NY DRIE Tax Abatement Credit (TAC) Adjustment Application for Tenants 2015-2025 free printable template

Show details

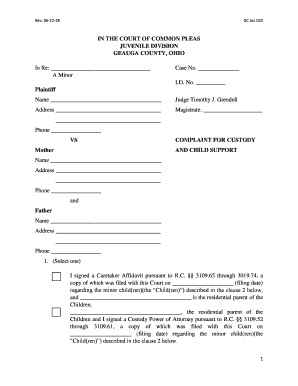

TM Finance DIE NYC DEPARTMENT OF FINANCE l PROGRAM OPERATIONS DIVISION DIE TAX ABATEMENT CREDIT (TAC) ADJUSTMENT APPLICATION FOR TENANTS Instructions: Use this form if you are presently receiving

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign abatement tac form

Edit your abatement tac form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your abatement tac form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit abatement tac form online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit abatement tac form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

What are the exemptions for NYC finance?

The City of New York offers tax exemptions and abatements for seniors, veterans, clergy members, people with disabilities, and other homeowners. These benefits can lower your property tax bill.

What are the exemptions for NYC?

The City of New York offers tax exemptions and abatements for seniors, veterans, clergy members, people with disabilities, and other homeowners. These benefits can lower your property tax bill.

How does drie work in NYC?

This program is for tenants with a disability who qualify to have their rent frozen at their current level and be exempt from future rent increases. The program covers legal increases in your rent by applying credits to your property tax bill.

What is the NYC Department of Finance exemption?

The Department of Finance (DOF) administers a number of benefits in the form of tax exemptions, abatements, and money-saving programs. Exemptions lower the amount of tax you owe by reducing your property's assessed value. Abatements reduce your taxes by applying credits to the amount of taxes you owe.

How do I contact drie in NYC?

Ask about DRIE. Call 212-639-9675 if you have a hard time hearing.

Who qualifies for drie nyc?

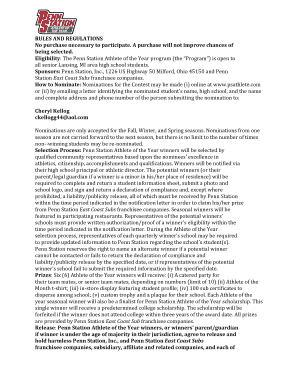

Eligibility Criteria Have a combpined household income for all members of the household that is $50,000 or less; Spend more than one-third of your monthly household income on rent or maintenance; and. Be at least 62 years old.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get abatement tac form?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific abatement tac form and other forms. Find the template you want and tweak it with powerful editing tools.

How do I execute abatement tac form online?

pdfFiller has made it simple to fill out and eSign abatement tac form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the abatement tac form in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your abatement tac form in minutes.

What is drie tax abatement credit?

The drie tax abatement credit is a tax credit available to property owners who participate in the Division of Real Estate (DRE) program for residential properties in New York City.

Who is required to file drie tax abatement credit?

Property owners who participate in the DRE program for residential properties in New York City are required to file drie tax abatement credit.

How to fill out drie tax abatement credit?

The drie tax abatement credit can be filled out by providing information on the property, including the address, owner's information, and other relevant details outlined in the application form.

What is the purpose of drie tax abatement credit?

The purpose of drie tax abatement credit is to provide tax relief to property owners who participate in the DRE program for residential properties in New York City.

What information must be reported on drie tax abatement credit?

Information such as property address, owner's information, participation in the DRE program, and other relevant details must be reported on drie tax abatement credit.

Fill out your abatement tac form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Abatement Tac Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.