Get the free anti-money laundering and suspicious activity attestation

Show details

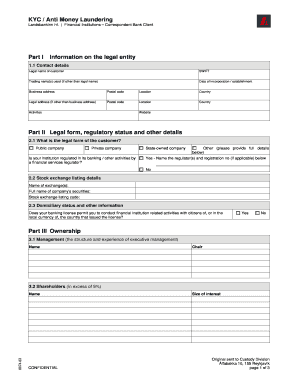

This document is an attestation by a Broker regarding the implementation of an Anti-Money Laundering program and compliance with federal rules for suspicious activity reporting.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aml letter form

Edit your aml letter template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your anti money laundering letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing aml comfort letter template online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit aml attestation form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out anti money laundering letter template form

How to fill out anti-money laundering and suspicious activity attestation

01

Gather necessary documents and information relevant to your business activities.

02

Read through the anti-money laundering (AML) guidelines provided by your regulatory authority.

03

Complete the personal identification information, including name, address, and contact details.

04

Provide details regarding the nature of your business and its operations.

05

Disclose any suspicious activity or transactions that you have observed.

06

Ensure that all statements made are true and accurate to the best of your knowledge.

07

Review the completed attestation for any errors or omissions.

08

Sign and date the document to certify its accuracy.

09

Submit the attestation to the designated regulatory body or your compliance officer.

Who needs anti-money laundering and suspicious activity attestation?

01

Financial institutions such as banks and credit unions.

02

Insurance companies and securities firms.

03

Real estate agents and brokers.

04

Casinos and gaming establishments.

05

Accountants and tax professionals dealing with significant financial transactions.

06

Money service businesses (MSBs) and payment processors.

07

Professionals in high-risk industries, such as precious metals dealers.

Fill

form

: Try Risk Free

People Also Ask about

What is an AML declaration?

The purpose of the AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing, such as securities fraud and market manipulation.

How do I get an AML certificate?

Here are the steps to obtain an AML certification: Earn a degree. Typically, AML specialists have at least a bachelor's degree in finance, economics, financial management or a similar discipline. Earn AML or banking experience. Prepare for your ACAMS exam. Pass the ACAMS or equivalent exam. Apply for AML positions.

What is an AML attestation?

AML checks, which can range from basic know your customer (KYC) verification to real-time screening, are designed to identify customers and assess their associated risk. AML checks are a safeguard to help prevent businesses from becoming directly or indirectly caught up in criminal activity.

What is an AML attestation letter?

An AML (Anti-Money Laundering) letter is a formal document provided by a financial institution or a regulated entity to confirm compliance with AML regulations. It typically certifies that the institution has appropriate policies, procedures, and controls to prevent money laundering and other financial crimes.

What is AML authentication?

AML verification, short for Anti-Money Laundering verification, is a process used by financial institutions and other businesses to prevent criminals from disguising the source of illegal funds.

What is an AML confirmation?

AML Checks as Part of Perpetual KYC These checks help to identify and prevent money laundering, terrorist financing, fraud, or other financial crimes. They involve verifying the identity of customers, reviewing their transactions for suspicious activity or patterns and assessing the risk associated with them.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is anti-money laundering and suspicious activity attestation?

Anti-money laundering (AML) and suspicious activity attestation refers to the process by which institutions and organizations confirm compliance with laws and regulations aimed at preventing money laundering and reporting any suspicious activities that might indicate financial crime.

Who is required to file anti-money laundering and suspicious activity attestation?

Financial institutions, including banks, credit unions, broker-dealers, and certain non-financial businesses are typically required to file anti-money laundering and suspicious activity attestations, as mandated by regulatory authorities.

How to fill out anti-money laundering and suspicious activity attestation?

To fill out the attestation, organizations must collect relevant information on their AML programs, document any suspicious activities identified, and fill out the required forms accurately, ensuring compliance with applicable regulations and submitting within designated timelines.

What is the purpose of anti-money laundering and suspicious activity attestation?

The purpose of AML and suspicious activity attestation is to ensure that institutions are actively monitoring for and reporting potential money laundering activities, thereby protecting the financial system from criminal activities and maintaining regulatory compliance.

What information must be reported on anti-money laundering and suspicious activity attestation?

Organizations must report details such as the nature of suspicious activities, the rationale for their identification, the identity of the involved parties, transaction amounts, and the measures taken in response to these activities.

Fill out your anti-money laundering and suspicious activity attestation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aml Attestation Letter Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.