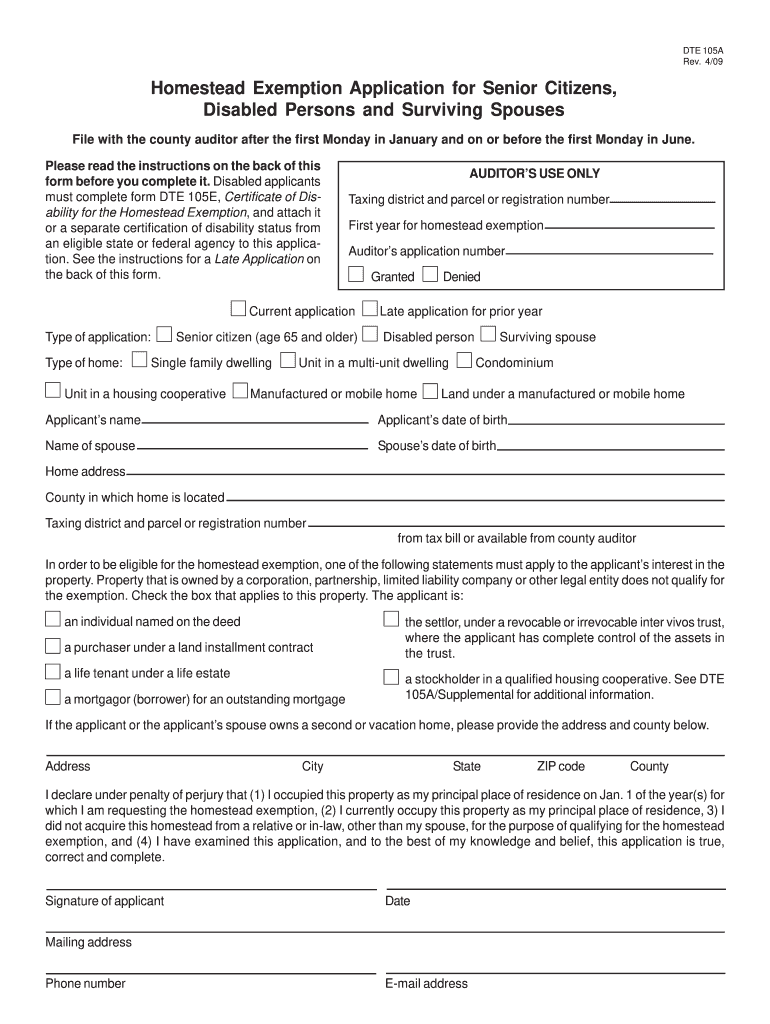

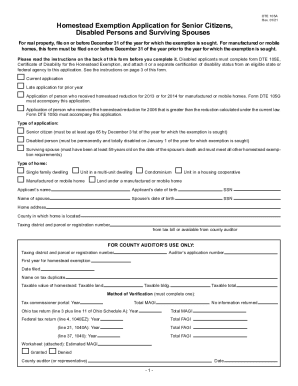

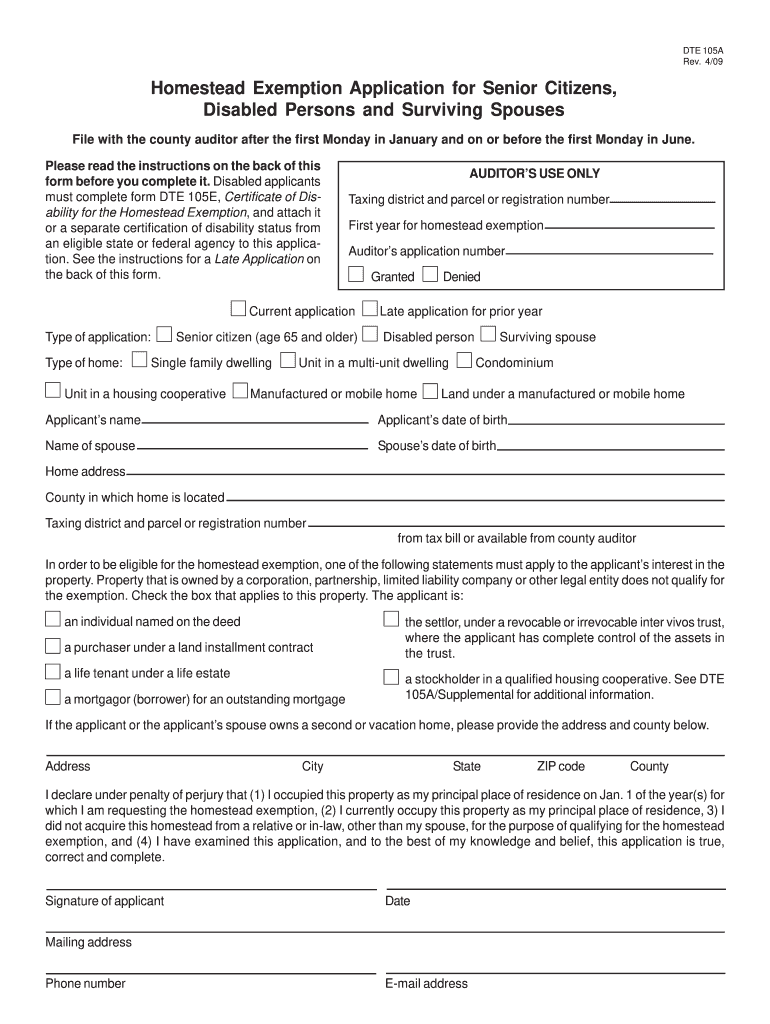

OH DTE 105A 2009 free printable template

Get, Create, Make and Sign OH DTE 105A

How to edit OH DTE 105A online

Uncompromising security for your PDF editing and eSignature needs

OH DTE 105A Form Versions

How to fill out OH DTE 105A

How to fill out OH DTE 105A

Who needs OH DTE 105A?

Instructions and Help about OH DTE 105A

Hey you tighten with a co real estate advisors welcome back to the channel if you're new here hit that subscribe button, so you don't miss another video today we cover a very important topic i.e. a money-saving topic which is a homestead exemption a homestead exemption helps you save money on your home taxes an exemption removes part of the value of your property from taxation and lowers your tax bill makes sense right so for example if your property is valued when you back up if your property has an assessed value it's going to be very important terminologies can be very important, and you'll see why in a second if your home it has an assessed value of 200000, and you qualify for a homestead exemption of 25000 effectively you're removing 25000 of the assessed value of your property i.e. instead of you paying taxes on 200000 worth of home you're paying taxes on a hundred and seventy-five thousand dollars worth of home that makes sense, so before we go any further with homestead exemption let's look at the formula you have the assessed value which is the value that your county has assessed on your property they have another value which is a market value which is different the market value 99999 of the time is going to be higher than the assessed value i.e. it's going to be a hundred percent of the time higher than your assessed value the assessed value can be reduced by the homestead exemption that we're mentioning and there's some other exemptions that you as a person you as individual and homeowner can qualify for so that's your assessed value that is what you're looking when you go to your cat the county appraisal districts or the website and look up your property that's the value that you're looking for now something else in the other part of the equation is the property tax rate now property tax rate varies by Counting varies by city varies by school district so if you were out there looking for homes prior to purchasing you may have noticed the difference tax the different tax rates that were being applied on the home based off of the area that you were looking at so if you're out there presently looking for a home right now become this into that because tax implications are a real thing so let's look at tap that let's look at the homestead exemption from the tax benefit side there are some legal benefits when it comes to why you want to have a homestead exemption, but we're not going to cover that in this video there's going to be another video in this channel that covers that but for our purposes we want to stay on the tax side we want to stay on the tax benefit side which helps us with our pocketbook alright so one important thing to realize is this tax exemption is owned only needs to be done once so once you do this once you get that homestead exemption know that that homestead exemption stays with it until you sell the home ardor you yourself removing so if you file it today know that next year you don't have to file it the following...

People Also Ask about

Can you still homestead in Ohio?

Can you homestead your house in Ohio?

How to apply for Homestead Act in Ohio?

Who qualifies for homestead in Ohio?

At what age do you stop paying property tax in Ohio?

What is the income requirements for Homestead Exemption in Ohio?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit OH DTE 105A from Google Drive?

How do I make changes in OH DTE 105A?

How do I fill out OH DTE 105A on an Android device?

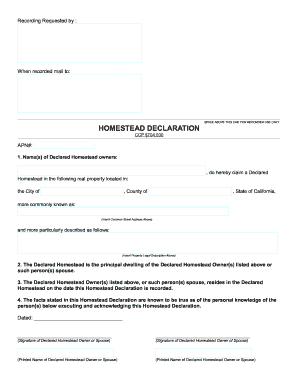

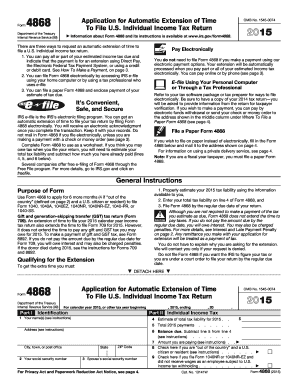

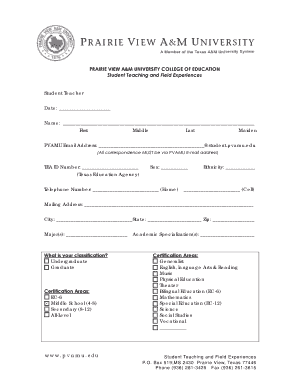

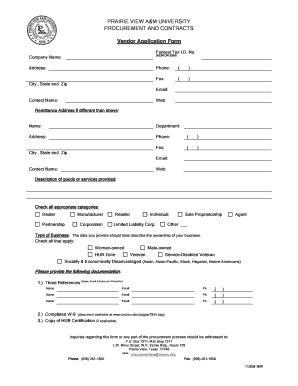

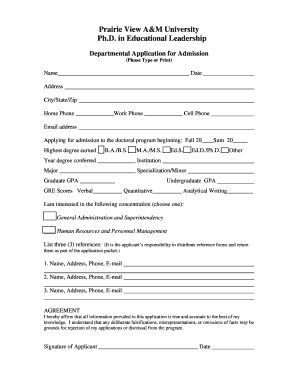

What is OH DTE 105A?

Who is required to file OH DTE 105A?

How to fill out OH DTE 105A?

What is the purpose of OH DTE 105A?

What information must be reported on OH DTE 105A?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.